Is Plenitude a value trap?

Value Investing Case Study 41-1: Plenitude: A property and hospitality play or a value trap? It presents my rationale for continuing to hold onto this stock and why it is not a value trap.

I first invested in Plenitude Bhd (Plenitude or the Group) in early 2007 at an average price of RM 1.54 per share. When the price began to rise in 2010, I sold off some of it at an average price of RM 3.79 per share.

When the price dropped to below RM 2.50 per share sometime in 2012/13, I bought additional shares. I have held onto the shares till today with an average holding period of 11.4 years at an average cost of RM 2.28 per share.

|

| Chart 1: Plenitude share price Note: The share price shown is after accounting for the 2010/11 bonus issue. |

Plenitude today (22 Feb 2023) is trading at RM 0.94 per share compared to its NTA of RM 4.15 per share. Is Plenitude a value trap?

A value trap is a company that seems cheap but is cheap because the fundamentals do not support the market price. There are fundamental reasons why the price is cheap. Is this the case for Plenitude?

Join me as I show why Plenitude is not a value trap. I will base my analysis on the 2010 to 2022 period. I will also share my Investment Thesis and explain why I continue to hold onto the shares.

Should you go and buy it? Well, read my Disclaimer.

Contents

- Company profile

- Business performance

- Management performance

- Value creation

- Prospects

- Conclusion

- Investment thesis

|

Company profile

Plenitude was listed on the Main Board of Bursa Malaysia in Nov 2003. The Group has currently core interests in property development, property investment, and hospitality.

Property development is the largest revenue contributor as can be seen in Chart 2. As of the end of 2022, the Group has property development projects in the central, southern, and northern regions of Malaysia.

|

| Chart 2: Segment Profile |

The property investment segment is a relatively small revenue contributor. The investment properties comprise apartment units, land, and commercial buildings. On its website, Plenitude listed the following as available for leasing:

- Shops and commercial space in Tebrau City.

- Retail outlets in GurneyWalk and Tanjong Point Galleria. Both are in Penang.

- Residential units in Ampang Puri Condominium, Kuala Lumpur.

- Plenitude hotels and land for lease.

Looking at them, I would only consider the Ampang Puri condominium as a dedicated investment property. The shops and retail outlets appear to be either unsold units or units developed to support the sale of residential units.

They appear to be Plenitude efforts to extract some value while considering how to dispose of them. This also applies to the land for lease. As such I would not consider property investment as something that the Group is focused on.

Accordingly, and based on the Total Assets deployed, I see Plenitude as a property development and hospitality group. Refer to Chart 3.

|

| Chart 3: Total Assets by Segments |

Entry into hospitality

Plenitude diversified into the hospitality industry in 2001 with the acquisition of the 220 rooms Tanjung Bungah Beach Hotel. This was refurbished and rebranded as Four Points by Sheraton Penang in 2013. This was further rebranded as Mercure Penang Beach Hotel effective October 2018.

The next expansion was in 2015 with 2 major corporate exercises:

- The acquisition of the 259-suite Gurney Resort Hotel & Residences, Georgetown, Penang. This was refurbished, rebranded, and opened to the public as Ascott Gurney Penang in March 2022.

- The takeover of The Nomad Group Bhd (Nomad) in 2015 at an offer price of RM1.25 per Nomad share. This price was satisfied through the issuance of new ordinary shares of RM1.00 each in Plenitude at an issue price of RM2.50 each.

Nomad owns the following properties:

- Novotel KL City Centre.

- Nomad Sucasa in Jln Ampang. This was rebranded as Oakwood Hotel and Residence Kuala Lumpur in FYE 2016.

- GLOW Penang, Jln Macalister. This was rebranded as Travelodge Georgetown on 1 January 2019.

- The Nomad Service Residence Bangsar. This is now known as Domitys Bangsar.

Another major expansion took place in 2018/19.

- The Group acquired the 224-room 14-story midscale Holiday Inn Express hotel in Jun 2019. This was rebranded as Travelodge Myeongdong Euljiro, Seoul, South Korea.

- Tanjong Point Residences, Penang that was completed in FYE 2019.

- The Group completed the acquisition of 226 rooms at Heritage Hotel Ipoh in December 2018. This was rebranded as Travelodge, Ipoh

Then in 2022, the Group acquired a 14-story midscale hotel that was rebranded as Travelodge Honmachi Osaka. The Group currently holds over 2,000 hotel rooms across Malaysia, alongside its international hotels, in South Korea and Japan.

Today, the hospitality division of Plenitude encompasses 10 hotel properties. They range from international hospitality brands to home-grown brands and two residences.

“Plenitude’s four hotels in Penang contributed 42% of the Group’s hotel revenue while 3 properties in Kuala Lumpur contributed 31%, Travelodge Ipoh and Travelodge Myeongdong Euljiro added 16% and 11% respectively.” 2021 Annual Report

Business performance

I generally looked at the trend for 3 metrics – revenue, PAT, and gross profitability. As can be seen from Chart 4, all 3 metrics declined relative to 2010.

|

| Chart 4: Performance Index |

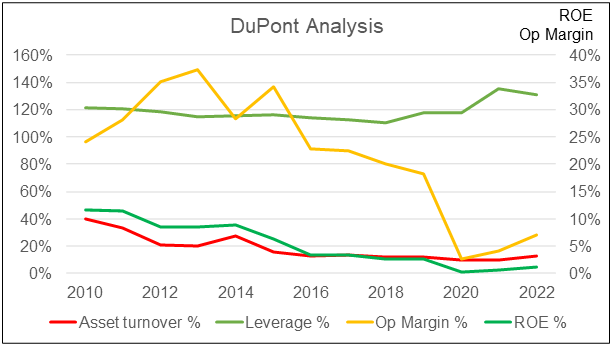

The declining performances resulted in a declining ROE. In 2010/11, the ROE averaged 12 %. By 2021/22, it had averaged less than 1 %.

A DuPont analysis showed that the decline in the ROE was due to the decline in the operating margins and asset turnover. Refer to Chart 5. From 2010/11 to 2021/22, operating margins had dropped by ¾ while asset turnover had declined by about 2/3.

|

| Chart 5: DuPont Analysis |

Segment contribution

To dive into the reasons for the declining performance, I first looked at the segment returns as shown in Table 1. You can see that despite involving the largest capital, the hospitality segment did not deliver any returns. The return from the property development segment was reasonable enough given the 6 % WACC for Plenitude.

Effectively, the property development segment has been supporting the Group. As shown in Chart 2, the property development business is cyclical with a trough from 2016 to 2020. Part of the decline was due to the measures taken by the Malaysian govt in a few years before 2016 to control property speculation. Notwithstanding the cyclical nature, this segment has been profitable every year since I first invested in the Group. You can get a sense of this from Chart 6.

|

| Chart 6: Segment Returns |

Turning around the hospitality business

The hospitality segment used about 55 % of the Group’s 2022 capital but did not deliver any returns since 2013. But I could not find any discussions for this poor performance in the Annual Reports until 2017.

The 2020 and 2021 performances were due to Covid-19. Management attributed the poor performance of the other years to intense competition. These are illustrated by the following quotes:

- “FYE 30 June 2017 was a challenging year for the hospitality industry with the emergence of new hotels/budget hotels in Kuala Lumpur and Penang.” 2017 Annual Report.

- “The hotel/hospitality division faced competition due to emerging new hotels and boutique hotels.” 2018 Annual Report.

- “The Group’s hospitality assets registered a fall in occupancy rates…was mainly attributed to the dilution of rates offered by other hotels and increased supply of new hotel rooms in the region.” 2019 Annual Report.

The Group appears to have adopted the following to address the competitive pressures:

- A RM 200 million refurbishment and rebranding program. This was estimated based on the work-in-progress component of the Property, Plant, and Equipment. This is sizeable when compared with the 2022 hospitality segment assets of RM 1.2 billion.

- Improving operating efficiencies as illustrated by the following quote.

“To maintain a healthy gross operating profit, Plenitude mitigates the lower occupancy and average room rate through improvement in operational efficiencies by reducing wastages and delivery turnaround time. A centralised purchasing system was set up to help mitigate rising material costs.” 2017 and 2018 Annual Reports.

There are positive signs based on the comparisons shown in Table 2. The 2022 gross profit margin seems to have improved compared to those in 2017/18.

The hospitality revenue in 2022 has improved due to the opening of the economy. But it is not clear whether the Group has managed to overcome the intense competition. This is because the 2022 revenue is still significantly below that in the pre-pandemic peak of 2018. Refer to Chart 2.

With better gross profit margins, higher revenue would translate into improved gross profitability. But the jury is still out on this.

|

| Table 2: Hospitality Performance Notes a) Room revenue and related services as per Notes to Revenue in the Annual Report. b) Operations costs as per Notes to Cost of Sales in the Annual Report. |

Financial strengths

I would rate Plenitude as financially sound based on the following:

- As of the end of FYE 2022, it had RM 406 million cash and short-term investments. This is about ¼ of its shareholder’s funds.

- It has a Debt Equity ratio of 0.2 as of FYE 2022. This has increased from its 2020 Debt Equity ratio of 0.09. Note that in 2020, its peers had an average Debt Equity ratio of 0.48.

- Plenitude Debt would have an equivalent A- (Fitch) bond rating. This is based on its interest coverage ratio using Damodaran synthetic rating approach.

- From 2010 to 2022, it generated an average of RM 45 million cash flow from operations. During these 13 years, there were only 2 years with negative cash flow from operations.

Malaysia is still recovering from the impact of Covid-19 and there is still uncertainty about the pace of economic recovery. Having a strong financial position will ensure that Plenitude would be able to meet the challenges of a slower recovery.

Management Performance

“I think you can learn a lot about that (management performance) by reading about both what they’ve accomplished and what their competitors have accomplished, and seeing how they have allocated capital over time,” Warren Buffett.

Based on the above, I would rate the management’s performance as average.

- Compared to its peers, Plenitude performance did not stand out.

- Plenitude had a reasonable capital allocation plan.

The subsequent sections detail my rationale for the above.

Peer comparison

This section is based on the based rates as reported in my article “Will the Malaysian Property industry turn around by 2024?”. I compiled the performance of 85 Bursa Malaysia property companies with data from 2010 to 2020. I classified them into 3 groups based on the 2021 shareholders’ funds:

- Large - those with shareholders’ funds greater than RM 1 billion. Plenitude falls into this category.

- Medium - those with shareholders’ funds between RM 300 million and RM 1 billion in 2021.

- Small – those with shareholders’ funds of less than RM 300 million.

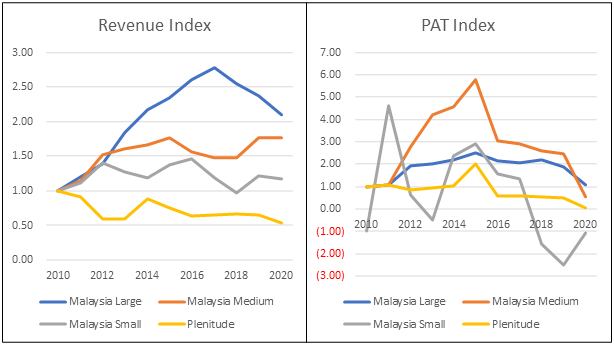

Table 3, Chart 7, and Chart 8 show Plenitude performance compared to the sector. I would not rate Plenitude’s performance as outstanding. You should not be surprised given the poor performance of its hospitality segment.

- Plenitude revenue and PAT growths were lower than the sector growths. But its PAT over the period was less volatile that the sector.

- Plenitude had better average gross profitability although it followed the sector declining trends.

- Plenitude ROE looks more like those of the Medium-sized companies rather than the Large-sized ones.

|

| Table 3: Sector Comparison |

|

| Chart 7: Peer Revenue and PAT |

|

| Chart 8: Peer Gross Profitability and ROE |

Capital Allocation

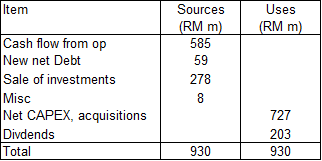

Table 4 summarizes the Plenitude capital allocation plan from 2010 to 2022. The Group generated RM 585 million cash flow from operations. This was not sufficient to fund its Dividends and CAPEX. The shortfall was covered by Debt and the sale of securities and other investments.

The Dividends paid were equal to a 25% payout ratio (relative to the PAT).

The bulk of the CAPEX and acquisition was for building up the hospitality business. Unfortunately, there are no returns from this segment.

Is this a good capital allocation plan? Yes, only if management can turn around the hospitality business. Otherwise, it would have been better to return the funds to shareholders.

|

| Table 4: Sources and Uses of Funds Notes: Based on 2010 to 2022. |

Value creation

I look at the following to assess whether there has been value creation.

- I compare the returns with the appropriate cost of funds. Value is created if the returns exceed the cost of funds.

- I look at the Q Rating to see whether it is better than the average to denote value creation.

Taking into account the returns and the Q Rating, I would not consider that Plenitude has created shareholders’ value.

In looking at returns, I considered the performance of the business as well as the actual return achieved by a shareholder. Table 5 summarizes the results. You can see that there was hardly any value creation.

|

| Chart 6: Estimating Shareholders' Gain |

Q Rating

Plenitude has an overall Q rating of 0.46 placing the Group just about the central position of the panel. Refer to Chart 9. The best is the 100th position and the worst would be the 1st position.

The rating reflects a good risk profile and strong financial position but zero growth and profitability ratings. For details on the Q Rating refer to “How To Mitigate Risks When Value Investing”.

|

| Chart 9: Q Rating |

Prospects

I would rate the long-term business prospects as good. This is because property development and hospitality are not sunset industries. There is short-term pain due to Covid-19 and the cyclical factors. But the Group has the financial strength to withstand any prolonged downturn.

I have already covered the prospects of the Malaysian property development sector in my MKH article. Refer to "MKH – will there be another multi-bagger opportunity?"

Looking at Chart 2, you can see that Plenitude is rebuilding back its property development business. It has announced plans to launch RM 500 million of properties in FYE 2023. This is about doubled the past 5 years’ average sales launches.

With its 1,192 acres of landbank, Plenitude should not have a problem for this segment. But the hospitality segment is a different story.

Hospitality

According to Mordor Intelligence, the Malaysian hospitality sector is forecast to grow at 4 % CAGR from 2018 to 2028. The sector was badly affected by Covid-19 but there are positive tailwinds:

“The Government has outlined several strategies… re-energize the tourism industry…The government has also launched the National Tourism Policy (NTP) 2020 - 2030, a ten-year transformation plan for the tourism industry. The NTP was designed to place Malaysia among the top ten tourist destinations in terms of both arrivals and receipts.”

But competition is not going to let up. According to Research and Markets, the international chain brand hotels are significantly expanding in the country.

“Though both international and Asian brands contribute to an almost equal number in terms of total hotels present in the country, international brands and their chains are dominating the supply of rooms/keys.”

Plenitude had rebranded its hotels and taken steps to improve efficiency. But it is not going to be easy sailing.

|

Valuation

I use 3 metrics to triangulate the intrinsic value of Plenitude. Table 7 summarizes them. You can see that based on the current market price there is a sufficient margin of safety.

My average purchase cost is RM 2.28 per share. This is significantly below the Asset Value. Note that the Asset Value is conservative as I did not account for the “revaluation surplus”. In its Annual Report, the Book Value of investment properties was stated as RM 32 million although the fair market value was RM 117 million.

I have mentioned that as retail investors, we should focus on the Earnings Value. Based on the Earnings Power Value, there is also a 20 % margin of safety.

My EPV valuation models were based on Damodaran (FCFF) and Penman (Residual Income) approaches. For details on the method, refer to “Is Glomac a value trap?”. The key point is that EPV ignores growth. This is not unreasonable given that I have shown that Plenitude is not a high-growth Group.

As a property and hospitality Group, a significant portion of its assets is in properties. As such I would consider the Asset Value as a good floor value. So even ignoring the EPV, there is already a good margin of safety.

At the same time, Plenitude’s Acquirer’s Multiple of 5.8 makes it an attractive target. The rule of thumb is that anything lower than 6 is a good price.

Valuation limitations and risks

In my MKH article, I discussed how I have included “excess land” and “revaluation surplus” as non-operating assets. Refer to "MKH – will there be another multi-bagger opportunity?"

This same situation applies to Plenitude. If you strip them out, we would have 1.58 per share of EPV. There is still a margin of safety based on the current market price although there would be none based on my purchase cost.

Secondly, to estimate the EPV, I used the past 12 years’ operating EBIT to represent the future. The historical EBIT was low due to the negative contribution by the hospitality segment. If the hospitality business is turned around, the EPV would be higher than RM 2.28.

But there is already a 20% margin of safety based on the historical EBIT. A higher EBIT contribution via improved performance will mean a better margin of safety.

But more importantly, should the hospitality business be not viable, Plenitude may dispose of the hotels. I am sure that it would not suffer a 50% impairment in such disposal. Any impaired Asset Value would still be higher than my purchase cost.

Conclusion

Plenitude started as a property developer but in 2001 diversified into the hospitality business. Today the hospitality business is the largest segment in terms of the Total Capital Employed. It used about 55 % of the Total Capital Employed compared to the 33 % used by the property development segment.

The property development segment was the major contributor to the Group’s performance. The hospitality segment had an average negative return during the past 13 years.

The returns of the property development segment had declined since 2010. This is due to the cyclical nature of the property market as well as Covid-19. There are signs that this is turning around with the opening of the economy.

The hospitality segment’s poor performance was due to competitive pressures. The Group had refurbished and rebranded the hotels to address this. At the same time, it had also focused on efficiency to improve the margins. There are signs that gross profit margins are improving but the jury is still out on whether revenue will improve. This is because the economy had opened only in 2022 following the pandemic years.

The hospitality business is a turnaround case. Because of its size, the creation of shareholders’ value will depend on a successful turnaround.

The positive side is that the current stock price and my purchase cost are very much below the Asset Value. As a property and hospitality group, a lot of the assets are tied to properties. As such the Asset Value is a very good indication of its intrinsic value.

At the same time, the EPV based on the historical performance provides some margin of safety to the purchase cost and market price.

For these reasons, I will continue to hold onto my investments in Plenitude. At the same time, this is not a value trap based on the market price.

Investment Thesis

Plenitude has two major potential profit contributors – property development and hospitality.

Property development has been contributing to the bottom line, even in the 2020/21 pandemic years. With the opening of the economy, I expect the contribution to be better.

The hospitality business was built up over the past 8 years and today used up 55% of the Group’s capital. But it was not profitable since 2013. The Group has taken steps to turn around this business. There are signs of improving margins but the jury is still out on revenue growth.

To improve the Group’s returns, the hospitality business has to be a turnaround. But the margin of safety is not dependent on this turnaround. Rather any turnaround is a multi-bagger opportunity.

|

END

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

If the above article was useful, you can find more insights on how to make money in my e-book. The e-book is now available from Amazon, Kobo and Google Play.

PS: If you are in Malaysia or Singapore, the e-book can only be download from Kobo and Google Play.

How to be an Authoritative Source, Share This Post

|

Disclaimer & DisclosureI am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment