Is TDM a value trap?

Value Investing Case Study 51-1. TDM Berhad: Turnaround story or long-term value trap? Unveiling the plantation giant's prospects! I also used the analysis to justify my decision to continue to hold onto my investment in TDM.

I bought TDM Berhad (TDM or the Group) in 2020 on the basis that it was a plantation company with a healthcare arm.

When I bought TDM, the palm oil price was at the trough part of the cycle. I hoped to benefit when prices uptrend. I expected that the company’s performance would improve with the uptrend in palm oil prices. The healthcare business would be a bonus.

While the prices of palm oil did go up, there was no significant improvement in TDM performance. This was because TDM had to provide impairments for its Indonesian plantation.

My investment thesis did not turn out as planned. To be honest, I did not notice the Indonesian problem when I first bought TDM. Today the market price of TDM is below my average purchase cost. Should I exit or continue to hold?

Join me as I review TDM’s performance and try to answer the exit or hold question. I have also formulated a new investment thesis. Based on this, I should continue to hold.

Should you go and buy TDM? Well, read my Disclaimer.

Contents

- Company background

- Operating performance

- Financial position

- My investment in TDM

- Valuation

- Investment thesis

- Conclusion

|

Company background

TDM was incorporated on 1 December 1965 and listed on Bursa Malaysia under the plantation sector in 1970.

Following a restructuring exercise and new strategic direction in 2004, TDM today has 2 business segments – Plantation and Healthcare.

Plantation

TDM currently develops and manages 13 oil palm estates and two palm oil mills located in Terengganu, Malaysia. The Group also operates two bio-composting plants and two biogas plants in Malaysia.

The Group has currently a total of 28,479 ha of planted oil palm at its plantations in Terengganu. TDM is a small player in terms of planted areas.

To give you a sense of TDM's size, I compared its performance with several companies with oil palm operations. Refer to Table 1. You can see that its FFB yield and oil extraction rate were the worst among its peers.

|

| Table 1: Peer comparison – plantation. Note: Based on 2022 data. |

In 2007, TDM expanded its plantation business to Kalimantan Barat, Indonesia. The maiden revenue from Indonesia was in 2013. In its 2015 Annual Report, the Group stated that:

“…has earmarked that the growth of the plantation operations will be in Kalimantan.”

By FYE 2016, the Group had a planted landbank of 31,807 ha in Terengganu and 12,645 ha in Kalimantan, Indonesia. In its 2016 Annual Report, the Group stated that the assets in Indonesia amounted to RM 532 million. This was equal to about 21% of the Group’s total assets.

But then things began to go wrong:

- In 2016, the Group recognized impairment charges on the palm oil mill and biological assets in Kalimantan, Indonesia amounting to RM 41.7 million and RM 5.5 million respectively.

- The 2018 Annual Report, stated that the plantations in Kalimantan continued to be stricken throughout the financial year by a stop-work order lasting six months. The Group also incurred an impairment approximating RM 41.3 million from the deterioration of estate conditions and biological assets at the Indonesian estates.

- The 2019 Annual Report talked about a reduction in the planted areas of about 2,000 ha attributed to fires in the Kalimantan plantation. RM 34 million was written off.

In its 2019 Annual Report, the Group stated that it had decided to dispose of the Kalimantan assets. In its Q4 2023 announcements, the value of the Indonesia assets were reported as RM 106 million (after all the impairments).

The Indonesian operations were never a big contributor to the Group’s revenue as can be seen from Chart 1. However, as I will show later, it had a big profit impact due to the impairments.

|

| Chart 1: Revenue by regions |

Healthcare

The Group currently owns and operates five specialist hospitals under Kumpulan Medic Iman Sdn Bhd (KML Healthcare):

- KMI Kelana Jaya.

- KMI Kuantan.

- KMI Kuala Terengganu.

- KMI Taman Desa.

- KMI Tawau.

In 2023 the Healthcare segment accounted for more than half of the Group’s revenue. But this was not the case in the past. You can see from the left part of Chart 2 that over the past 12 years, the revenue contribution of the Healthcare segment has grown from about 23 % in 2012 to 56% in 2023.

In terms of profit, the Healthcare segment was profitable for 11 of the past 12 years.

On the other hand, the Plantation segment incurred 4 years of losses. On a time-weighted basis, the Plantation segment contributed 40% more than the Healthcare segment EBIT. Refer to the right part of Chart 2.

Chart 2: Revenue contribution

Operating performance

I looked at 2 groups of metrics to get a sense of where the business is heading. Refer to Chart 3.

- The left part of Chart 3 tracks the trends of 3 metrics – revenue, PAT, and gross profitability (gross profits/total capital employed).

- The right part of Chart 3 tracks the trends of 3 return metrics – operating return (NOPAT/total capital employed), ROE, and ROA.

You can see that while revenue has had some growth over the past 12 years, PAT was volatile and trending down with major losses in 2018 and 2019.

- The loss in 2018 was due to lower revenue from its plantation segment, forex losses of RM 28.1 million, and an impairment of RM 41.3 million for the Indonesian plantation.

- The loss in 2019 was due to the Plantation segment. First, there was a loss for the continuing plantation operations due to high depreciation and amortization arising from the adoption of the MFRS framework. There was also an impairment loss resulting from the plan to dispose of the Indonesian plantation assets.

|

| Chart 3: Performance Index and Returns |

Given the PAT trend, you should not be surprised to see that generally there were declining trends for all the 3 returns metrics. And the ROE and ROA in 2018 and 2019 mirror the profit drops.

From an overall perspective, over the past 12 years, the Group achieved an average ROE of negative 2%. This was because of the 2018 and 2019 performances.

Segment performance

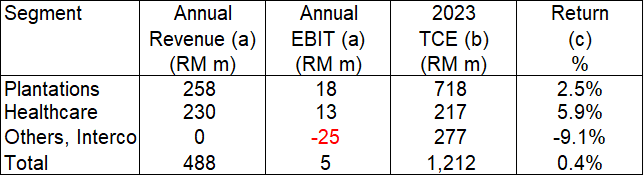

The Plantation and Healthcare segments are driven by different economic factors. As such it is more meaningful to look at the returns separately. Table 2 provides such a picture.

You can see that the Healthcare business is much more profitable than the Plantation business. Note that the cost of discontinuing the Indonesian operations was captured under the Others segment.

|

| Table 2: Segment returns Notes a) 2012 to 2023 time-weighted average. b) Total Equity + Total Debt. c) Annual EBIT/TCE. |

The Plantation business is a cyclical one and given TDM's track record, I do not expect much growth. Over the past 12 years, the segment revenue contracted at a 3% compounded rate.

On the other hand, the Healthcare revenue has grown at 11% CAGR for the past 12 years. The segment EBIT has also grown at 12% CAGR.

Table 3 summarizes the comparative performance of the 2 segments over the past 12 years.

Compared to the Plantation segment, the Healthcare segment achieved improvements in returns and operating efficiencies.

|

| Table 3: Segment comparison |

Prospects

The plantation and healthcare sectors are not sunset sectors.

The palm oil sector is one of Malaysia’s primary industries and while cyclical, it is a viable sector. For more insights into this sector refer to:

TDM is not the only Bursa plantation company to face problems with its Indonesian assets. Kumpulan Fima also faced problems. Refer to “Is KFIMA one of the better Bursa stocks?”

Of course, other Bursa companies have done well with their Indonesian plantations. A good example is MKH. Refer to “MKH – will there be another multi-bagger opportunity?”

At the same time, the private healthcare sector is a growing one in Malaysia.

- Columbia Asia recently announced its acquisition of Sime Ramsay Medical Centre.

- Affinity Equity Partners was reported to be bidding for the Penang-based Island Hospital.

- IHH Healthcare announced the construction of a new 200-bed tertiary hospital in Kuching.

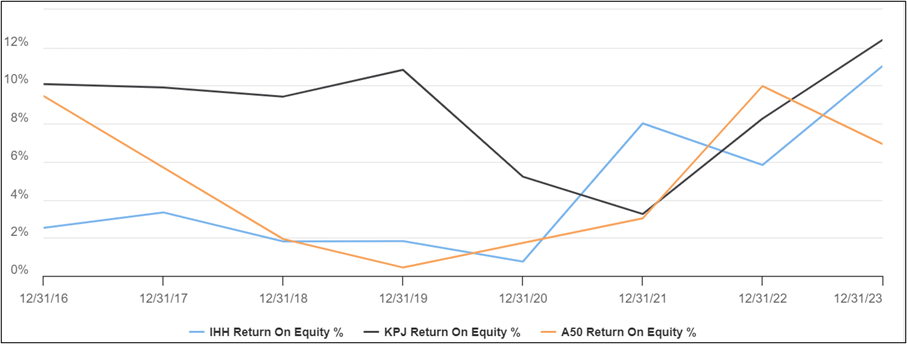

The chart below shows the financial performance of several public listed private hospital groups with operations in Malaysia:

- IHH Healthcare (IHH).

- KPJ (KPJ).

- Thomson Medical Group (A50).

You can see that they have all shown ROE uptrends since 2020.

|

| Chart 4: Healthcare companies’ performance |

Financial position

I would rate TDM as financially poor based on the following:

- It has a DE of 0.78 as of Dec 2023. While this has come down from its 2020 high of 0.96, it is much higher than its 2012 low of 0.02.

- It currently has an interest coverage ratio of 0.8. I defined this as EBIT/interest. This is equal to a CC (Fitch) synthetic rating as per the Damodaran approach.

- Its average ROE over the past 12 years of negative 2% meant that it did not create shareholders. value.

- It did not have a good capital allocation plan. As can be seen from Table 4, its cash flow from operations was not enough to fund its CAPEX & Acquisitions. The CAPEX and Acquisitions were not at a sustainable rate as the expenditure far exceeded the cash flow from operations.

|

| Table 4: Sources and Uses of Funds 2012 to 2023 |

There are of course some positive points:

- As of the end of Dec 2023, it had RM 168 million cash and short-term investments. This is about 10 % of its total assets.

- During these 12 years, it generated a cumulative RM 873 million cash flow from operations compared to a cumulative loss after tax of RM 31 million. This is a very good cash conversion cycle. But this is offset by the poor capital allocation plan.

My investment in TDM

I invested in TDM in 2020 as part of my diversification into the plantation sector.

Towards the end of 2019, I sold my shares in RCE with a multi-bagger gain and was looking for another multi-bagger investment.

Palm oil prices then were trading around its past 10-years low. Refer to Chart 5. As a cyclical commodity, I expect prices to trend up. When this happened, I expected the performance and market prices of plantation companies to follow suit.

|

| Chart 5: Palm oil prices. Source: Trading Economics |

I looked for several “cheap” Bursa plantation companies to invest in. Boustead Plantation was one of them. Another was TDM.

At that juncture, the market price of TDM over the past few months had been around RM 0.40 per share. My investment thesis for TDM was based on the following:

- I expected the CPO price in 2020 to increase by about RM 500 per MT boosting earnings by RM 38 m.

- The market price was below its 2018 NTA of RM 0.65 per share.

- The Book Value of its Malaysian portion of land and bearer plants was RM 0.50 per share. There were historical costs. Based on RM 30,000 per mature acre for Malaysian plantation land, I estimate that its revised planted land value to be double its Book Value.

- Over the past 10 years, it had an average EPS of RM 0.16 per share. Its average dividend was RM 0.075 per share.

I thought the Healthcare segment was a bonus.

I thus bought TDM. Today my total investment in TDM ranks near the bottom of my portfolio (ranked from top to bottom in terms of the total cost of investment).

Unfortunately, the market did not re-rate TDM as expected. I estimated that I have incurred a total loss of 13.4 % CAGR since 2020. Table 5 shows how I estimated this.

|

| Table 5: Estimating my returns in TDM |

To be honest, I was very gung-ho with TDM. The plan to dispose of the Indonesia assets had been stated in the 2019 Annual Report. I took the view that it was all history and that the future would be brighter. I did not foresee that the loss from the Indonesian operations would continue to significantly impact the bottom line from 2020 to 2022.

The acquisition of Boustead Plantation showed that the revised Book Value is something that an acquirer would consider. However, this meant that TDM had to sell its plantation assets to crystalize this value.

|

Valuation

The Plantation and Healthcare segments are driven by different economic factors. Thus it is more appropriate to value TDM based on a sum-of-parts basis.

I considered 2 Scenarios:

- Scenario 1. This is based on the Earnings Value for both the Plantation and Healthcare segments.

- Scenario 2. This is a very optimistic Scenario where the Plantation segment was valued based on the Asset Value of its plantation land. I used the Boustead Plantation valuation of RM 48,000 per ha as the basis for the Asset Value. The Healthcare segment was valued based on its Earning Value.

The value of TDM was estimated to be RM 0.42 per share under Scenario 1 and RM 0.97 per share under Scenario 2.

The market price of TDM shares as of 26 March 2024 was RM 0.285 per share. There is more than a 30% margin of safety under both Scenarios

Note that the current Book Value of TDM plantation land is equal to RM 14,300 per ha. If I substituted this value into the formula for the Asset Value of Scenario 2, Table 6, I would have a Scenario 2 value of RM 0.42 per share.

It does appear that RM 0.42 per share is a reasonable value for TDM.

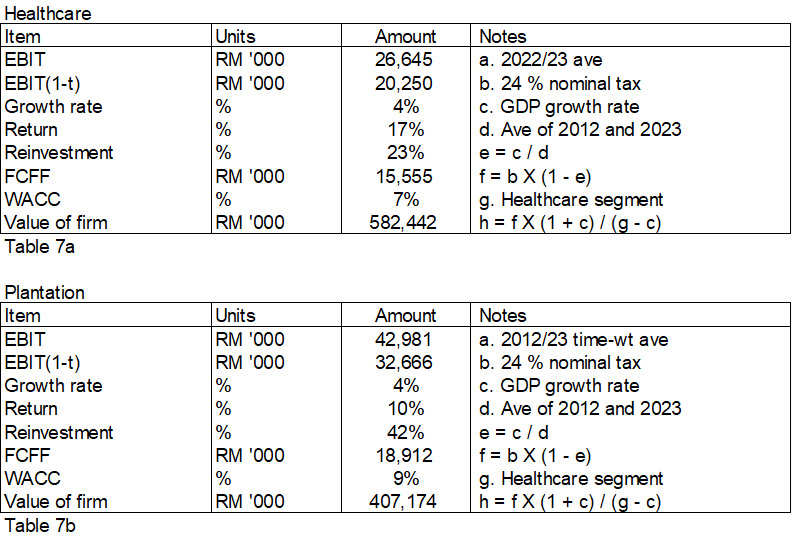

Valuation model

The Earnings Value was derived based on the Free Cash Flow of the Firm (FCFF) model as illustrated in Table 6.

Earnings Value or EV of firm = FCFF X (1+g) / (WACC – g).

FCFF = EBIT X (1-t) X (1 – Reinvestment rate).

g = growth rate assumed as 4%.

WACC = weighted average cost of capital for the respective segment. This was derived based on the Damodaran build-up approach.

t = nominal tax rate of 24 %.

Value of equity = Value of firm + cash + assets held for sale – debt – minority interests.

The assets held for sale refer to the Indonesian assets. From a conservative basis, I took the net asset as the value of the assets held for sale.

|

| Table 6: Sum of Parts Valuation |

The Reinvestment rate for the Earnings value was derived from the fundamental growth equation of

Growth = Return X Reinvestment rate.

The Return was based on the average 2012 and 2023 returns as shown in Table 3.

The Earnings Value hinges on the assumption of the EBIT

- In the case of the Healthcare segment, I assumed that the average of the 2022 and 2023 EBIT is a good reflection of the future performance. This is a conservative estimate given the growth record of this segment.

- In the case of the Plantation segment, the EBIT was the past 12 years’ time-weighted average EBIT. It excluded the losses from the Indonesian operations.

|

| Table 7: Earning Value of the firm for the Healthcare and Plantation segment |

Investment thesis

The Group's performance over the past 8 years was impacted by the poor performance of its Indonesian plantation. This has been resolved with its plan to sell the Indonesian assets. The Group is left with 2 operating segments – Malaysian Plantations and Healthcare.

The Plantation and Healthcare segments are driven by different economic factors. As such I valued TDM based on a sum-of-parts approach. On such a basis, there is more than a 30% margin of safety based on the Earnings Value and combined Earnings and Asset Values.

As such I do not consider TDM a value trap.

|

Conclusion

TDM made a wrong bet on its Indonesia plantations. The Group ventured into Indonesia in 2007. The Group had earmarked Indonesia as the growth path for the Plantation segment.

Unfortunately, the Indonesia venture did not turn out as planned. In 2019, the Group announced its plans to sell its Indonesian assets.

In its 2016 Annual Report, the Group stated that the assets in Indonesia amounted to RM 532 million. This was equal to about 21% of the Group’s total assets. By 2023, this had been written down to RM 106 million. This is equal to a loss of RM 0.25 per share. Considering that the Group’s 2016 NTA was RM 0.87 per share, this loss is very significant.

Without the Indonesian operations, the Plantation segment was a profitable one. I estimated that over the past 12 years, it delivered an EBIT of about RM 43 million annually. The Plantation segment 2023 net asset was estimated to be RM 381 million. If TDM can continue to deliver the historical EBIT, there would be a decent return.

On the other hand, the Healthcare segment had a good track record in terms of growth and profits. It delivered double-digit revenue growth over the past 12 years. I estimated that it could achieve an annual EBIT of RM 27 million. With RM 146 million of net assets deployed in 2023, this segment has a good return.

TDM is undergoing a turnaround. The plantation and healthcare businesses are not sunset sectors. My analyses showed that these businesses are fundamentally sound. We just need to give the Group time to deliver the turnaround.

I have some concerns about the Group's financial position, especially on the CAPEX and Acquisition expenditure. But these are within management control. And the Group has a good cash conversion ratio.

When I bought into TDM in early 2020, I had assumed that the losses from the Indonesian operations had all been accounted for. This was because the company had announced its plans to dispose of the Indonesian assets in 2019. I did not foresee that there would be significant losses from this “asset held for disposal” for another 3 years.

In 2023, the losses from the “asset held for disposal” were negligible. I assumed that moving forward, there would not be any further losses from this asset.

Based on the above, you can understand why I prefer to continue to hold onto my investments in TDM. There is a good potential for improved performance and I would expect the market to re-rate it when this happens.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

the major risk for TDM is getting fine by Indonesia government for RM275 in relation to a fire incident in 2019

ReplyDelete