Is OSK a value trap?

Value Investing Case Study 47-1. OSK Holdings: A property powerhouse or just a proxy for RHB? Exploring its true potential! This post also summarized my investment thesis on why I should continue to hold it.

I first bought into OSK Holdings (OSK or the Group) in 2013. At that juncture, OSK had just undertaken a corporate exercise that saw it disposing of its investment banking arm to RHB Capital Bhd.

OSK then ended up with a 9.8 % stake in RHB Capital Bhd. I saw this as a proxy for owning shares in the banking sector. At that juncture, OSK only had a small property arm, the bulk of which was in investment properties.

Since then OSK has undertaken another corporate exercise to build up its property development segment. While still having about a 10% stake in RHB Capital, OSK today is a different animal compared to when I first bought it.

This article is an assessment of the current business of OSK to see whether I should continue to hold onto my shares. At the same time, if you are new to OSK, you would be interested to know whether it is a value trap.

Join me as I show why I should continue to hold onto my investments and why it is an investment opportunity for a fresh investor. It is not a value trap.

Should you go and buy it? Well, read my Disclaimer.

Content

- Background

- Performance

- Financial strengths

- Peer comparison

- My investment in OSK

- Valuation

- Investment Thesis

- Conclusion

|

Background

OSK began operations in 1963 as a small stockbroking company which then grew into a regional investment bank. In 1997, OSK diversified into properties.

As OSK Investment Bank became a Bank Negara-regulated entity in 2007, the property arm was divested from the Group due to regulatory requirements.

On 28 May 2012, OSK Investment Bank merged with RHB Investment Bank. Following some corporate restructuring exercises towards the end of 2012, OSK became a majority shareholder in RHB with a 10% equity interest in RHB Capital Berhad.

OSK subsequently embarked on a corporate exercise on 15 October 2014, to merge PJ Development Holdings Berhad (PJD) and OSK Property Holdings Berhad (OSKP) into the Group.

PJD was established in 1965 as a plantation and property development company. Over the years, PJD divested its plantation business and grew its business in four key areas:

- Property development.

- Construction.

- Manufacturing of building materials under the Acotec and Olympic Cables brands.

- Hospitality under the Swiss Garden International and SGI Vacation Club brands.

OSK is now a property company in Malaysia with over 89% interest in PJD and 100% interest in OSKP. The Group today has over 2,000 employees with business operations in Malaysia and Australia.

Chart 1 shows the structure of the Group as of the end of 2022.

|

| Chart 1: Group structure |

The Group today has 5 major business segments:

- Financial Services. This segment includes a substantial stake in RHB Capital Berhad, Malaysia’s 4th largest banking group. This arm also provides venture capital and private equity via its affiliate company, OSK Ventures International Berhad, and moneylending and capital financing via OSK Capital Sdn Bhd.

- Property. This is a core business interest of the Group. Represented by OSK Property, the property division is formed through the integration of OSK Property Holdings and the property arm of PJD Holdings.

- Construction. Established in 1979, the segment has constructed and built multiple residential and commercial properties and infrastructure projects in Malaysia. Currently, this segment focuses on in-house projects.

- Hospitality. Swiss-Garden International is the home-grown hospitality brand under the Group and comprises the hotels business and the vacation club business.

- Industries. This segment is involved in the manufacturing and sale of high-quality cables and Integrated Building Systems wall panels.

While the Financial Services segment employed the largest amount of the net assets, its revenue contribution was small. This was because a big part of the net assets was for its investment in RHB. Refer to Table 1.

The biggest revenue contribution came from the Property and Construction segments. I have grouped the Construction business with the Property one as the majority of the Construction projects are in-house ones. As such there was not much external revenue from the Construction segment.

|

| Table 1: Segment Profile Notes a) Revenue for FYE 2022. b) Net Assets as of FYE 2022. The total added up to SHF + MI. |

|

Performance

Due to the 2014 corporate exercise, it is more appropriate to look at OSK's historical performance from 2015. Note that in this analysis, 2023 performance was based on the Sep 2023 LTM performance.

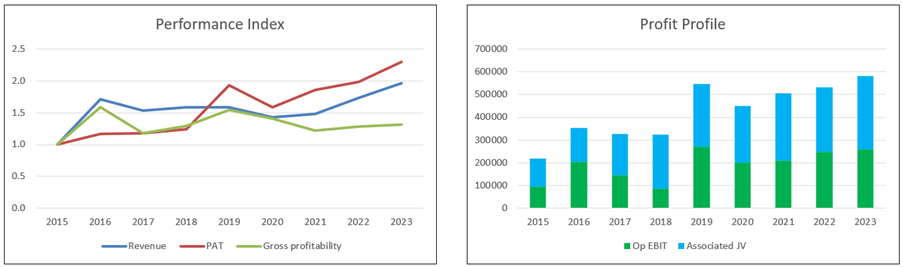

To get an overview of OSK's performance, I looked at 3 metrics – revenue, PAT, and gross profitability (gross profits/total assets). The left part of Chart 2 illustrates the trends for these 3 metrics:

- From 2015 to 2023, revenue and PAT grew at 8.8 % and 10.9 % CAGR respectively. But as shown in the left part of Chart 2, a big part of the revenue growth was in the past 3 years.

- The jump in profits in 2019 was attributed to the turnaround of the Financial Services segment and improvements in the Property Development segment. And of course, in 2020 we had Covid-19.

The only concern I have is with the comparatively lower growth of 3.5 % CAGR for gross profitability. You can see that over the past 3 years, despite the high revenue and profit growth, there was not much growth in gross profitability.

|

| Chart 2: Performance |

OSK has an unusual business model in that a significant part of its PAT came from its investments in associates and JV. You can see this clearly from the right part of Chart 2.

Over the past few years, the contribution from the investments in associates and JV (especially from its investment in RHB) was much larger than its operating profits.

One characteristic of this is that the ROE was much higher than the Operating return (NOPAT / Total Capital Employed) as shown in the left part of Chart 3.

- ROE represents the profits inclusive of those from investments in associates and JV. It averaged 6.6 % over the past 9 years.

- The Operating return is from the operations before accounting for the contribution from the associates and JV. This averaged 2.2 % from 2015 to 2023.

|

| Chart 3: Returns and DuPont Analysis |

From an operations perspective, the Op returns are more important as it is a measure of the capability of management. In this context, a DuPont Analysis of the Op Return (refer to the right part of Chart 3) showed that:

- There has not been much improvement in Asset turnover. You should not be surprised as this is in line with the low growth in gross profitability.

- Leverage has declined because debt grew at faster rate than equity or total assets. This is not a good sign.

- The operating margins over the past few years were lower than that in 2015.

From a fundamental perspective, I would rate OSK as average as the negative points were balanced by the plus points.

Financial strengths

OSK is not so sound financially as there were both negative and positive points. Positive points included the following:

- As of the end of Sep 2023, it had RM 640 million cash. This is about 6% of its total assets.

- It has a DE of 0.52 as of Sep 2023 compared to my cut-off of 1.0.

- It currently has an interest coverage ratio of 5.4. I defined this as EBIT/interest. This is equal to a - A (Fitch) synthetic rating as per the Damodaran approach.

The negative points included the following:

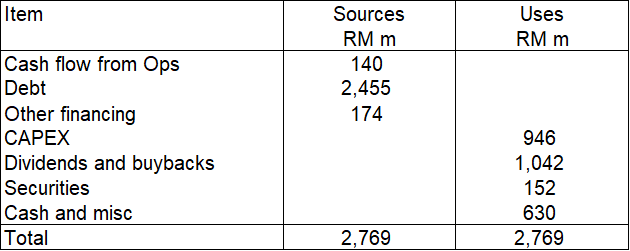

- From 2015 to 2023, it managed to generate a cumulative RM 140 million Cash flow from Operations compared to a cumulative PAT of RM 3.7 billion. This is a very low cash conversion cycle. Part of the reason was that about RM 2.0 billion of the PAT came from its associated/JV.

- Over the past 9 years, there was negative Cash flow from Operations 1/3 of the time.

- It did not have a good capital allocation plan. As can be seen from Table 2, it had to resort to debt to fund its CAPEX and dividends.

|

| Table 2: Sources and Uses of Funds 2015 to 2023 |

Peer comparison

OSK currently has a shareholders’ fund of RM 6.0 billion (as of Sep 2023). I thus compared its performance with property companies with shareholders’ funds greater than RM 1 billion.

The sector performance was based on the base rates data presented in my article "Will the Malaysian Property Industry turn around by 2024? ". They covered the 2010 to 2020 period.

As I was looking at OSK performance from 2015, I had to revise the peer data to cover only 2015 to 2022. Table 3 compares the performance of OSK with those of its peers for this period.

Except for revenue growth, OSK underperformed the sector for the other metrics. It is not a good endorsement of management.

According the Warren Buffett, there are 2 key criteria to assess management. One is to see how well they do relative to their peers and the next is how they have allocated capital. OSK did not do well on both of them.

|

| Table 3: Comparative performance Note: The sector performance was based on the median for the sector. |

My investment in OSK

I first invested in OSK in 2013 at RM 0.99 per share. I then increased my investment over the next few years so that together with the bonus issue, my average purchased cost was RM 1.16 per share.

I estimated that my average holding period till the end of Dec 2023 was 8.2 years. The market price as of the end of 2023 was RM 1.33 per share.

I estimated that taking into account the bonus issue, my investment had generated a total return of 6.5 % CAGR. Refer to Table 4. This is much better than the returns from keeping my monies in a fixed deposit.

You can see that dividends accounted for about ¾ of the total gain. The current market price reflects that soft market situation. As such I am confident that there is potential for further capital gain. In other words, the 6.5 % CAGR looks like a good base.

OSK is an example of differentiating between a good company and a good investment. This is differentiating the business fundamentals from the investment returns.

- A good company is one with strong fundamentals.

- A good investment is one that can enable you to make money.

OSK is a good investment because I managed to buy it at a cheap price. It may not be a wonderful company in the Warren Buffett sense of being able to compound business returns.

But it is not a loss-making one. Just that its business returns as measured by the ROE are in single-digits.

|

| Table 4. Estimating my total return |

Valuation

The value of a company = value to operating assets + value of non-operating assets. Normally,

Value of operating assets = present value of the cash flow generated by the operating assets.

Value of non-operating assets = book value.

In the case of OSK, we should not follow the normal approach for the non-operating assets because of its large contribution to the profits. This is especially true for the investments in RHB. Rather it would be more appropriate to estimate the intrinsic value of RHB.

Value of OSK = value of operating assets + value of RHB + value of other non-operating assets.

Valuation of operating assets plus other non-operating assets

Looking at the right part of Chart 2, you can see that from 2015 to 2023, there was hardly any operating EBIT growth. Over this period the NOPAT grew at 0.6 % CAGR. Given this, it makes more sense to value the operating assets on an EPV basis.

I estimated the value of the operating assets plus other non-operating assets to be RM 0.96 per share. Refer to the valuation model in Table 5.

|

| Table 5: Earnings value of operating assets plus other non-operating assets |

Value of RHB

I estimate the Earnings Value of RHB based on the average values of 3 methods

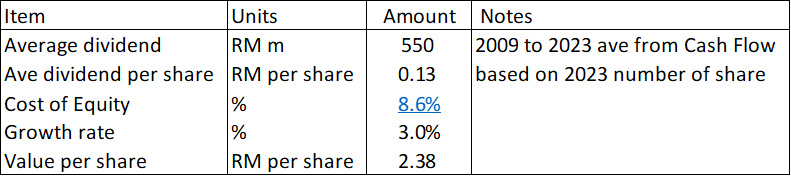

- Actual dividend. Refer to Table 6.

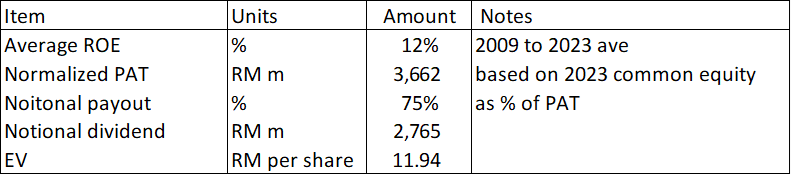

- Notional dividend. Refer to Table 7.

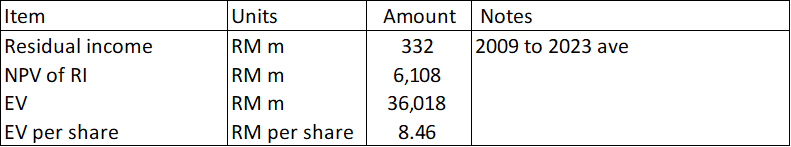

- Residual income. Refer to Table 8.

For details of the method, refer to “Is Affin a value trap?”

|

| Table 6: Valuation based on actual dividends |

|

| Table 7: Valuation based on notional dividend |

|

| Table 8: Valuation based on Residual income |

I then assumed that the Earnings value of RHB is the average of these 3 values. This came to RM 7.59 per share or RM 32,331.5 million.

In 2022, OSK had a 10.18 % interest in RHB. This is equal to RM 3,291 million or RM 1.60 per share.

Sum-of-parts value

The value of OSK then becomes:

RM 0.96 + RM 1.60 = RM 2.56 per share.

The market price of OSK as of 7 Feb 2024 is RM 1.50 per share. There is thus a 70 % margin of safety.

You can see that the biggest contributor is its investment in RHB.

The book value of OSK as of the end of Dec 2023 was RM 2.92 per share. You can see that the sum-of-parts value is lower than the book value. You should not be surprised by this as OSK had low returns.

Limitations and risks

In interpreting the valuation results, you should consider the following:

- Cyclical sector.

- Larger contribution from associates and JV.

The property sector is cyclical. For more details on this, refer to “Is Glomac a value trap?” The latest property cycle was from 2009 to 2022. As such I should be using the average contribution margin during this period. Unfortunately, there is not enough history for OSK. As such, I would consider the intrinsic value of the operating assets as an optimistic one.

I have shown that the bigger earnings contribution was from its investment in RHB. This is reflected in the sum-of-parts valuation. The bigger portion of the Group value came from the non-operating assets.

OSK's investment in RHB of about RM 3.4 billion is about 40% of the total capital employed. Over the past 3 years, this 40% contributed about 56% of the profits.

As far as I can tell, OSK management has no operating role in RHB. We have a situation where the bigger contribution came from an operation where management does not have a role. In the operations controlled by management, the business return was not fantastic.

It is a poor reflection of management. Does it mean that when the investment in RHB becomes overpriced, we should divest our stake in OSK?

|

Investment Thesis

Over the past 8 years, OSK has transformed itself from a financial services company to a property group. While OSK's main operation is property development, a big part of the profits came from its investment in RHB.

From an operations perspective, the Group is not strong fundamentally. I have concerns about its financial standing. As a property company, the Group did not perform as well as its peers. Its ROE was boosted by the investments in RHB.

OSK is trading below its Earnings Value and Asset Value. While part of the reason for this could be due to market sentiments, I think that its operation result has a role. Nevertheless, there is a large enough margin of safety so that OSK is not a value trap but an investment opportunity.

|

Conclusion

There are two general questions value investors ask before investing in a company:

- Is it a good company? In other words, is it fundamentally strong?

- Is it a good investment? I assess this by looking at whether there is a sufficient margin of safety (> 30 %) at the current price.

OSK does not meet the first test. But it did well on the second test.

From a value investor perspective, there is a sufficient margin of safety. OSK is trading at a price equivalent to the value of its investment in RHB. In other words, the market is ascribing zero value to its property operations. This is too pessimistic.

While it may not be the best company from a fundamental perspective, it does not look like a company whose operations are going to collapse. As such I would see OSK as an investment opportunity even for a fresh investor. It is not a value trap.

I originally invested in OSK as a proxy for investing in the Bursa banking sector. I think that this is still a good proxy.

The market price of RHB is RM 5.60 per share. Based on the value of RHB of RM 7.59 per share, there is a 36 % margin of safety. The margin of safety for OSK is much larger at 70%. You can see why I think OSK is still a good proxy for investing in the Bursa banking sector.

At the same time, OSK now has a property arm. But I think that there are better property counters from a fundamental perspective. When the margin of safety for RHB disappears, I would divest my stake in OSK. In other words, I would not wait for the 70% margin of safety in OSK to disappear before selling my stake.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment