How to grow the stock picking portfolio value?

Fundamentals 20-7: This is the June 2023 review of the stock picking portfolio that was first established at the start of 2022. I will also share my views on how to grow the portfolio value.

In Jan 2022, I constructed a stock portfolio based on the companies that I had analyzed and valued over the past year. The goal was to track the portfolio performance to provide insights into establishing and managing a stock portfolio.

This is my sixth quarterly review. The goals of each portfolio review were:

- To determine the portfolio return.

- To ensure that the portfolio still meets the diversity criteria.

Over the past few articles, I covered the “mechanics” of assessing the portfolio returns and diversity. I looked at various circumstances:

- Increasing the fund size.

- Receiving dividends.

- Selling some stocks.

- Investing in new stocks.

In this article, I will also dive a bit into how to grow the portfolio value. I will use the stock in the portfolio to illustrate the things to consider.

This post builds on the data from the various tables presented in my earlier articles in this series. To benefit from this article, you should first read the following:

Contents

- Tracking performance

- End Jun 2023 Returns

- End Jun 2022 Diversity

- How to grow the portfolio value

- Conclusion

|

Tracking performance

To recap, I started with a USD 100,000 investment fund. I then added another USD 10,000 at the end of 2022.

I did not use all the monies when I established the portfolio. There is some balance cash. When looking at performance, I will look at it from the fund perspective rather than just the stock portfolio perspective. For the avoidance of doubt:

- The portfolio refers to the stocks that I invest in.

- The fund refers to both the value of the stock portfolio and the unutilized cash.

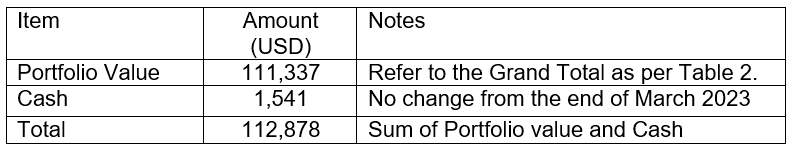

The total fund value as of the last review date (end of March 2023) was USD 111,447 as per Table 1. Refer to “How often do you review the stock picking portfolio?” for details.

|

| Table 1: Total Fund Value as of the end of Mac 2023 |

I did not sell or buy any stocks over the last 3 months. As such the cash position at the end of Jun 2023 is the same as that at the end of March 2023. But stock prices did change over the past 3 months. This affected the value of the portfolio as of the end of June 2023 is shown in Table 2.

The total portfolio value had increased to USD 111,337 (refer to Table 2) compared to USD 109,906 as of the end of March 2023 (refer to Table 1).

The total fund value at the end of June 2023 then became USD 112,878 as per Table 3.

|

| Table 3: Total Fund Value as of the end of Jun 2023 |

Note that to derive the portfolio value in USD, I used the updated forex rates as per Table 4.

|

| Table 4: Forex Rates at the end of Jun 2023: 1 USD to the respective currencies. |

Recap

When it comes to assessing performance, I consider the following 3:

- Look at absolute returns.

- Compare the returns with those of the benchmarks.

- Compare the returns on a risk-adjusted basis.

When it comes to the fund or stock portfolio, the return is complicated by the following situations:

- During the period, some of the stocks could have lost money. You could have a negative total gain if a capital loss is larger than the dividends.

- You could have sold off some stocks and be holding cash. Alternatively, you could be holding onto some dividends in cash form rather than have them reinvested during the review time.

- You could have allocated additional cash to the funds. In other words, the amount set aside for investment is bigger not because of any gain, but because of additional funds.

To cater to such situations, I define the total gain and return in the following manner.

- Total Gain = current value - previous value + dividends.

- The Total Returns for the period = Total Gain divided by the previous value.

- The fund value includes any un-invested cash.

I used the market value of the stocks in the portfolio to calculate the portfolio value. It is the sum of the market value of the respective stocks. The current and previous values refer to the value of the portfolio assuming it is liquidated.

The market value of a particular stock = number of shares held × market price. The number of shares held currently may be different from the number of shares held before. This could be due to bonus issues and or other corporate activities.

To ensure that I am comparing apple-to-apple, I also include any dividends or money that I have received that has not been reinvested.

- The dividends refer to all the dividends received during the annual review period. Since there is a likelihood that you may reinvest the dividends, I look at the after-tax value of the dividends received.

- The cash on hand could be money pending reinvestment or money taken out.

I hope that I have shown you how to handle various situations through the past few articles. I have provided work examples so that you can see the “mechanics” of the computation.

While all the computations are mathematically correct, not all make sense. For example, when you look at the year-end quarterly returns, you can have returns excluding dividends and returns with dividends.

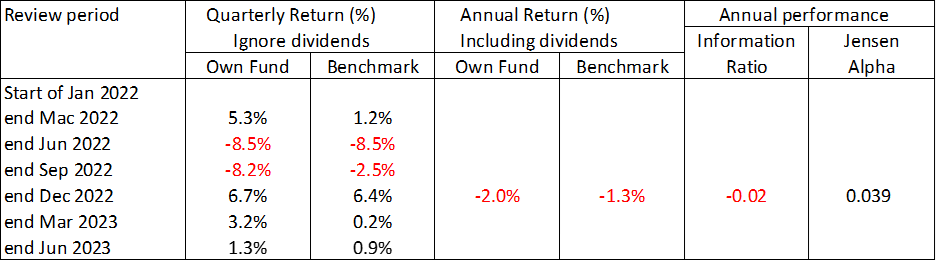

To ensure a meaningful comparison, I recommend considering quarterly performance excluding dividends. Then on an annual basis, I would consider a total return basis ie including dividends.

Along the same lines, I would assess the Information Ratio and Jensen Alpha only on an annual basis.

|

End Jun 2023 Returns

The fund returns for the quarter ended Jun 2023 = (112,878 – 111,447) / 111,447 = 1.3 %.

A summary of the quarterly and annual returns over the past few quarters are shown in Table 5.

Benchmarking returns

You can see that the portfolio gained when looking at the latest quarter. Now whether this is a good performance can only be gauged by comparing it with some reference performance or benchmark.

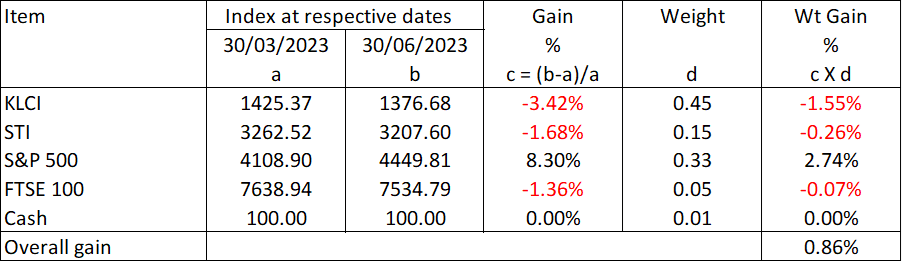

In my previous article, I created a benchmark based on the following:

- KLCI for Bursa Malaysia.

- STI for SGX.

- S&P 500 for the US.

- FTSE100 for the London Stock Exchange.

The weights for each benchmark are the value of funds allocated to the respective stock exchange at the beginning of the period. Refer to Table 6 which estimated the benchmark return.

You can see that the benchmark gained 0.9 % for the quarter compared to the fund gain of 1.3 %. I would consider this a good performance.

I have not attempted to compute the benchmark return from the start of the fund for this quarter.

- The quarterly total gains for the benchmarks are difficult to find.

- The weights used in the benchmark quarterly review differ from quarter to quarter. Refer to the previous post “How often do you review the stock picking portfolio?” for an illustration.

For these reasons, when it comes to estimating the benchmark returns, I differentiate between the following:

- The quarterly returns where I have ignored dividends.

- The annual returns which are based on a total return basis ie with dividends.

Summary of performances

Table 7 summarizes the performance of the fund based on my recommended approach.

For 2022, the fund with a -2.0 % return did worse than the benchmark with a -1.3 % return. But in the first and second quarters of 2023, the fund with 3.2 % and 1.3 % returns respectively outperformed the benchmark.

|

| Table 7: Summary of Performances Note: Refer to the previous article of this series for the computation of the Information ratio and Jensen Alpha. |

End Jun 2023 Diversity

The goal of a portfolio is to have about 20 to 30 uncorrelated stocks. You will have difficulty computing the covariances required to determine the correlations. As such, I used a rule of thumb to ensure diversity.

- Single stock concentration - the market value of a stock should not be more than 10% of the market value of the total portfolio.

- Group concentration - the market value of the stocks within a group should not be more than 30% of the market value of the total portfolio.

Refer to my earlier post on this series for the details. The diversity profile at the end of Jun 2023 is presented in Table 8. You can see that there are not much changes compared to the previous quarter.

|

| Table 8: Diversify profile |

How to grow the stock portfolio value

There are 2 ways for the portfolio value to grow over time:

- The market price of the stocks in the portfolio increases over the years in line with the improvements in the business fundamentals. The assumption here is that you do not sell these stocks as they are still underpriced. In other words, their intrinsic values have also increased such that the latest market prices are < updated intrinsic values.

- You sell the overpriced stocks and reinvest the proceeds in other underpriced stocks.

Warren Buffett’s current approach is represented by the former – his ‘forever” stocks. I must admit that I don’t have his investing skills and have not found any “forever” stocks.

Rather I rely on the latter approach. The challenge is then identifying the overpriced situations and selling to lock in the gains. But this is easier said than done.

I must admit that I have made selling mistakes over the years. I categorize them into 2:

- Selling too early.

- Being greedy and not selling out.

The first mistake is about leaving money on the table ie selling too early. For example, in 2007, I invested in KESM, a Bursa technology company. I bought the shares at an average price of RM 2.00 per share. I had estimated its intrinsic value was RM 5.00 per share.

But for many years, the share price did not move very much. Then it started to go up in 2016. By then I had waited for more than a decade so I decided to get out when the price hit RM 5.00 per share. It was not a clever move in hindsight.

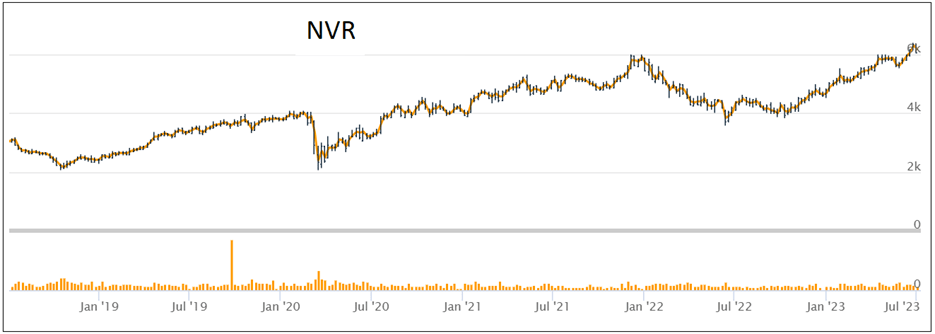

As you can see from the chart below, the share price went up to RM 20.00 per share in 2018. Of course, at that price, it was overvalued. If the wait had been a few more months, I would have gotten a multi-bagger.

Moral of the story – as a fundamental investor, I am not good at reading market sentiments.

|

| Chart 1: KESM share price |

The second type of mistake is about being greedy and holding out for more gains. I have already mentioned about my experience with Heitech Padu and Poh Kong in my previous article. Refer to “How often do you review the stock picking portfolio?” if you want to read my sad story.

Which is more painful? Both are equally painful. Will it happen again? I think so.

But to come back to my point. The goal is to exit when a stock is overpriced so that you can reinvest the gains in other underpriced stocks. I judge this “overpricing” based on the intrinsic value.

There are of course several perspectives on intrinsic values. I use all of them when thinking about selling.

- For brick-and-mortar companies, the first sign of overpricing is when the price is more than 1.5 times the Book Value.

- I also look at Earnings Power Value. I consider it overpriced when the stock price is double my estimate of the Earnings Power Value.

I don’t exist all in one go. Rather I scale out starting with the Book Value perspective. Then I sell a bit more when it comes to the Earnings Power Value. I do hold back a bit if the Earnings Value with growth is much higher than the Earnings Power Value.

Stock Picking Portfolio

I will use the end of Jun stock portfolio to illustrate the things to consider when thinking about growing the portfolio value.

If you refer to column F in Table 2, you can see that there are 8 companies with positive gains. To see whether there is a selling opportunity, the first estimate is the % Gain. This is the $ gain divided by the $ investment

For example, the % gain for Dayang = (value in column F) / value in column E) = 2066 / 4981 = 41 %.

I started the portfolio in Dec 2022. Dayang gained 41 % in about 1 ½ years. Dividing the 41% by 1.5 will give a rough estimate of the compounded annual gain of about 27 %. I would consider a compounded gain of 10% per annum as a good performance.

The right-most column in Table 9 shows the % gains for the 8 companies. You can see that 7 of them generated more than 10% compounded annual returns.

Will I be leaving money on the table if I exit now? One way to answer this question is to compare the current market price with the various estimates of intrinsic values. When I first started the portfolio, I provided estimates of the intrinsic values. Refer to Table 2, Panel Valuation in “How to Construct a stock picking portfolio for 2022.”

I now compared the market price with the various valuation metrics as shown in Table 9. In the table, I defined the Margin of safety = (Intrinsic value) / (Stock price) – 1.

A negative % meant that the stock price is higher than the intrinsic value. If we have a case like NVR where all 3 valuation metrics are negative, it meant that the stock is overpriced on all metrics. Time to sell.

If you have a case where all 3 metrics are positive, like US Steel, it meant that prices are still below all the 3 estimates of intrinsic values. Still, hold.

As for the others, I would wait for better gains before selling.

|

| Table 9: Assessing the status of the 8 stocks with positive gains Note: Intel and HSBC AV were based on the end of 2022 Book Value. Their EPV was based on the past 12 average EPS with a 10% discount. |

There is a difference between identifying a selling opportunity and executing the sale. To help ensure that I am not leaving money off the table, I scale out of my position.

I do look at technical and charts to help guide the timing of the sale. For example, in the case of NVR, I look at historical prices as illustrated in the case of NVR in Chart 2.

You can see that over the past 5 years, the current stock price is the peak. Can it still go higher?

I know that the property sector is cyclical and we are at the peak of the US Housing Starts. Many newbies would be attracted by the price uptrend and as such may cause market prices to go higher. Taking this into consideration, I would probably wait for a few more weeks before selling the first tranche.

|

| Chart 2: NVR stock price |

Note that the above is an illustration of the thinking behind the sale. It relied on old estimates of intrinsic value. In practice, I would update the intrinsic values first to verify the margins of safety.

Conclusion

There are 2 keys questions when reviewing and interpreting the results of the portfolio review:

- How did we perform?

- Are we still well diversified?

What I said in my previous article is still valid:

- Compare quarterly returns excluding dividends to assess how well the fund has performed during the year.

- Compare annual returns on a total return basis to assess how well the fund has performed year-to-year.

- Use the Information Ratio and Jensen Alpha on an annual basis.

Based on this, the portfolio in 2022 did not perform as well as the benchmark. But in the following two quarters, the portfolio outperformed the benchmark.

In the context of risk management, I am satisfied that the portfolio at the end of Jun 2023 is still diversified.

Note that I have yet to use the portfolio review to check for investment mistakes. I will illustrate this in due course when I have held the stocks for several years.

How can you grow your portfolio value? I suggest that you sell the overpriced stocks to reinvest the proceeds in other underpriced stocks. I have used the Jun 2023 portfolio to illustrate the issues to consider.

END

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment