How often do you review the stock picking portfolio?

Fundamentals 20-6: This is the March 2023 review of the stock picking portfolio that was first established at the start of 2022. I will also share my views on how often you should review the portfolio.

In Jan 2022, I constructed a stock portfolio based on the companies that I had analyzed and valued over the past year. The goal was to track the portfolio performance to provide insights into establishing and managing a stock portfolio.

This is my fifth quarterly review. I have assumed that the portfolio should be reviewed every three months. In this article, I will explain why I chose 3 months and how I differentiate between the frequency of checking the portfolio and checking individual stocks.

The goals of each portfolio review were:

- To determine the portfolio return.

- To ensure that the portfolio still meets the diversity criteria.

I will then decide whether to re-balance within the existing stocks, invest in new stocks or hold more cash.

In my Dec 2022 review, I increased the fund size and invested in new stocks. In this article, I will show how to track portfolio returns given the changes in the fund size and composition.

Should you rush to buy or sell them? Well, read my Disclaimer.

This post builds on the data from the various tables presented in my earlier articles in this series. To benefit from this article, you should first read the following:

Contents

- Frequency of portfolio review

- How often do you check on individual stocks

- Tracking performance

- End Mac 2023 Returns

- End Mac 2022 Diversity

- Conclusion

|

Frequency of portfolio review

I differentiate between reviewing the stock portfolio and reviewing individual stocks.

- When I review individual stocks, the goal is to look for selling signals. I focus on the individual stock and do not worry about how it links to other stocks.

- When I review the stock portfolio, I am looking at the collection of stocks as a whole. I would consider how one particular stock relates to other stocks.

As such, the frequency for reviewing the stock portfolio differs from that for reviewing individual stocks.

How often you review the stock portfolio is related to what you do in the review. My portfolio review goals are:

- Tracking performance. I compute the returns based on the various performance metrics. This is a “mechanical” process and is not dependent on the frequency of the review.

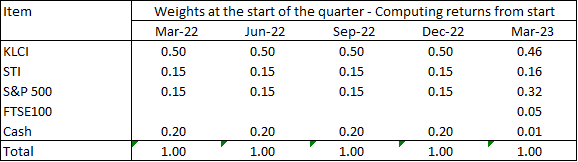

- Checking diversity. The key purpose of having a stock portfolio is risk mitigation. This is achieved by having a diversified portfolio. I used stock diversity as the basis. As shown in my previous articles, this is affected by stock prices. Table 1 shows how the diversity profile of the stock portfolio changed over the past 6 quarters. You can see that the changes did not require any re-balancing. Checking every 3 months seemed sufficient. If you have a very volatile situation, you may need to check more frequently.

- Checking for investment mistakes. I define an investment mistake as a stock that did not provide an acceptable return after 5 years. An acceptable return is at least equal to the bank’s fixed deposit rate. Returns depend on company performance as well as market sentiments. Since company results are announced quarterly, the most frequent review is every quarter.

For these reasons, I have chosen to review the portfolio quarterly. You could argue that we could have reviewed the portfolio every 6 months instead of quarterly. This is debatable. But I would not agree to a shorter review period because of the “myopic loss aversion” concept.

|

| Table 1: Changes in Diversity Note: Based on the profile at end of the period after new investments and/or additional funds. |

Myopic loss aversion

There is a behavioral phenomenon known as loss aversion. This refers to the situation where a loss is perceived as more severe than an equivalent gain.

For instance, the pain of losing RM 1,000 is often far greater than the joy gained in finding the same amount. The result is that investors tend to make poor investment decisions as a consequence of trying to avoid the pain of a loss.

Myopic loss aversion is the idea that the more frequently we check our portfolio, the higher our chance of seeing a loss and, thus more susceptible to loss aversion.

Accordingly, checking your portfolio frequently will lead to poorer investment decisions. Checking your portfolio weekly or monthly is not going to give better results because of this behavioral issue.

That is why I have chosen to review my portfolio quarterly. It is a balance between checking for changes in diversity and myopic loss aversion.

How often do you check on individual stocks?

I am a long-term investor with an average holding period of 6 to 8 years for each stock. All the literature on long-term investing advises that you should not check your stock prices daily. This is because daily prices are mostly noise.

According to Forbes, there are a few reasons why one should avoid monitoring daily stock movements.

- It may encourage you to trade.

- It won't give you an edge. If you just look at daily price changes you may only see the distracting noise. You may miss the medium-term signals in longer-term data that could have some signaling value.

- There is a better use of your time.

When I first started, I followed this advice. But I have found out that I have lost opportunities by not checking on prices daily. This is because when prices spike, it is because of some market sentiments or activity. These tend not to last and if you fail to sell when the prices spike, you would have lost some multi-bagger opportunity.

I will illustrate this with some examples of my investments.

HeiTech Padu.

This is a Bursa Malaysia IT company where I had some investments in 2019 at RM 1.04 per share. In Oct 2020 there was market rumor that the company was going to be awarded some MyEG-type of government contracts.

The prices started to go up following the news. I did not see the news but saw the price moving up as I was checking on prices every other day. The news was something I found out when I tried to see the reason for the price hike.

I started to sell when it reached RM 1.59 per share. I kept selling a few lots at a time following the price uptrend. But I held back my balance of 10 lots when the price reached RM 1.80 per share. I was greedy and wanted the last 10 lots to be above RM 2.00 per share.

But as can be seen from Chart 1, the price did not go beyond this level and quickly dropped below my average sale price of RM 1.62 per share. To make a long story short, I am still holding the 10 lots. The market price as of the end of March 2023 was RM 0.75 per share. This is the price of being too greedy.

|

| Chart 1: Heitech Padu share price |

Poh Kong

This is a Bursa Malaysia gold jewelry retailer. I bought the shares about a decade ago at an average price of RM 0.45 per share. For many years the price did not change very much. Then sometime in Aug 2020, the price spiked up.

There was no special news about the company. The only reason I could think of was that gold prices had begun to go up following the Covid-19 global lockdown.

I only found out that the price had spiked as I was looking at the prices every few days. I sold off about half of my investments over the next few days at an average price of RM 1.73 per share.

I held onto the balance hoping for higher prices. But as can be seen from Chart 2, it was a temporary situation as prices dropped below RM 1.00 per share within 2 weeks after my last sale.

The price has not gone above RM 1.00 per share since then. And I still have the balance of half of my original investments. In hindsight, I was trying to be too clever and greedy.

|

| Chart 2: Poh Kong share price |

What is the moral of the stories? I am a long-term investor looking for multi-bagger opportunities. Over the past 2 decades, these opportunities came from:

- Business improvements coupled with better market sentiments.

- Price hikes due to M&A exercises. These could be takeovers or privatizations.

- Price spikes due to market speculations.

Price uptrends due to the last 2 items, especially the last one do not last long. If you fail to catch it, you would have lost a good opportunity.

I would say that a significant number of my gains were due to the last two items. To keep abreast of what is happening, I check prices almost daily.

I have a contrarian approach when it comes to checking on individual stocks. This is because I am using the daily stock price check as a proxy for looking for unusual pricing opportunities. I always have my stock valuation as the base to compare with.

To summarize, the following is how I use the portfolio review and the daily stock price checks;

- Use the quarterly portfolio review for re-balancing purposes. This is to avoid the portfolio getting out of balance from a diversity perspective due to the price changes.

- Use the daily price check for exit signals. From a value investing perspective, I am looking for situations when the price is more than 50% higher than the intrinsic value.

- When I have identified a stock to buy based on value investing principles, I do check the stock price daily to find the best buy price.

- After holding a stock for more than 5 years, I use the quarterly portfolio review to check whether I have made an investment mistake for that particular stock.

Tracking performance

To recap, I started with a USD 100,000 investment fund. I did not use all the monies when I established the portfolio and as such, that is some balance cash. When looking at performance, I will look at it from the fund perspective rather than just the stock portfolio perspective. For the avoidance of doubt:

- The portfolio refers to the stocks that I invest in.

- The fund refers to both the value of the stock portfolio and the unutilized cash.

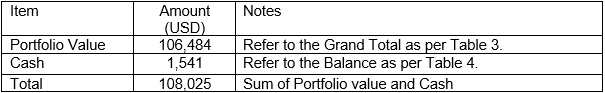

The total fund value as of the last review date (end of Dec 2022) was USD 108,025 as per Table 2. Note that this is accounting for the additional USD 10,000 funds and the new investments made at the end of Dec 2022.

|

| Table 2: Total Fund Value as of Dec 2022 |

|

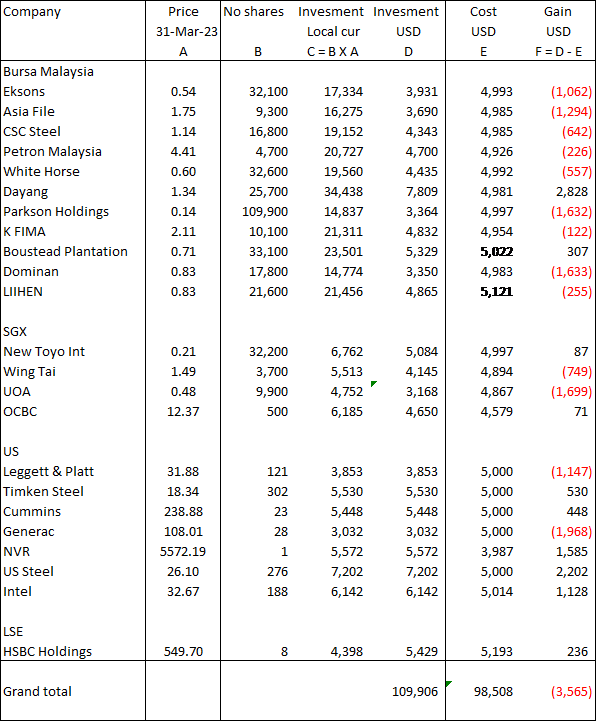

| Table 3: : Portfolio Status as of the End of Dec 2022 |

|

| Table 4: : Cash Position as of the End of Dec 2022 |

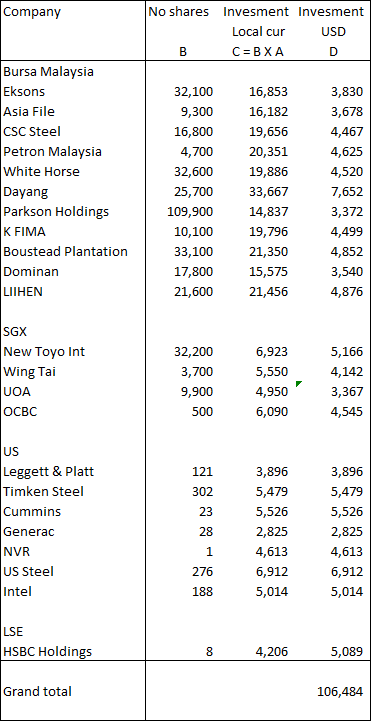

To update the portfolio, I entered the end of March 2023 stock prices as per Column A in Table 5 and EXCEL did the rest. Refer to Table 5.

|

| Table 5: Portfolio as of the End of March 2023 |

The total portfolio value had increased by USD 3,422 to USD 109,906 (refer to Table 5) compared to USD 106,484 as of the end of Dec 2022 (refer to Table 3).

The total fund value at the end of March 2023 then became USD 111,447 as per Table 6.

|

| Table 6: Total Fund Value as at end March 2023 |

Note that to derive the portfolio value in USD, I used the updated forex rates as per Table 7. Also, because of the new investments in HSBC, I now need the USD to GBP forex rate.

|

| Table 7: Forex Rates |

Recap

When it comes to assessing performance, I consider the following 3:

When it comes to the fund or stock portfolio, the return is complicated by the following situations:

To cater to such situations, I define the total gain and return in the following manner.

I used the market value of the stocks in the portfolio to calculate the portfolio value. It is the sum of the market value of the respective stocks. The current and previous values refer to the value of the portfolio assuming it is liquidated.

- Look at absolute returns.

- Compare the returns with those of the benchmarks.

- Compare the returns on a risk-adjusted basis.

When it comes to the fund or stock portfolio, the return is complicated by the following situations:

- During the period, some of the stocks could have lost money. You could have a negative total gain if there is a capital loss that is larger than the dividends.

- You could have sold off some stocks and been holding cash. Alternatively, you could be holding onto some dividends in cash form rather than have them reinvested during the review time.

- You could have allocated additional cash to the funds. In other words, the amount set aside for investment is bigger not because of any gain, but because of additional funds.

To cater to such situations, I define the total gain and return in the following manner.

- Total Gain = current value - previous value + dividends.

- The Total Returns for the period = Total Gain divided by the previous value.

- The fund value includes any un-invested cash.

I used the market value of the stocks in the portfolio to calculate the portfolio value. It is the sum of the market value of the respective stocks. The current and previous values refer to the value of the portfolio assuming it is liquidated.

The market value of a particular stock = number of shares held × market price. The number of shares held currently may be different from the number of shares held before. This could be due to bonus issues and or other corporate activities.

To ensure that I am comparing apple-to-apple, I also include any dividends or money that I have received that has not been reinvested.

- The dividends refer to all the dividends received during the annual review period. Since there is a likelihood that you may reinvest the dividends, I look at the after-tax value of the dividends received.

- The cash on hand could be money pending reinvestment or money taken out.

I hoped that I have shown you through the past few articles, how to handle various situations. I have provided work examples so that you can see the “mechanics” of the computation

.

While all the computations are mathematically correct, not all make sense. For example, when you look at the year-end quarterly returns, you can have returns excluding dividends and returns with dividends.

While all the computations are mathematically correct, not all make sense. For example, when you look at the year-end quarterly returns, you can have returns excluding dividends and returns with dividends.

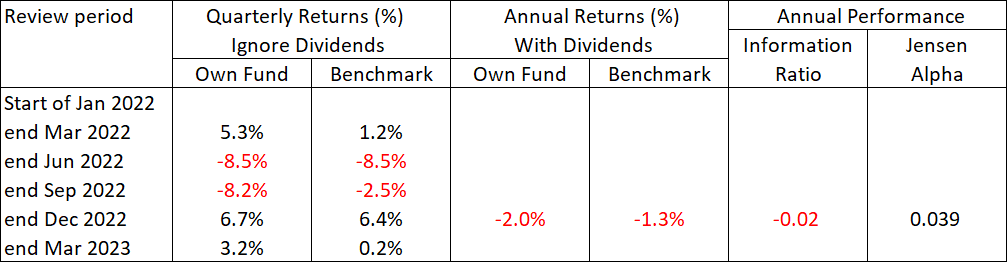

To ensure a meaningful comparison, I recommend considering quarterly performance excluding dividend. Then on an annual basis, I would consider a total return basis ie including dividends.

Along the same lines, I would assess the Information Ratio and Jensen Alpha only on an annual basis.

End March 2023 Returns

The fund returns for the quarter ended March 2023 = (111,447 – 108,025) / 108,025 = 3.17 %.

Note that the previous quarter's value of RM 108,025 included the additional new funds, new purchases and sales for the quarter. As such the 3.17 % is the actual return for the quarter that ended in March 2023. A summary of the quarterly and annual returns is shown in Table 8.

Benchmarking returns

You can see that the portfolio gained when looking at the latest quarter. Now whether this is a good performance can only be gauged by comparing it with some reference performance or benchmark.

In my previous article, I created a benchmark based on the following:

- KLCI for Bursa Malaysia.

- STI for SGX.

- S&P 500 for the US.

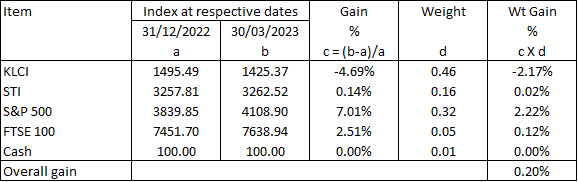

I now included the FTSE100 for the London Stock Exchange.

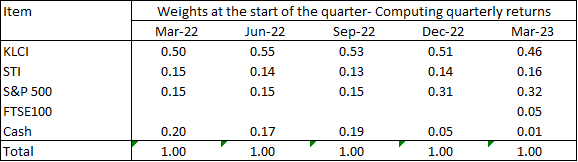

The weights for each benchmark are the value of funds allocated to the respective stock exchange at the beginning of the period. Refer to Table 9 which estimated the benchmark return.

You can see that the benchmark gained 0.2 % for the quarter compared to the fund gain of 3.2 %. I would consider this a good performance.

I have not attempted to compute the benchmark return from the start of the fund for this quarter. This is because of the following:

- I now have the FTSE100 to consider.

- The quarterly total gains for the benchmarks are difficult to find.

- The weights used in the benchmark quarterly review differ from quarter to quarter. But those used for the benchmark returns from the start of 2022 do not change as they are based on the fund value from the start of the fund. These are illustrated in Tables 10 and 11.

|

| Table 10: Weights Used to Compute the Quarterly Benchmark Returns Note: After accounting for the new investments and/or funds at the end of the previous quarter. |

|

| Table 11: Weights Used to Compute the Benchmark “from-start” Returns/ Note: The Mac 2023 weights included the FTSE100. |

For these reasons, when it comes to estimating the benchmark returns, I differentiate between the following:

- The quarterly returns where I have ignored dividends.

- The annual returns based on a total return basis ie with dividends.

Summary of performances

Table 12 summarizes the performance of the fund based on my recommended approach.

For 2022, the fund with a -2.0 % return did worse than the benchmark with a -1.3 % return. But in the first quarter of 2023, the fund with a 3.2 % return outperformed the benchmark.

|

| Table 12: Summary of Performance Note: Refer to the previous article of this series for the computation of the Information ratio and Jensen Alpha. |

Note that in my previous articles, I presented the YTD fund and benchmark returns from the start of 2022. When you go beyond one year, this is not realistic as the last quarter of the year would include the dividends. I have also mentioned the changes in the benchmark weights.

As such, a more realistic picture of the returns would be to focus on those measures shown in Table 12.

I am a long-term value investor. As such I focused on the annual returns rather than the quarterly returns.

End Mac 2023 Diversity

The goal of a portfolio is to have about 20 to 30 uncorrelated stocks. You will have difficulty computing the covariances required to determine the correlations. As such, I used a rule of thumb to ensure diversity.

- Single stock concentration - the market value of a stock should not be more than 10% of the market value of the total portfolio.

- Group concentration - the market value of the stocks within a group should not be more than 30% of the market value of the total portfolio.

Refer to my earlier post of this series for the details. The diversity profile at the end of March 2023 was presented in Table 1. You can see that there are not many changes compared to the previous quarter.

Basis of my diversity criteria

I have chosen 4 factors – location, sector, investment type, and size – to assess diversity.

These were chosen because I believe that the stock prices for each group within a factor are not correlated. Charts 3 to 5 illustrate what I mean.

- Chart 3. This compares the trends for the 4 indices representing the 4 locations (stock exchanges).

- Chart 4a. This shows the price trends for several sectors in the US stock market.

- Chart 5. This shows the price trends for different sizes of stocks.

|

| Chart 3: Comparative index trends |

|

| Chart 4a: : Price trends for different sectors Note: Refer to Chart 4b for the key to the different sectors. |

|

| Chart 4b: Key for the sectors in Chart 4a. |

|

| Chart 5: Price trends for different sizes of stocks |

You can assess the correlations visually. If the prices for the items do not move in the same direction all the time, they are likely to be lowly correlated.

I have not been able to find any chart to show that the stock prices for different investment types are not correlated. But given the nature of each investment type, I believe that the correlations would be low.

|

Conclusion

There are 2 keys questions when reviewing and interpreting the results of the portfolio review:

- How did we perform?

- Are we still well diversified?

Over the past few articles, I have shown you how to track and compute the various returns. While mathematically correct, not all of the measures are appropriate. In this article, I have recommended to:

- Compare quarterly returns excluding dividends to assess how well the fund has performed during the year.

- Compare annual returns on a total return basis to assess how well the fund has performed year-to-year.

- Use the Information Ratio and Jensen Alpha on an annual basis.

Based on this, the portfolio in 2022 did not perform as well as the benchmark. But in the quarter that ended March 2023, the portfolio outperformed the benchmark. Refer to Table 12.

Note that because of the changes in the size and composition of the fund during the year, the annual returns computed as illustrated are not very accurate. I will cover this in a later review.

I have explained why I review the portfolio quarterly. I differentiate between reviewing the stock portfolio and individual stocks. As such, I recommended a contrarian view of checking for stock prices every few days.

In the context of risk management, I am satisfied that the portfolio at the end of March 2023 is still diversified. I have used 4 factors to assess diversity and I have illustrated why I have chosen them.

Note that I have yet to use the portfolio review to check for investment mistakes. I will illustrate this in due course when I have held the stocks for several years.

END

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

If the above article was useful, you can find more insights on how to make money in my e-book. The e-book is now available from Amazon, Kobo and Google Play.

PS: If you are in Malaysia or Singapore, the e-book can only be download from Kobo and Google Play.

How to be an Authoritative Source, Share This Post

|

Disclaimer & DisclosureI am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment