What to look for when analysing Bursa property companies

Case Notes 34. This article focuses on 3 issues when assessing Bursa property companies - cyclical performance, status of the development pipeline and estimates of the RNAV.

I am a long-term value investor holding onto companies for 6 to 8 years. In this context, I often invest in property companies because of their long-term perspective.

In my portfolio of about 30 odd stocks, about 1/3 of them have property or property-related businesses. In the former, property is the core business whereas in the latter, property development is a secondary business segment.

In this article, I will share my experience in assessing and valuing Bursa property companies. It summarizes what I have learned from 2 sources:

- My value investing experience over the past 25 years.

- My experience in running a property company - i-Bhd.

I will first illustrate how the role of Malaysian residential property companies differs from those of the US. Thereafter I will focus on 3 key issues:

- Cyclical perspective.

- Development pipeline.

- RNAV valuation.

I will also take a brief look on whether you are better off investing in properties or property stocks from a return perspective.

While I will cite certain companies in this article, they are meant to illustrate my points. They are not advice to invest in them. In any event, please read my Disclaimer.

Contents

- Key characteristics of Malaysian property companies

- Cyclical perspective

- Development pipeline

- RNAV valuation

- Should you invest in property companies or properties?

- Conclusion

|

Key characteristics of Malaysian property companies

To illustrate these characteristics, I will compare the activities of Malaysian property companies with those in the US. I group the differences into 3:

- Range of activities.

- Financing the development

- Range of properties.

These characteristics impact the way you assess and value property companies.

Range of activities

In the United States, the development of land and home building are often carried out by separate entities. Each entity specializes in their respective aspects of the real estate development process.

Malaysia property companies have an integrated approach covering both land development and home building.

US

Land development involves preparing raw land for construction by installing infrastructure such as roads, utilities, drainage systems, and landscaping.

In the US, land development companies focus on acquiring parcels of land. They then obtain the necessary zoning approvals, and execute the infrastructure development process. An example of such a company is Forestar Group Inc.

Once the land is fully developed, it is typically sold to homebuilders or other developers who specialize in constructing buildings on the prepared lots.

US Homebuilders specialize in the construction of residential properties. These companies purchase developed land from land developers or directly from landowners. They then design and construct homes according to market demand, building codes, and other regulatory requirements. An example of such a company is D.R. Horton.

Malaysia

In Malaysia, it is common for property developers to undertake both land development and home-building activities as integrated processes. They often acquire raw land, obtain necessary approvals, and then proceed to both develop the land and construct buildings on it.

These companies manage the entire development process. These include land preparation, infrastructure development, and building construction, under a unified development plan. The integrated approach allows developers to control the entire development process. It streamlines decision-making, and optimizes resource utilization.

In addition to residential projects, Malaysian property developers may also undertake mixed-use developments. These incorporate residential, commercial, retail, and recreational components within the same project. Integrated property development enables developers to create comprehensive master-planned communities or townships that offer a range of amenities and services to residents.

Financing the development

There are 2 common sales and revenue recognition processes:

- Sell when completed.

- Build and sell.

The former is often referred to as the "traditional" or "completed inventory" approach. It signifies the practice of developers completing the construction of properties before marketing and selling them to buyers. This is the US approach.

In Malaysia, residential properties are mostly developed under the "build and sell" process. This is commonly known as "off-plan" sales or "under construction" sales. This term indicates that buyers purchase properties based on architectural plans and artist impressions before construction is completed.

US

In the US, the "sell when completed" approach typically involves developers completing the construction of residential properties before monies are transferred from buyers to developers. Of course in practice, developers take a booking fee at the start.

Developers then finance the construction phase through a variety of means, including loans, equity investments, or presales. They assume the risks associated with construction delays, cost overruns, and market fluctuations.

Once construction is finished, the sale is recognized.

Malaysia

In Malaysia, the "build and sell" process involves developers initiating the construction of residential properties based on pre-sales or commitments from buyers.

Developers typically market properties off-plan. Buyers purchase units based on architectural plans, specifications, and artist impressions before construction is completed.

Buyers pay a series of instalments or progress payments throughout the construction process. The final payment due upon completion and handover of the property.

Developers assume the risks associated with construction, including delays and cost overruns. But buyers also bear some risk as they commit to purchasing properties based on incomplete information and without physically inspecting the finished product.

The build-and-sell approach requires the buyers to trust in the developer's ability to deliver the project as promised.

Range of properties

Property companies in the US typically specialize in one specific property type such as residential, commercial, industrial, or hospitality.

Malaysian property companies often have diversified portfolios, developing various types of properties to spread risk and capture different market segments.

While Malaysian property companies do develop commercial and industrial properties, there is often a strong emphasis on residential developments. This is probably due to population growth and urbanization trends. Mixed-use developments, incorporating residential, commercial, and sometimes even industrial elements in a single project, are common in Malaysia.

Cyclical sector

The property sector is cyclical. The housing starts best illustrate this.

Chart 1 shows the US Housing Starts over the past 70 years. You can see that there have been several peak-to-peak cycles. At the same time, there is no change to the long-term annual housing starts of about 1.5 million units.

|

| Chart 1: US Housing Starts |

We see a similar picture for Malaysia as shown in Chart 2. Over the past 20 years, there appear to be 3 peak-to-peak cycles.

There are of course other ways to look at the property cycles. For more details refer to “How to identify property cycles for equity investment opportunities”

|

| Chart 2: Malaysia Housing Starts |

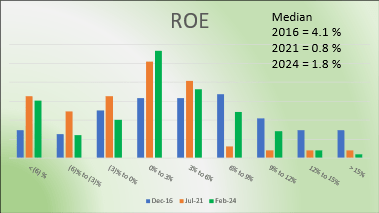

Given the cyclical nature of the housing starts, you should not be surprised to find that the performances of property companies are also cyclical. This can be seen from the histogram in Chart 3 which shows the ROE of the Bursa Malaysian property companies for 3 periods:

- 2016 is about the peak of the last cycle.

- 2020. This is the bottom of the cycle as a result of the measures to control Covid-19.

- 2024 post Covid-19. The housing starts are recovering but we have yet to reach the peak of the cycle.

You can see that in 2016, the ROE is more distributed about the median. In 2020 the ROE is more skewed towards the lower ROE.

|

| Chart 3: Histogram of ROE, Bursa Property companies |

According to Professor Damodaran, the performances of cyclical companies are often dependent on a cyclical macro-variable rather than the firms’ characteristics. As such extrapolating the performance based on the current results can lead to misleading valuations.

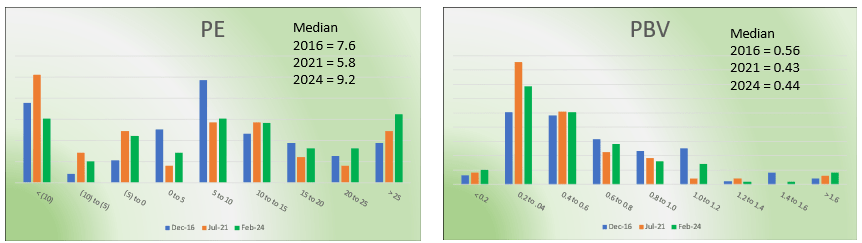

This is best illustrated by Chart 4 which shows the histograms of the PE and PBV of the Bursa property companies for 3 periods.

The PE has fat tails irrespective of the period. But there are fatter tails during the Covid-19 period.

The PBV is skewed towards the left for all the 3 periods. You can see the majority trading at less than 1.

The key takeaway? If you are valuing property companies based on their earnings, you should look at the earnings over the cycle.

I will discuss looking at the asset value later.

Development pipeline

The property development pipeline refers to the series of stages involved in the planning, construction, and completion of real estate development projects.

Each stage of the property development pipeline presents its own set of challenges, risks, and opportunities. The typical stages in the property development pipeline are:

- Identification and Acquisition. This initial stage involves identifying potential development opportunities through market research, site analysis, and feasibility studies. Once a suitable site is identified, negotiations take place for land acquisition. These include due diligence to assess factors such as zoning regulations, environmental considerations, and access to utilities.

- Planning and Design. In this stage, the developer works with architects, engineers, and urban planners to conceptualize the project and develop detailed design plans. The developer also seeks necessary approvals and permits from local authorities. This may involve public consultations, environmental impact assessments, and compliance with building codes and regulations.

- Financing. With the project plans in place, the developer secures financing for the project.

- Construction. This stage involves getting contractors to carry out the building process according to the approved plans and specifications. Project management becomes crucial to ensure timelines are met, costs are controlled, and quality standards are maintained.

- Marketing and Sales. As construction progresses, developers typically start marketing the project to potential buyers or tenants.

- Completion and Delivery. Once construction is finished and all necessary inspections and certifications are obtained, the project is ready for occupancy. The developer transfers ownership to buyers.

Depending on the types (townships vs stand-alone buildings) of projects, the time from land acquisition to handover of the properties may take several years. Chart 5 illustrates a typical development pipeline.

|

| Chart 5: Typical development process |

I will point out 2 features of this development pipeline:

- Flow through the pipeline.

- Assessing performance.

Flow through the pipeline

The best way to look at property companies is to see how they manage the pipeline. Refer to Chart 6.

|

| Chart 6: Development pipeline |

Take the analogy of a water pipe. To ensure that there is a continuous flow of water coming out at the end of the pipe, the whole pipe must be filled with water at any point in time. If there is a disruption in one stage of the pipeline, this disruption will flow through the pipe. Eventually there will be a disruption at the end of the pipeline.

The video illustrates how a disruption such as the stoppage of activities during the Covid-19 year will flow through the pipeline. Until the various stages of the development pipeline have been built back to the “steady state” level, we will not see a steady revenue stream for the property companies.

Depending on the length of the pipeline and what was disrupted, it may take some time before a property company builds back its revenue to the pre-COVID-19 level.

Assessing performance

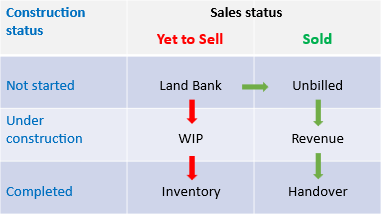

Because of the development process, the industry has its terminology to describe the various stages of the development process.

We use phrases such as gross development value or GDV, launches, sales, unbilled sales and revenue. Sales are not revenues. Launches are not sales.

Chart 7 illustrates some of the common terminology that an investor will come across when reading the annual reports of Bursa property companies. It can be confusing for newbies.

|

| Chart 7: Bursa property companies' terminology |

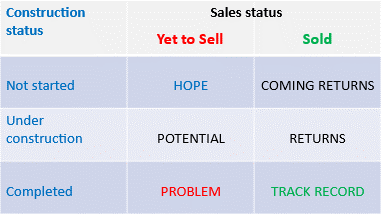

I have one framework to assess the development pipeline and to make sense of the various terminology. It looks at the gross development value (GDV) of a project and breaks it down into 2 – sales and construction. These are then broken down into several sub-stages.

Chart 8 summarizes the framework.

- The green arrows show the ideal flow.

- The red arrows show the worst flow.

|

| Chart 8: Flow through the development pipeline |

From a revenue and earnings perspective, each stage of the process will have a different financial impact. Refer to Chart 9.

|

| Chart 9: Impact of each stage the development pipeline |

The key takeaway is that when you read annual reports of Bursa property companies, try to build a picture of the development pipeline. This will then enable you to cut through the noise and PR-talk to what is important from a valuation perspective.

To illustrate what I mean, I have carried out such an analysis for Glomac. For background and analysis of this company, refer to my blog article “Is Glomac a value trap?”

I have built up a picture of the gross development value based on the data in the various annual reports of Glomac. This is summarized in Chart 10.

Historically pre-Covid-19, Glomac achieved an average revenue of RM 500 million a year. For FYE 2023, Glomac only achieved RM 340 million in revenue. It is obvious that to rebuild back to RM 500 million of annual revenue, each stage of the pipeline needs to be about RM 500 million or more.

Looking at the 2023 GDV profile, I think it would probably take another 2 years for Glomac to achieve this.

|

| Chart 10: GDV profile of Glomac – 2023 |

Unfortunately, most Bursa property companies do not present the information in this format. You will have to dig through the various annual reports to compile this picture.

But I am confident that if you do this, you can cut through the PR talk and get a better understanding of the company's performance. The ideal picture is illustrated in Chart 11.

|

| Chart 11: Ideal GDV pipeline |

RNAV valuation

I have earlier mentioned that to value cyclical companies based on their earning value, you should look at their performance over the cycle.

For further details on these, refer to “How to overcome issues when valuing cyclical companies”.

In the Bursa Malaysia context, property companies own a lot of land. In this respect, many consider the Asset Value (book value or NTA) as a floor value for many property companies.

However, in most cases, the values of the land are carried at historical costs. As such, many analysts use a metric known as RNAV (Revised or Revalued Net Asset Value) to estimate the value of the companies.

However, I want to share my concern about the RNAV computed by many analysts. The common approach for a company is to:

- Determine the projected earnings of each project. This is generally based on some discounted cash flow projection.

- Add the total projected earnings to the book value of the company to arrive at the RNAV.

- Then apply a discount to arrive at the discounted RNAV. In many cases, the discount ranges from 30% to 80%. Most analysts do not provide a basis for the discount. We have to accept them as the analyst call.

Chart 12 illustrates such a calculation of Mah Sing.

|

| Chart 12: RNAV calculation for Mah Sing |

When I was developing property, I have appointed registered land surveyors to determine the revised land value. While the land surveyors undertake a similar process as the analysts, they have a different basis to determine the RNAV.

- They first estimate the projected earnings based on some discounted cash flow method.

- They next estimated the “expected” earnings or returns from developing the land based on the sector performance.

- They then compared the projected earnings with the expected earnings. If the expected earning is more, the surveyors attribute the “excess” to the value of the land.

- We then have the revised or revalued land value.

If you see the RNAV as a revaluation of the land, the surveyor's approach is more logical. They do not talk of a discount to the RNAV.

I suspect that analysts are also trying to determine the revised land value. I would like to think that the discount is their shorthand method of doing this. Unfortunately, until analysts can explain the basis of their discount, I would take their discounted RNAV with a pinch of salt.

Should you invest in property companies or properties

In my article “In Malaysia, which has better returns; Stock market or Property?”, I opined that if you have a 30-year investment horizon, you are better off investing in properties.

In that article, I look at the comparative indices till 2019. Chart 13 updates the indices till 2022.

In the chart, the indices all start at the same level in 2002. But after 20 years, the Housing Price Index (HPI) in 2022 has overtaken the KLCI. However, the Bursa Property Index did much worse than the HPI.

Moral of the story? In Malaysia, if you have a long-term investment horizon, you are better off investing in properties rather than stocks. Of course, this is just looking at indices.

In practice, whether you can make money depends on your ability to identify the correct property. But then this is no different from value investing which requires you to identify the correct stocks.

|

| Chart 13: Comparative Indices |

This is of course a quick recap of my findings. For details read the original article. In the context of investing in property stocks, you should also consider REITs. For further discussions of these, refer to “Bursa REITs, Property Stocks, or Properties – how to choose?”

Conclusion

It is obvious that to invest in property companies, you should understand how they make money. In this article, I covered 3 factors to consider when investing in Bursa property companies.

- Assessing the performance over the cycle.

- Understanding the property development pipeline.

- Understanding the shortcomings of the RNAV.

The RNAV is but only one way to value property companies. For discussions on other valuation approaches refer to “Valuing property companies through a house valuation lens.”

There are of course other issues to consider such as the management team, location of the projects, financial strengths, and others. But I hope what I have presented here can be another perspective in understanding property companies.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment