Was I wrong to invest in AmFirst REIT?

Value Investing Case Study 37-1: A fundamental analysis of AmFirst REIT to determine what to do with this loss-making investment.

I first bought Amfirst REIT (AmFirst) in 2007 and over the next few years, I built up my investments to about 234,000 units. This included subscribing to its Rights in 2012.

My average purchased price including the Rights was RM 1.00 per share. As of 5 Dec 2022, AmFirst was trading at RM 0.37 per share. Did I make a mistake in investing in AmFirst?

To answer the question, you have to also look at the Dividends paid over the years. At the same time, we know that the Malaysian property market was soft for the past few years. The performances and market prices of Bursa Malaysia properties companies and REITs reflected this situation.

But we know that the property sector is cyclical. We are probably near the bottom of the current cycle. When the property market uptrends, so will the performances of the property companies and REITs. In looking at whether AmFirst was an investment mistake, we should consider the performance over the cycle.

Join me as I explore this question taking into account the Dividends paid and the property cycle.

Should go and buy it? Well, read my Disclaimer.

Contents

- AmFirst profile

- Financial performance

- Peer comparison

- Unitholder’s performance

- Hold or exit?

- Conclusion

- Appendix 1

|

If you are not familiar with REITs or AmFirst, I suggest that you read the following articles:

This post will build on the information contained in them, especially the last one.

Amfirst profile

AmFirst IPO in 2006 as an office REIT as it owned 4 office properties. Then in 2009, it acquired The Summit. This was a complex comprising a shopping mall, a hotel tower, and an office tower. AmFirst expanded its retail investment in 2016 when it acquired the Mydin Hypermarket premises.

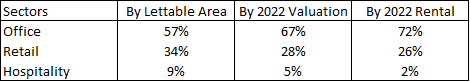

AmFirst today has 9 properties. Refer to Table 1. The majority of the properties are located in the Klang Valley. I would consider AmFirst a mixed-sector REIT today as can be seen in Table 2.

|

| Table 1: Composition of Properties |

|

| Table 2: Sector Profile |

Corporate structure

AmFirst is part of the Amcorp Group Berhad (Amcorp). Refer to Chart 1. Amcorp is an established investment holding company with its core business in financial services, property development, and investment.

AmFirst is managed by AmREIT which is responsible for the management, investment, and business strategies of the REIT.

AmREIT is wholly owned by AmREIT Holdings. This in turn is 70% owned by AmInvestment Group Berhad (AIGB) and 30% owned by Amcorp Properties Berhad (AmProp).

- AIGB is a wholly owned subsidiary of AMMB Holdings Berhad (AMMB), a Bursa Malaysia banking group.

- AmProp is a wholly owned subsidiary of Amcorp Group Berhad (Amcorp), which is also a substantial shareholder of AMMB.

When I first bought AmFirst in 2007, REITs were a new investment instrument in Malaysia. I must admit that I chose AmFirst because of the reputation of AmCorp.

|

| Chart 1: Corporate Structure |

Financial Performance

While AmFirst has grown its properties – lettable area and valuation – over the years, its occupancy has declined. Refer to Chart 2.

|

| Chart 2: Property Trends |

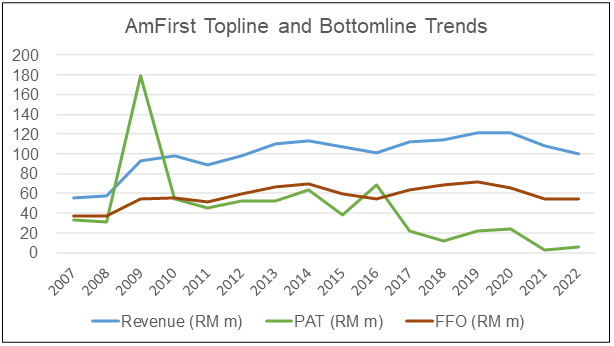

The financial performance of AmFirst can be considered mixed. While Revenue and FFO in 2022 were higher than those in 2007, PAT was lower. Refer to Chart 3.

From 2007 to 2022 on a per-year compounded basis,

- Revenue grew by 4.0 %. But the bulk of this growth came from 2007 to 2009. From 2009 to 2022, revenue only grew at 0.5 % CAGR.

- PAT declined by 11.5 %. After spiking in 2009, PAT declined from 2010 to 2022. The PAT growth in 2009 was due to a substantial gain from the revaluation of properties.

- Funds Flow from Operations (FFO) grew by 2.6 %. Note that I defined FFO = PAT + Depreciation – Gain from Asset Disposal – Gain from Asset Revaluation Surplus

|

| Chart 3: Topline and Bottomline Trends Note: Amfirst FYE is in March. The 2007 performance was based on annualizing the 3 months’ results. |

We can trace the financial performance of AmFirst to the declining tenancy performance. As per Chart 4, you can see that the rental per sq ft and occupancy had been declining.

|

| Chart 4: Tenancy Trends Note: Amfirst FYE is in March. 2007 average rental per sq ft was based on annualizing the 3 months’ results. |

We are not comparing apples-with-applies when looking at the overall occupancy or average rental. This is because, over the years, new properties were added. There was even one property that was sold off. For an apple-to-apple comparison, we should look at the performance of individual properties.

Chart 5 shows the occupancies of the individual properties.

- Bangunan Ambank Group (BAG) had the best track record with 97 % occupancy in 2007 and 98 % in 2022. During the past 16 years, it was 100 % most of the time.

- The worst performers were Menara AmFirst, The Summit, and Prima 9

|

| Chart 5: Occupancy Trends |

Chart 6 tracks the gross monthly rental for the individual properties.

- Bangunan AmBank Group was the best performer. The 2022 rental at RM 5.02 per sq ft per month is still higher than that of 2007 of RM 4.53 per sq ft per month.

- The worst performer was The Summit where the 2022 rental was RM 1.05 per sq ft per month compared to the 2009 rental (on acquisition) of RM 3.12 per sq ft per month.

- I would also mention that Prima 9 had two years (2016 and 2017) of zero occupancies.

|

| Chart 6: Rental Trends Note: For Prima 9, Prima 10, Jaya 99, and Mydin I ignored the rental for the year of acquisition as they may not be the full-year results. |

In my previous article, “What to consider when investing in REITs”, I discussed how AmFirst had funded its growth. Refer to it for details. Suffice it to say that AmFirst used a combination of Debt and new Capital to fund its growth. The new Capital was unitholder dilutive and probably contributed to part of the decline in unit price.

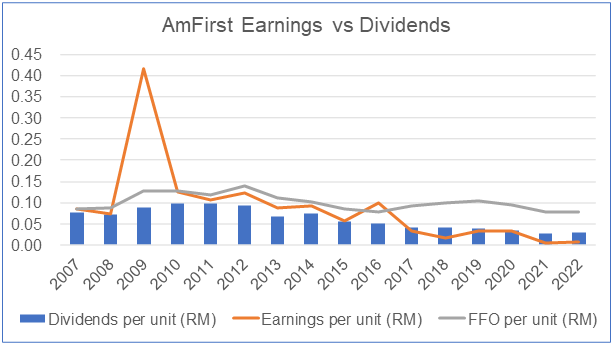

We have the combination of not-so-good financial performance and the increase in the number of units. This meant that the unit holders were worse off in 2022 compared to 2007. Refer to Chart 7. You can see that Earnings per unit and FFO per unit declined. This then led to a declining Dividend per unit. Certainly not an exciting picture for a unitholder who bought them in 2007.

|

| Chart 7: Earnings and Dividend Trends |

Peer comparison

Charts 8 and 9 compared AmFirst’s performance with those of a sample of Bursa Malaysia REITs. These comparisons enabled me to determine whether AmFirst’s performance was due to the market or its problems.

There were 18 companies including AmFirst in the peers. Refer to Appendix 1 for the list of REITs. Note that I covered the 2012 to 2021 period for the Peer comparison.

In the Charts, the central tendency was presented as mean and median. The upper quartile (Q3) and lower quartile (Q1) represented the range.

Not all 18 companies had data starting from 2012. As such for the central tendency, I used the median as the main metric. The missing data does not significantly affect the quartile values.

Refer to “Hunting for Bursa REITs to invest in” for more analysis on the Bursa Malaysia REITs and the method used in the analysis.

|

| Chart 8: Peer Revenue and PAT |

|

| Chart 9: Peer ROE and FFO per unit |

A summary of the comparisons is presented in Table 3. From 2012 to 2021,

- The panel median revenue grew at a CAGR of 2% whereas AmFirst revenue grew at 1 % CAGR.

- AmFirst’s PAT and ROE declined much more than those for the panel median.

- AmFirst FFO per unit declined less than that for the panel median.

In terms of the average ROE from 2012 to 2021, the panel had a better return of 6.7 % compared to AmFirst’s return of 4.4 %. On the other hand, AmFirst’s average FFO per unit was better than that of the panel median.

For a REIT, the key metric would be FFO per unit. On such a basis, I would conclude that AmFirst did better than the market median.

|

| Table 3: Summary of Peer Comparisons |

Unitholders Performance

In my article, “What to consider when investing in REITs”, I discussed AmFirst unitholder’s performance. Refer to it for details.

I had originally bought 138,500 units. When AmFirst offered the Rights, I not only subscribed to my entitlement, but I also subscribed to excess Rights. All in, I subscribed to 95,215 units. In total, I bought 233,715 units at an average price of RM 1.00 per share.

I bought them at different times. Based on a cost-weighted average basis, I estimated that this is equivalent to buying them all on 20 May 2011. From that date till 5 Dec 2022, I would have held onto the shares for about 11.55 years.

In my previous REIT article, I illustrated how to compute that total Gain if you had bought 1,000 units in 2007 and held onto them till 2022. I used the same approach to compute my Gain based on my actual purchase.

Table 4 illustrate the computation. On such a basis, my investment in AmFirst had delivered a 0.9 % CAGR over the past 11.55 years.

|

| Table 4: Estimating My Return |

Projected unitholder’s gain

In my article “Was Tower REIT an investment mistake?”, I had assumed a scenario where the property market recovers in 8 years. To see whether it is worthwhile to continue to hold, I projected the best-case scenario for AmFirst on the same basis. The key assumptions were:

- The best price would be achieved in 8 years ie 19.55 years total holding period.

- I assumed that the market price would retrace its historical pattern. As such, I took the Dec 2014 market price as the projected price in 8 years. The market price then was RM 0.90 per unit.

- I assumed the Dividends to retrace its historical pattern. The Dividends for the next 8 years is thus equal to those from 2015 to 2022 of RM 0.321 per unit.

Based on these, I would achieve a 3.5 % CAGR based on a 19.55-year holding period. Refer to Table 5.

|

| Table 5: Estimating the Projected Return |

Hold or exit?

I originally invested in AmFirst on the basis that it was trading at a discount to its Book Value and had a good FFO Yield.

- My average purchase price (before the Rights) was RM 1.13 per share. The Book Value of AmFirst in 2010/2011 (equivalent period) was RM 1.40 per share. As a REIT, the Book Value is a good indication of the intrinsic value.

- I estimated its FFO Yield (based on the RM 1.13 purchase cost) to be 5.5 %.

The price of AmFirst is today RM 0.37 per unit. This is due to a combination of declining performance and negative market sentiments. The decline in the performance per unit was due to a reduction in the occupancy, average rental per sq ft as well as dilutive share issuance.

The property market is cyclical and currently at the bottom of the cycle. I expect the demand for office space to uptrend and peak in the next decade. When this happens, the performance of AmFirst will improve. The market price will experience a corresponding uptrend.

Together with the Dividends, this will provide a better total gain. It is better than selling off now to invest in another underprice stock as illustrated below.

In my Tower REIT case study, I illustrated a hold and exit analysis. I used the same framework to conclude that I should continue to hold. The rationale is summarized below.

Over the past 20 years, I have achieved a compounded 10 % total return with my stock portfolio. Based on this, and assuming no Dividend, it would mean doubling the unit price in about 7 to 8 years. I used this as the alternative investment benchmark.

If I sell AmFirst now at RM 0.37 per unit to invest in another underpriced stock, on a per-unit basis:

- I would gain = RM 24,795 / 233,715 = RM 0.11 per unit. This includes Capital Loss + Dividend. Refer to Table 4.

- The gain from the alternative investment = RM 0.37 per unit ie doubled my investment.

- There would thus be a net gain of RM 0.37 + RM 0.11 = RM 0.48 per unit.

But in Table 5, I have shown that AmFirst could generate a total gain of RM 223,686 / 233,715 = RM 0.96 per unit. This is more than the RM 0.48 per unit gain from selling now.

The risk is whether AmFirst could achieve Capital Gain and Dividends in 7 to 8 years. It does not look impossible. As such I should continue to hold.

|

Conclusion

AmFirst’s mission is:

“We focus on delivering sustainable long-term income distributions and investment performance of our diversified portfolio of commercial real estate.”

My analysis showed that it failed in its mission:

- The annual dividend had declined from an average of RM 0.09 per unit (2008 to 2010) to an average of RM 0.03 per unit (2020 to 2022). I would not consider this sustainable.

- The Book Value had grown by a 1.0 % CAGR from 2007 to 2022. Can this be deemed sustainable?

- The average FFO per unit had declined from an average of RM 0.11 per unit (2008 to 2010) to an average of RM 0.08 per unit (2020 to 2022). This is not considered a good investment performance.

From a unitholder’s perspective, from 2011 to 2022, I achieved a total gain of RM 24,715. My gain was at 0.9 % CAGR. Not exactly great compared to the returns from keeping the money with the Malaysian Employees Provident Fund (EPF). Over the past 10 years, the EPF had a 6.1 % average annual return.

Based on these, I would conclude that my investment in AmFirst was a mistake.

But based on my hold-exit decision-making framework, I should not exit. The potential gain from a recovery of the property market far outweighs the potential gain from selling now and investing in other undervalued stocks.

It is ironic – it is an investment mistake, but it is better to hand on than cut loss.

Appendix 1 – Peer REITs

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment