The first annual review of the stock picking portfolio

Fundamentals 20-5: I established a stock picking portfolio at the start of 2022. This is the first annual review of the portfolio. Unlike the quarterly review, I will include dividends in the annual review.

In Jan 2022, I constructed a stock portfolio based on the companies that I had analyzed and valued over the past year. The goal was to track the portfolio performance to provide insights into establishing and managing a stock portfolio.

This is my fourth quarterly cum first annual review. The goals of each review were:

- To determine the portfolio return.

- To ensure that the portfolio still meets the diversity criteria.

I will then decide whether to re-balance within the existing stocks, invest in new stocks or hold more cash.

Unlike the previous reviews, I will include dividends received when computing returns. Secondly, I have increased the fund size and added HSBC, Intel, and OCBC to the portfolio.

Should you rush to buy or sell them? Well, read my Disclaimer.

This post builds on the data from the various tables presented in my earlier articles in this series. To benefit from this article, you should first read the following:

Contents

- Tracking performance

- End Dec 2022 Return (before buying new shares)

- End Dec 2022 Diversity (before buying new shares)

- Buying more

- Conclusion

|

To recap, I started with a USD 100,000 investment fund. I did not use all the monies when I established the portfolio and as such, that is some balance cash. When looking at performance, I will look at it from the fund perspective rather than just the stock portfolio perspective. For the avoidance of doubt:

- The portfolio refers to the stocks that I invest in.

- The fund refers to both the value of the stock portfolio and the unutilized cash.

During the period from the 1st of Jan 2022 to the end of Dec 2022, the stock markets where I invested declined considerably. Except for one (Boustead Plantations), I did not sell any of the other portfolio stocks. In the first place, the falling prices meant that there was no opportunity to take profits. But more importantly, the intrinsic values of the stocks were still intact.

I believe that the market has priced in all the bad news. As such, I took the opportunity to deploy all the cash. For simplicity, I assumed buying at the end of Dec 2022 after the review.

Tracking performance

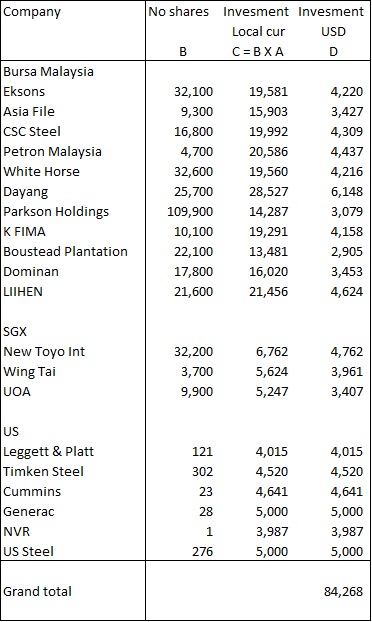

The total fund value as of the last review date (end of Sep 2022) was USD 88,415 comprising as per Table 1. Note that this is accounting for the new investments made after the end of Sept 2022.

|

| Table 1: Total Fund Value as of the End of Sep 2022 |

|

| Table 2: Portfolio Status as of the End of Sep 2022 |

|

| Table 3: Cash Position as of the End of Sep 2022 |

Let us consider the situation at the end of Dec 2022 before I bought the new shares. Since I did not buy or sell any stocks, the only changes were in the stock prices.

To update the portfolio, I entered the end of Dec 2022 stock prices as per Column A in Table 4 and EXCEL then did the rest. Refer to Table 4.

|

| Table 4: Portfolio as of the End of Dec 2022 (Before Buying New Shares) |

The total portfolio value had increased by USD 5,956 to USD 90,224 (refer to Table 4) compared to USD 84,268 as of the end of Sep 2022 (refer to Table 2).

The total fund value at the end of Dec 2022 then became USD 94,371 as per Table 5.

|

| Table 5: Total Fund Value as of the End of Dec 2022 (Before Buying New Shares) |

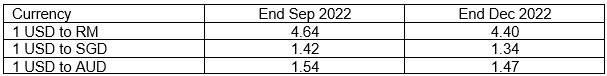

At the same time, I also have used the updated forex rates as per Table 6. Note the changes in the rates as of the end of Dec 2022 compared to the end of Sep 2022. It reflects the strengthening of the USD against the other currencies.

|

| Table 6: Forex Rates |

You can see that the increase in the value of the portfolio is partly due to the strengthening of the USD. Without the changes in the forex rates, the value of the portfolio would be USD 87,049 compared to USD 90,224. About half of the portfolio gain from the end of Sep 2022 to the end of Dec 2022 was due to forex gain.

End Dec 2022 Return (before buying new shares)

I started the investment with an initial USD 100,000 set aside for the portfolio. Table 7 shows how the value of the Fund had changed over the past few quarters.

The returns in Table 7 are before accounting for dividends. In reality, there have been dividends paid during 2022. As such I will include the dividends when computing the year-end return.

Year-end returns incorporating dividends

The dividend information for each stock was obtained from Investing.com, based on the dividends received in 2022.

- I would exclude dividends that were declared in Dec 2022 but payable in 2023.

- I would also include those declared in 2021 but payable in 2022.

For those stocks purchased during the year, the dividends would depend on whether the stock was in the portfolio on the ex-payment date.

Table 8 summarizes the dividends received in 2022. You can see that in total the portfolio received USD 3,592 in 2022. I assumed that this was all in cash thereby increasing the cash position from USD 4,147 to USD 7,739.

|

| Table 8: 2022 Dividends Note: I have left the dividend per share for LIIHEN blank as the total dividends for LIIHEN was based on different amount of shares in 2022. |

If I include the dividends, then the year-end fund position becomes USD 97,963 as shown in Table 9.

The returns for 2022 are then a loss of 2.0 % derived from (97,963 – 100,000) / 100,000.

|

| Table 9: Total Fund Value as of the End of Dec 2022 Including Dividends |

Recap

I would like to recap what I said previously regarding returns. When it comes to assessing performance, you have the following options:

- Look at absolute returns.

- Compare your returns with those of the benchmarks.

- Compare the returns on a risk-adjusted basis.

When it comes to the fund or stock portfolio, the return is complicated by the following situations:

- During the period, some of the stocks could be losing money. You could have a negative total gain if there is a capital loss that is larger than the dividends.

- You could have sold off some stocks and been holding cash. Alternatively, you could be holding onto some dividends in cash form rather than have them reinvested during the review time.

- You could have also allocated additional cash to the funds. In other words, the amount set aside for investment is bigger not because of any gain, but because of additional funds.

To cater to such situations, I define the total gain and return in the following manner.

- Total Gain = current value - previous value + dividends.

- The returns for the period = Total Gain divided by the previous value.

- The fund value includes any un-invested cash.

I used the market value of the stocks in the portfolio to calculate the portfolio value. It is the sum of the market value of the respective stocks. The current and previous values refer to the value of the portfolio assuming it is liquidated.

The market value of a particular stock = number of shares held × market price. The number of shares held currently may be different from the number of shares held before. This could be due to bonus issues and or other corporate activities.

To ensure that I am comparing apple-to-apple, I also include any dividends or money that I have received that has not been reinvested.

- The dividends refer to all the dividends paid during the measurement period. Since there is a likelihood that you may reinvest the dividends, I look at the after-tax value of the dividends received.

- The money could be money pending reinvestment or money taken out.

Benchmarking returns

You can see that I incurred losses when looking from both the quarterly and year-to-date. Now whether the loss is a “good performance” can only be gauged by comparing it with some reference performance or benchmark.

In my previous article, I created a benchmark based on the following:

- KLCI for Bursa Malaysia.

- STI for SGX.

- S&P 500 for the US.

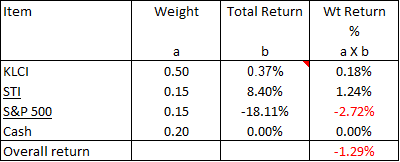

The weights for each benchmark are the value of funds allocated to the respective stock exchange at the beginning of the period. Refer to Tables 10 and 11 which estimated the benchmark returns ignoring dividends for the quarter and YTD respectively.

Note that for the fund, I have assumed that the cash did not earn any return. As such, I also assumed the same zero return for cash when computing the benchmark return.

I have included dividends in my funds. As such it is more appropriate to compare the fund returns with the benchmarks that included the dividends. Table 12 illustrate the computation of the total returns (capital plus dividends) for the benchmark.

|

| Table 12: Computing the Annual Benchmark Return (Including Dividends) |

Notes:

a) Based on the start of 2022.

b) Guesstimate for KLIC. STI and S&P were from FTSE Russel.

Comparing the returns

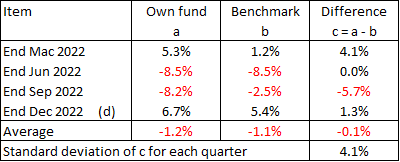

Table 13 summarized the performances of the fund with those of the benchmark before accounting for the dividends. You can see that the annual performance of the fund (from the start) was worse than the benchmark.

|

| Table 13: Comparing Performance with Benchmark (Before Dividends) Note: a) Before buying new shares and dividends. |

A more realistic comparison would be to include dividends ie a total return basis. The benchmark total return for 2022 was estimated to be a loss of 1.3 %. Refer to Table 12.

I had earlier estimated that on a total return basis, the fund incurred a loss of 2.0 %. The dividends had reduced the gap between the fund and the benchmark.

Risk-adjusted returns

I assess my performance here using the Information ratio and the Jensen alpha. Refer to my previous articles on the discussion of risk-adjusted returns.

The risk-adjusted returns for 2022 are:

- Information ratio = (0.02).

- Jensen Alpha = 0.039

Note the following limitations when looking at these risk-adjusted metrics,

- I did not include dividends.

- There were changes to the composition of the portfolio during the year. But the metrics assumed that there was no change.

- The metrics assumed volatility as risk. The Jensen Alpha is very dependent on the values of Beta.

Details for the computation of these 2 metrics are presented in the following 2 sub-sections.

Information ratio

Table 14 illustrate the data for the computation of the Information ratio.

|

| Table 14: Computing the Information Ratio (Before Buying New Shares) |

Fund relative performance = fund return - benchmark return = (1.2) % - (1.1) % = (0.1) %

Tracking error = Standard deviation of the differences = 4.1 %

Information ratio = (0.1) % / 4.1 % = (0.02)

This information ratio is interpreted as the fund underperforming the benchmark by 0.02 per unit of volatility over the past 4 quarters.

Jensen alpha

The alpha is one way to determine if a portfolio is earning the proper return for its risk level. The formula for calculating the alpha as per Investopedia is based on the Capital Asset Pricing Model:

Alpha = R(i) - [ R(f) + B × { R(m) - R(f) } ].

Where:

R(i) = the realized return of the portfolio.

R(m) = the realized return of the appropriate market index or benchmark.

R(f) = the risk-free rate of return.

B = beta of the portfolio for the chosen market index. The portfolio beta is the weighted average betas of all the stocks and cash in the fund.

The alpha for the fund in 2022 was derived as follows:

- The fund return is (5.6) %.

- The Benchmark return is (4.6) %.

- The risk-free rate of return for the year based on USD is 1.51 %.

- The portfolio beta is computed to be 1.17. Refer to Table 15.

Alpha = (5.6) - [ 1.51 + 1.17 × {(4.6) – 1.51} ] = 0.039

The alpha represents the amount of the portfolio return that is attributable to my stock-picking ability. As you can see, there was not much Alpha in 2022.

End Dec 2022 Diversity (before buying new shares)

The goal of a portfolio is to have about 20 to 30 uncorrelated stocks. You will have difficulty computing the covariances required to determine the correlations. As such, I used a rule of thumb to ensure diversity.

- Single stock concentration - the market value of a stock should not be more than 10% of the market value of the total portfolio.

- Group concentration - the market value of the stocks within a group should not be more than 30% of the market value of the total portfolio.

Refer to my earlier post on this series for the details. Based on the end Dec 2022 market prices, we have the following status:

- Regions/stock exchanges. 51 % of the portfolio is invested in Bursa Malaysia stocks. This was similar to the Sep 2022 position.

- Investment type. 39 % of the stocks are Quality Value ones. I would not worry too much about this as Quality Value stocks are my base investment type.

- Market cap. 39 % of the stocks have a market cap greater than USD 500 million each. The bulk of these is US companies.

- There was no breach under the sector criteria.

Since I was going to use up all the cash to invest in new shares, I would like to reduce the Bursa Malaysia exposure.

You will also notice from Table 15 that some of the stocks had exceeded the USD 5,000 single stock guideline. I did not sell down to rebalance them as I am betting that there is still upside. Besides they have not breached the 10% single stock cap.

|

Buying more

The market had declined since the beginning of the year. I would argue that this is due to price volatility rather than a reduction in the intrinsic values of the stocks.

I believe that the market has priced in the worst-case scenario and is probably near the bottom. As such I have added USD 10,000 to my funds and invested in three new stocks – HSBC, Intel, and OCBC. I consider these good companies facing some turnaround situations. Table 16 presents the key statistics.

If you want to know more about them, Seeking Alpha has a very good write-up and analysis for HSBC and Intel. There is one dated article on OCBC.

|

| Table 16: Profile of New Investments. Source: Yahoo Finance as of 5 Jan 2023 for all except OCBC ROE which was based on TIKR.com LTM. |

Table 17 summarizes the stock profile of the portfolio post the buying of the 3 new stocks.

- I invested in 500 shares of Oversea-Chinese Banking Corporation Ltd or OCBC (symbol 039.SI). This is to comply with the 100 shares minimum lot size under SGX. A 600 shares purchase would put it well above the USD 5,000 single share guideline.

- I invested in 188 shares of Intel Corporation (symbol INTC) and 8 shares of HSBC Holdings Ltd (symbol HSBA.L). Both Nasdaq and LSE have single share as the minimum lot size. These resulted in investments that are slightly larger than USD 5,000 each. I am OK with this as the single stock purchase guideline has increased by 10% with the additional funds.

These transactions left the fund with USD 3,091 cash. Since there was extra cash and Boustead Plantation price had declined to about when I first bought it, I decided to invest in 11,000 shares here. You can see the investments if you compare the Boustead Plantation value in USD in Table 15 with that in Table 17.

|

| Table 17: Portfolio Profile as of the End of Dec 2022 (Post Buying of New Shares) |

| |

| Table 18: Cash Position as of the End of Dec 2022 (Post Buying of New Shares and Additional Funds) |

You can see from Table 18 that cash has been reduced to USD 1,541.

You will notice that I used cost when looking at the single cost purchase guideline. However, when looking at the single stock investment cap, I used that market value. This is because my diversity guidelines are based on market value.

If you remember, the purchase cost guideline is derived by dividing the fund cost by the number of target stocks. As of the end of 2022, the fund is USD 110,000.

At the same time, I also have to check on the diversity given the additional 3 stocks.

- Regions/stock exchanges. We now have an additional stock exchange – LSE. This reduced the Bursa Malaysia portion to 46 % while the US portion increased to 32 %.

- Investment type. 38 % of the stocks are Quality Value ones. I would not worry too much about this as Quality Value stocks are my base investment type. But the Turnaround category has increased to 35% which is slightly above the limit.

- Market cap. We now have 48 % of the stocks with a market cap greater than USD 500 million each. The bulk of these is US companies.

- Sector. We now have two new sectors – IT and Finance. There was no breach under the sector criteria.

Should we be worried about the Market cap situation? Let me have your thoughts.

PS: For those of you who have been paying close attention, you notice that my diversity % were based on the fund rather than just the stock portfolio. This does not change the conclusion. If it fails that fund %, it will fail the stock portfolio %.

Conclusion

You will note that there are two aspects to maintaining the stock portfolio.

- Keeping track of the various transactions.

- Reviewing and interpreting the results.

I consider portfolio construction and maintenance as another set of skills to develop. As you can see, these involve tracking various transactions. That is why being familiar with EXCEL can reduce a lot of the computation work so that you can focus on the interpretations.

By providing details of the various transactions, I hope you have a template to set up your own EXCEL worksheet to track the various items.

In this post, the “new” analysis was to include dividends in computing the returns. I have now added another complication – increasing the fund size. In my next post, I will show how to compare the performance given this increase in the fund size.

There are 2 keys questions when reviewing and interpreting the results

- How did we perform?

- Are we still well diversified?

There are several approaches to answering the first question. The fund achieved a total loss of 2.0 %. Considering that I can get at least 3 % gain from bank interests, this is a bad absolute return. The fund loss is also worse than the benchmark loss of 1.3 %. And the risk-adjusted results are nothing to shout about.

The second question is because the goal of a portfolio is risk mitigation. This is achieved by having about 30 to 40 uncorrelated stocks. Rather than use Modern Portfolio Theory to determine the “uncorrelated” status, I used diversity as a rule of thumb. It is more practical for the retail investor.

I have sliced and diced the portfolio based on various factors that affect stock returns. I have chosen region, investment type, market cap (for size), and sector and investment type as the factors. I am sure you can think of others. Based on my factors, the portfolio is still diversified.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment