Is Glomac a value trap?

Value Investing Case Study 39-1: A fundamental analysis of Glomac to see whether it is a value trap. I invested in Glomac years ago. This post summarized my investment thesis on why I should continue to hold onto it.

Glomac Berhad (Glomac or the Group) is a Bursa Malaysia property developer. It is currently trading at RM 0.32 per share (as of 26 Jan 2023) compared to its Book Value of RM 1.51 per share.

A value trap is a company that appears cheap but is cheap because of poor business fundamentals. Does Glomac fit this criterion? Is the market suggesting that there is going to be a significant impairment of its assets?

To be able to answer the value trap question correctly, you have to look at its business fundamentals.

I am a long-term value investor in Glomac with an average purchased cost of RM 0.65 per share. I have held onto the shares for 10 years. Based on the current market price and the total dividends received so far, I would have a compounded annual loss of 1.2 %.

Should I cut the loss and sell it now? No.

There are 2 components to the return – capital gain and dividends. The loss is due to the capital gain portion and there are prospects for this to be higher. This is because the market price is significantly below its intrinsic value.

Join me as I analyze and value Glomac so that you can understand the basis of my decision. I concluded that Glomac is not a value trap.

Should you go and buy it? Well, read my Disclaimer.

Content

- Background

- Performance

- Financial strengths

- Peer comparison

- Value creation

- Valuation

- Investment Thesis

- Conclusion

|

Background

Glomac began in 1988 by entrepreneur co-founders Tan Sri Dato’ FD Mansor (Group Executive Chairman) and Datuk Richard Fong (Group Executive Vice-Chairman).

For transparency, I happen to know Datuk Richard Fong. He was 2 years my senior at RMC. On his private side, he is also an investor in one of the data centre operators in i-City.

Glomac was listed on the Main Board of Bursa Malaysia on 13 June 2000. Today, the Group comprises more than 55 subsidiaries and has completed close to RM9 billion in total sales value.

The Group has 3 business segments - Property Development, Construction, and Property Investment. However, in terms of revenue, Property Development accounted for about 92 % of the Group’s last 3 years’ annual average revenue. I would classify Glomac as mainly a property developer.

In the Malaysian context, property developers acquire land, undertake land development activities and then construct buildings for sale. They then move on to other sites to repeat the process.

Occasionally, they may keep some of the properties such as office buildings and shopping malls as long-term investments. They may also have a construction arm but this is focused on in-house projects rather than competing for 3rd party projects.

Glomac’s business model fits the above description. As of the FYE 2022 (Apr 2022), Glomac has the following business profile.

|

| Table 1: Segment Profile Notes a) Revenue for FYE 2022. b) Net Assets as of FYE 2022. The total added up to SHF + MI. |

Performance

The property sector is cyclical. As such you would classify Glomac as a cyclical company.

However, the correlation between Glomac’s revenue and the Malaysian Housing Price Index (HPI) for the past 2 decades is only 0.42%. This meant that changes in the HPI only explained about 18 % of Glomac revenue changes.

Chart 1 compares the % change in Glomac’s annual revenue vs the HPI. You can see that Glomac’s revenue was more volatile than HPI’s. The HPI had one major spike in 2012/13 that coincided with Glomac’s revenue spike in 2011.

|

| Chart 1: Annual Revenue Changes vs Annual HPI Changes |

Note that I am using the HPI to track the property cycle. Refer to "How to identify property cycles for equity investment opportunities".

I normally value cyclical companies by looking at their performance over the cycle. In the case of Glomac, there is no advantage in doing so. The HPI cycle only played a small role in the performance of the Group.

The performance of Glomac through these cycles can be seen from the Performance Index in Chart 2.

|

| Chart 2: Performance Index |

You can see that the PAT tracks the revenue. Both of these have been above the 2001 values for the past 2 decades. However, Gross Profitability for the past few years had been lower than that for 2001. I suspect that this was due to the Covid-19 restrictions.

Revenue and PAT peaked in 2012/13 and had been declining since then. The decline was due to the various measures instituted by the government to control property speculation. The profits in 2020 and 2021 were also reduced by some asset write-downs.

According to Professor Novy-Marx, gross profitability has the same power as Price to Book Value in predicting cross section returns. I used this as one of my performance metrics. It indicates how well a company has managed its assets relative to the gross profits. You can see that in the case of Glomac, gross profitability was less volatile than PAT.

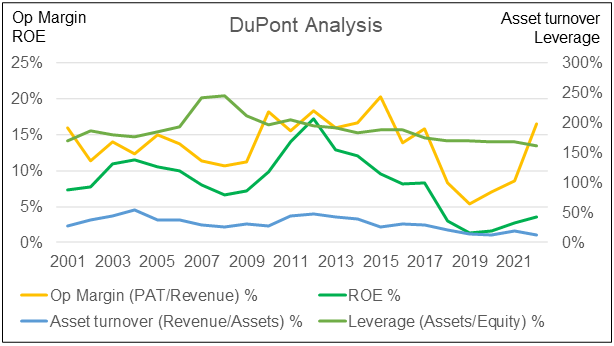

A DuPont analysis of Glomac through the past 2 decades is shown in Chart 3.

- The profit margins accounted for the bulk of the changes in the ROE.

- During 2012 to 2017, the ROE declined more than the profit margin. This was due to the decline in the Asset turnover and Leverage.

|

| Chart 3: DuPont Analysis |

Note that while Glomac’s business metrics may not appear to be cyclical, its stock prices have gone through several cycles over the past 2 decades. Refer to Chart 4. I interpret this as the market being more sentiments-driven than fundamentals-driven.

Investopedia defined a cyclical stock as “... a stock that's the price is affected by macroeconomic or systematic changes in the overall economy”. You can see that it is based on the stock price. By this definition, Glomac is a cyclical stock.

As a fundamental investor, I prefer to base the cyclicity on business fundamentals.

|

| Chart 4: Price Trend |

Financial strengths

I want cyclical companies to be financially sound in the downtrend portion of the cycle. This is because we don't know the duration and depth of the cycle. Prolonged cycles can result in asset impairment and poor cash flow generation. A company that is not financially strong may have survival problems.

I would rate Glomac as financially sound for the following reasons:

- It has a current ratio of 1.26 based on the Balance Sheet as of Oct 2022.

- It has a DE of 0.4 as of Oct 2022.

- Over the 2009 to 2022 cycle, it managed to generate a cumulative RM 121 million Cash flow from Operations. Over this period, there were 5 years with negative Cash flow from Operations.

- It currently has an interest coverage ratio of 3.4 based on the past 3 years of earnings. I defined this as EBIT/interest. This is equal to a BB (Fitch) synthetic rating as per the Damodaran approach.

|

Peer comparison

Glomac currently has shareholders’ funds of RM 1.22 billion (as of Oct 2022). I thus compared its performance with property companies with shareholders’ funds greater than RM 1 billion.

The sector performance was based on the base rates data presented in my article "Will the Malaysian Property Industry turn around by 2024? ". They covered the 2010 to 2020 period.

Table 2 compares Glomac’s performance with those of the sector. Except for revenue growth from 2010 to 2020, Glomac performed better than the sector median. I would rate Glomac’s performance as good.

|

| Table 2: Sector Comparison Note: The sector performance was based on the median for the sector. |

Value creation

I looked at the following metrics in assessing shareholders’ value creation.

Over the past 12 years, assuming that no dividend has been distributed, the shareholders’ funds would have increased by a CAGR of 9.2 %. This is about comparable to the 9.0 % cost of equity for Glomac.

I estimated Glomac’s weighted average cost of capital (WACC) to be 5.7 %. Over the past 12 years, the Group achieved an average 7.2 % return. This return is computed as EBIT(1-t)/TCE assuming a 24 % tax rate. The return is better than the WACC.

Consider a shareholder buying 10 shares at the start of 2012 (after the share split) and holding onto it till the end of 2022. Including the bonus share, he would have achieved a compounded annual loss of 0.6 % per annum. Refer to Table 3. Compare this with the 9.0 % cost of equity.

If you look at the above analysis, you will see that based on those related to fundamentals, Glomac did OK. But for value creation based on market prices, Glomac did not deliver.

|

| Table 3: Estimating Shareholders' Gain |

I also considered the Q Rating. For details on this rating scheme, refer to "How To Mitigate Risks When Value Investing".

Glomac has an overall Q rating score of 0.38 placing the Group below the average ranking of the panel companies. The rating reflects the poor growth position.

Valuation

I use 3 metrics to triangulate the intrinsic value of Glomac. Table 4 summarises them. You can see that based on the current market price there is a sufficient margin of safety.

My average purchase cost is RM 0.65 per share. This is significantly below the Asset Value or the Earnings Power Value.

|

| Table 4: Valuation Notes a) Based on Book Value as of Apr 2022. b) Based on the average of FCFF and Residual Income models. The values were based on a time-weighted 2011 to 2022 period. |

Valuation models

The valuation models were based on Damodaran (FCFF) and Penman (Residual Income) approaches.

The FCFF model was based on discounting the FCFF with the WACC.

FCFF = Free Cash Flow to the Firm = EBIT(1-t) – Reinvestments.

Reinvestments = CAPEX – Depreciation & Amortization + Increases in Net Working Capital.

The Residual Income model was based on TCE + discounted Residual Income.

TCE = Total Capital Employed = Shareholders’ Funds + Minority Interests + Debt – Non-Operating Assets.

Residual Income = WACC x TCE.

Both the above models valued the operating assets. To estimate the Value of the firm, I added the Value of non-operating assets. Then,

Value of Equity = Value of the firm – Debt

For both the models, the WACC was based on Damodaran built-up approach where:

- The Beta was derived taking into account the Betas for the various business segments.

- The market value of Debt was based on modelling the Debt as a single bond payment.

- The cost of Debt was based on the Default spread estimated based on Damodaran’s synthetic rating.

Limitations and risks

In interpreting the valuation results, you should consider the following:

As a property developer, a significant part of Glomac assets is tied up in hard assets. The concern with Asset Value is the potential impairment of under-utilized assets. Glomac provided for some impairments in 2020 and 2021. Together with the opening of the Malaysian economy post-Covid-19, I do not expect further provisions. I would consider the Asset Value as realistic.

My Earnings Power Value was estimated based on Glomac’s performance over the past 12 years ie 2011 to 2022. Note that this was part of the latest property cycle of 2009 to 2022. Normally for cyclical companies, I used the values over the cycle to represent future performance.

In the case of Glomac, the 2009 to 2022 average values were higher than those used in my analysis. For example, from 2009 to 2022 the average revenue was RM 464 million compared to my time-weighted RM 412 million used in my model.

As such I do not think that the conclusion would be different if I had used the full cyclical values. Besides my correlation analysis did not indicate any significant link between Glomac revenue and the HPI cycle.

My valuation model for property developers differs from that for manufacturing companies in my treatment of non-operating assets.

- In manufacturing companies, I consider cash, securities, and investment in associates as non-operating assets.

- In the case of property companies, in addition to the above, I also consider excess land as non-operating assets.

This is because many Malaysian property developers have landbank that far exceeds what they normally need to use over the next 5 to 6 years. In many cases, the land bank continues to grow.

As such, if the landbank is increasing as for Glomac, I treat any land over the normal usage as non-operating assets. At the same time, I also re-valued the land held for development based on a 5% annual appreciation. I treated this as a revaluation surplus

For Glomac, the non-operating assets are summarized in Table 5. You can see that this is equal to RM 0.95 per share. Note that the non-operating assets are only taken into account in the Earnings Power Value. The Assets Value does not include the revaluation surplus.

|

| Table 5: Non-operating Assets Note: I assumed that the revaluation surplus is after 24% taxes. |

Greenwald analysis

If you compare the Asset Value with the Earnings Power Value, you will notice that there are about the same. According to Professor Bruce Greenwald, you would expect to see this in a competitive environment.

More importantly, Glomac is not considered one with sustainable competitive advantages. In Greenwald framework, for a sustainable competitive advantage, the Earnings Power Value has to be greater than the Asset value. According to him, you only use the valuation model with growth if you have Earnings Power Value > Asset Value.

Note that in the Greenwald analysis, the Asset Value is based on the Reproduction Value. On such as basis, the value for Glomac would be higher than what is shown in Table 4. That is why I consider the Asset Value as about the same as the Earnings Power Value for Glomac.

The takeaway from this Greenwald analysis is that Glomac should not be valued as a growth stock. That is why I used the Earnings Power Value as this ignored growth.

Investment Thesis

The Malaysian property market has been soft since the mid-2010s. This was the result of several measures by the government to reduce property speculation. Covid-19 aggravated the situation.

As such the earnings of property developers have been declining over the past few years. The performance of Glomac was similarly affected.

The negative market sentiments have also not helped. Many property developers are today trading at less than half of their NTA. But the property sector is cyclical and with the post-Covid-19 opening of the economy, the bottom of the cycle has been reached.

I expect the business performance of Glomac in the coming years to improve. Together with the expected improvement in the market sentiments, the market price of Glomac would be much higher than what it is today.

The market price of Glomac is currently below its intrinsic value. This is from the perspective of the Asset Value, Earnings Power Value, and Acquirer's Multiple.

Given the projected fundamental performance and market direction, I should continue to hold my shares in Glomac.

|

Conclusion

There are two general questions value investors ask before investing in a company:

- Is it a good company? In other words, is it fundamentally strong?

- Is it a good investment? I assessed this by looking at whether there is a sufficient margin of safety (> 30 %) at the current price.

My analysis and valuation of Glomac are intended to answer these questions. I believe that the answers to both are positive. Sure, there are some concerns about the shareholders’ value creation. But this is due to the current market sentiments.

Is Glomac a value trap at the current price? For a company to be a value trap, its low price must be due to poor fundamentals. In the case of Glomac, the analysis does not indicate poor fundamentals. The intrinsic values are significantly higher than the market price. I would not consider Glomac a value trap.

Even based on my average purchased price of RM 0.65 per share, Glomac would not be considered a value trap.

END

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

If the above article was useful, you can find more insights on how to make money in my e-book. The e-book is now available from Amazon, Kobo and Google Play.

PS: If you are in Malaysia or Singapore, the e-book can only be download from Kobo and Google Play.

How to be an Authoritative Source, Share This Post

|

Disclaimer & DisclosureI am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment