Is Crescendo a value trap?

Value Investing Case Study 42-1: Crescendo: A niche property developer defying the value trap.

I have some investments in Crescendo Corporation Bhd (the Group or Crescendo) that I have been holding onto for almost 9 years. My average purchased price was RM 1.98 per share. The total dividends I have received over the holding period amounted to an average of RM 0.58 per share.

The market price for Crescendo as of 20 March 2023 was RM 1.15 per share. This meant that inclusive of the dividends, I have a negative total gain.

Was my investment in Crescendo a mistake? Does the current market price mean that it is a value trap?

A value trap is a stock that appears cheap but is cheap because there are fundamental issues with the business. In other words, the intrinsic value of the business is significantly less than the market price.

Is this the case for Crescendo? No. Join me as I show why Crescendo is not a value trap. I will also present my rationale on why I continue to hold onto the stocks.

Should you go and buy it? Well, read my Disclaimer.

Contents

- Company profile

- Performance

- Prospects

- Value creation

- Conclusion

|

Company profile

Listed on Bursa Malaysia in 1997, the Group today described its core business as:

“…operate and serve sustainable communities in Johor with our construction, investment, property development and education services segment through strategic town planning and effective living solutions.”

The Group traced its roots to 1985 with the conversion of 1,000 acres of oil palm plantation land into a development project known as Desa Cemerlang. This has both township and industrial components:

- 1989 - started development of the 600 acres Taman Perindustrian Cemerlang.

- 1990 - planning for a self-contained township at Desa Cemerlang. The development was started in 1995.

The other milestones for the Group included:

- 1990: acquired 843 acres for Ambok Resorts.

- 1998: established Crescendo International College. It started operations in 2000.

- 2001: acquired 1,390 acres for Bandar Cemerlang.

- 2004: acquired 38 acres for Taman Dato Chellam and 342 acres for Taman Perindustrian Nusa Cemerlang.

- 2005: acquired 41 acres next to Taman Perindustrian Nusa Cemerlang.

- 2017: Crescendo-HELP International School started.

The Group comprises 4 main business segments:

- Property development & construction - the development of industrial, residential and commercial properties. The construction arm focus on in-house projects.

- Manufacturing & trading of building materials. The manufacturing arm comprises 2 ready-mix concrete plants. These 2 plants also manufacture ‘u’ drains, concrete pipes/culverts, and other precast products for the local and export market.

- Property investment in industrial properties.

- Services & others. This segment also provides educational services. The education arm has 2 colleges built on 14.4 acres of land at Desa Cemerlang:

- Crescendo International College caters for Cambridge A-levels, tertiary education and professional qualification.

- Crescendo-HELP International School offers primary and secondary education.

As can be seen from Chart 1, the Property development & construction segment is the biggest revenue contributor. This is followed by the Manufacturing & trading segments.

|

| Chart 1: Segment Revenue |

In terms of property development, the Group focus on township and industrial properties in Johore. You can get a good sense of this by looking at the types of properties sold over the past 7 years as illustrated in Chart 2.

- About 38 % of the properties were industrial units.

- About 48 % were residential units.

|

| Chart 2: Types of Properties Sold |

Performance

Crescendo is a cyclical company. Its revenue went through 2 cycles over the past 12 years as shown in Chart 3.

However, its profits were more volatile and its 2022 PAT was lower than that in 2011. Nevertheless, the Group has been profitable ever since its IPO in 1997.

- The substantial increase in profit in 2014 was also contributed by the higher profit margin. This was the result of change in sales mix and fair value changes of investment properties amounting to RM 39 million.

- The profit in 2015 remained high due to the fair value gain in investment properties of RM 85.5 million.

- There was a gain from fair value adjustment on investment properties amounting to RM 41.4 million for 2017.

To get a sense of the impact of the fair value gain, I also plotted the adjusted EBIT. This is the EBIT less the fair value gain. You can see that this adjusted EBIT is less volatile and has a cyclical pattern. There is a 0.85 correlation between the adjusted EBIT and revenue.

The revenue and adjusted EBIT over the past few years were about the same level as those in 2011. But gross profitability over the past few years were about 25 % lower than that in 2022. The Group had become less capital efficient over the past 12 years.

|

| Chart 3: Performance Index |

Not surprisingly the ROE of the Group had been declining over the past 12 years. It was 8 % in 2011 but had declined to 2 % in 2022. A DuPont analysis showed that the decline was due to a declining Operating margin and Asset turnover. This was despite an increase in the Leverage. Refer to Chart 4.

|

| Chart 4: DuPont Analysis |

The Property development & construction segment was the largest EBIT contributor. This segment also delivered the best returns as measured by EBIT/Total Capital Employed.

|

| Table 1: Segment Performance |

The Property development & construction segment is key. But we should not ignore the Property investment and Manufacturing & trading segments. These 2 segments provide some “recurring” income to the Group. Refer to Chart 5.

|

| Chart 5: Segment EBIT Note: The EBIT for the Property investment segment included the fair value gain |

Financial status

I would rate the Group as financially sound based on the following:

- It had a Debt Equity ratio of 0.3 in 2022. The Group Debt Equity ratio had not gone beyond 0.4 over the past decade.

- Over the past 12 years, there were only 3 years when the Group incurred negative Cash flow from Operations. During the past 12 years, the Group generated an average of RM 22 million per year Cash flow from Operations.

- As of FYE 2022, the Group had RM 111 million cash. This is about 11 % of its total shareholders’ funds.

- If its Debt was rated, it would have an A – (Fitch) rating. This was based on a synthetic rating as per Damodaran using the interest coverage ratio.

During the period, the Group sourced about RM 510 million of funds. About half of this was from the Cash flow from Ops with the balance from new Equity and Debt. Note that the new Equity came from the conversion of ICULs and warrants.

About 45 % of the funds were used for CAPEX with the majority of the balance returned to shareholders in the form of share buyback and dividends. Refer to Table 2. Note that although there was a net increase in Debt, the Debt Equity ratio was relatively “stable”. This was due to the corresponding increase in capital.

Overall, I would rate this as a good capital allocation plan.

|

| Table 2: Sources and Uses of Funds Notes a) Net debt. b) Include sales of real estate properties. c) Include special dividends in 2022. d) Mostly increase in cash. |

Peer comparison

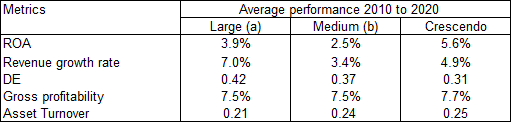

Crescendo currently has a shareholders’ fund of RM 0.92 billion (as of Jan 2022). I thus compared its performance with 2 categories of property companies:

- Large companies – those with shareholders’ funds greater than RM 1 billion as of 2020.

- Medium companies – these are companies with shareholders funds between RM 300 m and RM 1 billion as of 2020.

The sector performance was based on the base rates data presented in my article "Will the Malaysian Property Industry turn around by 2024? ". They covered the 2010 to 2020 period.

Table 3 compares Crescendo’s performance with those of the sector. Except for revenue growth, Crescendo performed better than the sector median for both the large and medium companies. I would rate Crescendo’s performance as good.

|

| Table 3: Peer Comparison Notes a) Sector values were based on the median of the large companies. b) Sector values were based on the median of the medium companies. |

Prospects

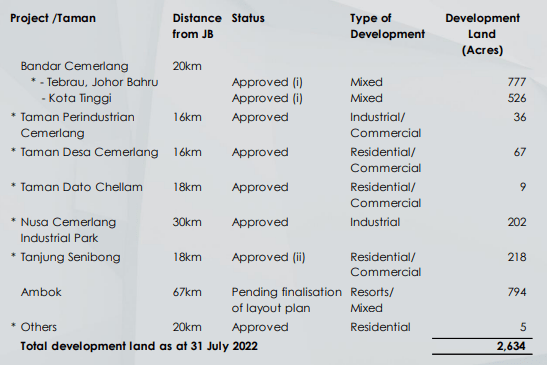

Crescendo is basically a township and industrial property developer that is focussed on Johore. Not surprisingly its 2,634 acres of development landbank is in Johore as summarized in Chart 6.

|

| Chart 6: Developments |

About half of the landbank is within Iskandar Malaysia. Furthermore, the Ambok land is 20 minutes-drive from the Pengerang Integrated Petroleum Complex. The location of the landbank augurs well for the future:

- Iskandar Malaysia is the main southern development corridor in Johor. It is formed by major cities such as Johor Bahru, Iskandar Puteri, Pasir Gudang, together with their surrounding areas. It is Malaysia's second largest urban agglomeration with a population of 2.5 million, after Greater Kuala Lumpur.

- Pengerang Integrated Petroleum Complex is a megaproject development in Johor. It spans over an area of 80 km2 and is one big step in creating value to the downstream oil and gas value chain in Johore.

The Group described its medium-to-long-term prospects and strategies as follows as per its Sep 2022 Corporate Profile.

- Demand for landed medium cost residential, industrial and commercial property market is expected to remain good especially in Iskandar Malaysia region for the next few years.

- Continue to concentrate our effort to develop landed residential properties in Bandar Cemerlang, the main contributors to Group earnings in the next few years.

In view of the transition of Malaysia to endemic phase and the re-opening of all economic sectors and international border on 1 April 2022, the Group will continue to focus on landed medium cost and affordable housing development.

- Continue to develop in smaller phases to be conservative.

- Continue to sell substantially built and completed buildings to meet demand from customers preferring to buy substantially built/completed buildings.

- Pre-built factories for rent to industrialists. Significant demand is expected for rental market at Nusa Cemerlang Industrial Park by foreigners currently operating in higher cost areas.

- To develop a wide range of properties ranging from low to medium-high cost residential properties, shop offices and from small terrace factory to large detached factory to target a wide spectrum of customers’ needs.

The Group is planning to launch about RM 600 million GDV of properties over the next 2 years as summarized in Table 4. This represents a turnaround plan. At its 2014/15 property development peak, the Group launched an average of RM 750 million GDV per annum. This was reduced to about RM 104 million GDV per annum over the past 3 years.

You can get a glimpse into Crescendo prospects by looking at its 2023 performance (FYE Jan 2023). Based on the TTM results, the Group achieved a revenue that is 6 % higher than that for FYE 2022. The TTM PAT was 47 % higher than that for FYE 2022 due to better gross profit margins and higher other income.

There are also positive media reports on the improving outlook.

“Johor’s property market as a whole is expected to remain positively stable, with a slow recovery in some sectors in 2023. The residential and commercial [segments] are expected to be stable in 2023. Johor has the highest number of overhang properties in Malaysia, with high-rise residential contributing to the oversupply, especially in Iskandar Puteri…Henry Butcher Malaysia points out…: The Edge Markets, Feb 2023.

“Developers in Iskandar Malaysia, Johor expect the property market outlook for the country’s first economic growth corridor to remain positive next year.” The Star Oct 2022.

“Several proposals and incentives of Budget 2023, including the creation of a special financial zone in Iskandar Malaysia, are expected to accelerate the social and economic development of the southern peninsula economic region post-pandemic.” New Straits Times Feb 2023.

“…Budget 2023…Pengerang is given special status and incentives for chemical and petrochemical activities…such status will boost the appeal of Pengerang Integrated Petroleum Complex...Phase 2 (2020-2026) of its development, and has received further committed investments of almost RM10 billion, including the development of Pengerang Industrial Park by Johor Corporation.” Business Today Oct 2022.

Value creation

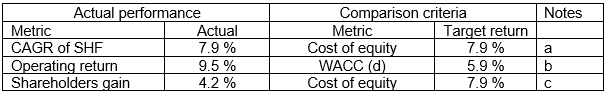

I look at the following to assess whether there has been value creation.

- I compare the returns with the appropriate cost of funds. Value is created if the returns exceed the cost of funds.

- I look at the Q Rating to see whether it is better than the average to denote value creation.

In looking at returns, I considered the performance of the business as well as the actual return achieved by a shareholder. Table 5 summarizes the results. You can see that there was hardly any value creation.

Taking into account the returns and the Q Rating, it is a hung jury when it comes to shareholders’ value creation.

|

| Table 6: Estimating Shareholders' Gain |

You can see from Table 6 that the positive total gain and CAGR was due to the dividends. The Group had a good dividend track record with an average 40% pay-out ratio. I expect this to be a consistent contributor to shareholders return in the coming future. When the capital gains turn positive, I would expect a jump in the total gain and CAGR.

Q Rating

Crescendo has an overall Q rating score of 0.40 placing the Group below the panel median rating of 0.44. Refer to Chart 7.

The rating reflects a good risk profile and strong financial position but zero growth and low profitability. For details on the Q Rating refer to “How To Mitigate Risks When Value Investing."

|

| Chart 7: Q Rating |

Valuation

I used 3 metrics to triangulate the intrinsic value of Crescendo. The valuation models for the Earnings Power Value (EPV) were based on Damodaran (Free Cash Flow to the Firm or FCFF) and Penman (Residual Income) approaches. For details of the valuation method, refer to my article “Is Glomac a value trap?”

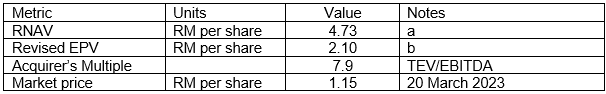

Table 7 summarizes the valuations. You can see that based on the current market price there is a sufficient margin of safety.

My average purchase cost is RM 1.98 per share. This is significantly below the Asset Value or the EPV.

For property companies, the Asset Value can be considered a floor value. Given that the market price is so much lower than the Asset Value, I would not consider Crescendo a value trap.

|

| Table 7: Valuation Notes a) Based on Book Value as of Jan 2022. b) Based on the average of FCFF and Residual Income models. The values were based on a time-weighted 2011 to 2022 period. |

Limitations and risks

In interpreting the valuation results, you should consider the following:

As a property developer, a significant part of Crescendo assets is tied up in hard assets. This is illustrated in Table 8 which breaks down the various components of the NTA. You can see that development land and investment properties make up a big portion of the NTA.

|

| Table 8: Components of NTA Note: The Others comprises the deferred tax assets less the long-term liabilities and minority interests. |

The concern with Asset value is the potential impairment of under-utilized assets. As the Group was profitable over the past 12 years, there was no impairment provisions. I would consider the Asset Value as realistic.

Revised Asset value and EPV

My valuation model for property developers differs from that for manufacturing companies in my treatment of non-operating assets.

- In manufacturing companies, I consider cash, securities, and investment in associates as non-operating assets.

- In the case of property companies, in addition to the above, I also consider excess land as non-operating assets.

This is because many Malaysian property developers have landbank that far exceeds what they normally need to use over the next 5 to 6 years. In many cases, the land bank continues to grow.

As such, if the landbank is increasing as for Crescendo, I treat any land over the normal usage as non-operating assets. At the same time, I also re-valued the land held for development based on a 5% annual appreciation. I treated this as a revaluation surplus.

For Crescendo, the non-operating assets are summarized in Table 9. You can see that this is equal to RM 3.71 per share.

If you want to be conservative, you can ignore the excess land for development and revaluation surplus. Along this line, then the Earnings Power Value is reduced to RM 2.10 per share. This conservative EPV is even higher than my average purchase cost of RM 1.98 (before deducting the dividends I have received).

|

| Table 9: Non-operating Assets Note: I assumed that the revaluation surplus is after 24% taxes. |

As the same time, if I included the revaluation surplus in the Book Value, I would have the Revised Net Asset Value of RM 4.73 per share. Refer to Table 10. You can see that the revised EPV is lower than the RNAV. I interpret this as under-utilization of the assets.

You should not be surprised as the Group used up about 30 acres of land annually. This is a very small amount relative to its 2,634 acres of landbank. All the more reason to include the excess land for development as part of the non-operating assets.

|

| Table 10: Revised Valuation Notes a) Revised Net Asset Value = Book Value + Revaluation surplus. |

|

Conclusion

Crescendo is a niche property developer. It focuses on industrial properties and townships in Johore.

The Group’s performance over the past few years was affected by the Malaysian soft property market as well as Covid-19. But there are signs that the Malaysian property cycle has reached its bottom. As such I would expect the Group performance to improve in the coming years.

Over the mid-to-long term, Crescendo would benefit from being near to the 2 most important projects in Johore – Iskandar Malaysia and Pengerang Integrated Petroleum Complex. I see the former and driving the demand for residential units. The latter would drive the demand for both residential and industrial units.

The Group is financially sound and has been profitable during the trough part of the cycle. Thus, it would be able to withstand a prolonged trough. But this provides it with the opportunity to improve its returns when the property market picks up.

I look at the intrinsic value of Crescendo from several perspectives – Asset Value, EPV and Acquirer’s Multiple. I also consider the RNAV and revised EPV perspective. All of them provide a significant margin of safety at the current market price.

Given the strong business fundamentals, and the margin of safety relative to the current market price, Crescendo is not a value trap.

My Investment Thesis

I bought Crescendo about 9 years ago hoping for it to be a multi-bagger. To a certain extent I was greedy as I did not sell any shares when the market price went up to RM 3 per share around 2014.

I have valued the EPV of Crescendo then at RM 4.00 per share and I was hoping for the price to go higher. The Book Value then was RM 3.25 per share.

|

| Chart 8: Market Price |

The Book Value had not changed very much since then with the 2022 value at RM 3.29 per share. Given my experience, I would exit if the market price goes up to the Book Value.

Over the past 12 years, the Group has generated a positive total gain for the shareholders. This was due to the dividends. The Group has a good dividend track record paying out about 40% of its earnings. I expect this dividend payments to grow in line with the Group’s performance.

But more importantly, the positive total gain over the past 12 years was reduced by the negative capital gain. When the stock market recovers, together with the improvement in the Groups’ performance, I would expect positive capital gain. This will provide a jump in the total return.

Given that my purchased cost is below both the Asset Value and Earnings Power Value, I would continue to hold onto the stocks.

|

END

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

If the above article was useful, you can find more insights on how to make money in my e-book. The e-book is now available from Amazon, Kobo and Google Play.

PS: If you are in Malaysia or Singapore, the e-book can only be download from Kobo and Google Play.

How to be an Authoritative Source, Share This Post

|

Disclaimer & DisclosureI am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment