A comprehensive guide on how to learn investing

- How to learn investing from a value investor perspective.

- What is valuing investing.

- Where to find value investment resources.

|

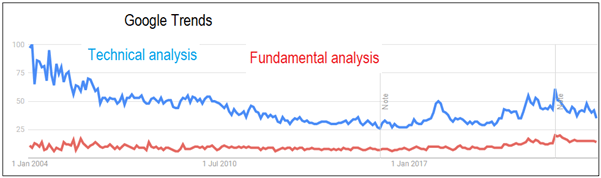

| Chart 1: Interest over time. |

- Analytical - how to analyze companies and value them.

- Behavioural - how to minimize human errors and other causes of risks.

Summary

- There are two main ways to learn investing: self-study and formal courses. Self-study allows for flexibility and a personalized learning experience but may require more time and discipline. Formal courses provide structured materials and the guidance of a teacher but may have fixed schedules and limitations.

- When choosing a method to learn investing, consider factors such as your existing knowledge, time availability, and preferred learning style. Self-study can be effective with online resources, while formal courses offer curated materials and instructor support. Assess courses based on their coverage of concepts and skills, comprehensiveness of materials, and level of guidance provided.

- What is value investing? It is an investment philosophy that involves buying undervalued stocks and holding them for the long term. It focuses on buying part ownership of businesses, buying bargains with a margin of safety, and mitigating risks.

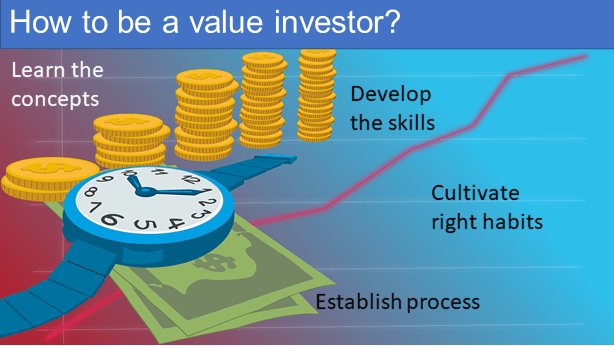

- To become a good value investor, you should learn the concepts of value investing and develop the necessary skills. You should also cultivate patient and contrarian attitudes, and establish your investment process. Additionally, company analysis and valuation are crucial skills for a value investor.

- I have provided the links to free online value investment resources to guide your learning.

|

Contents

- How to learn investing

- The self-taught route

- How to learn investing

- How to learn investing in stages

- Learning objectives

- The formal course route

- Self-study or classroom setting?

- General course vs formula course

- What to assess

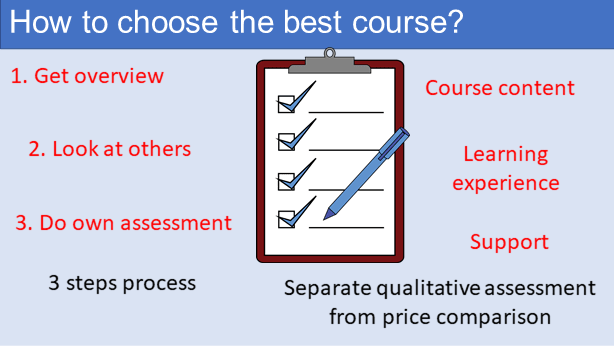

- How to choose the best course?

- What to learn

- What is value investing

- The value investment process

- Behavioural requirements

- Company analysis

- My approach

- What to analyze

- Valuation

- Relative valuation

- Asset-based valuation

- Earnings-based valuation

- Margin of safety

- Value investment resources

|

| Chart 2: Learning options |

How to learn investing

- Classroom setting. You join a group (can be online or physical room) that is led by a course leader (teacher, coach, or lecturer). He can provide immediate feedback on questions that the class may have. There is a fixed schedule for the classes.

- Self-study. The main feature here is that you study on your own. You don’t join a group. There is still a list of subjects that you have to go through although most likely you decide on the pace.

|

The self-taught route

How to learn investing

- Gain some knowledge.

- Practice to gain experience.

- Repeat steps (1) and (2).

- Only move on to the next level after you have mastered a particular level.

- Repeat (1) to (4).

- Start to invest with real money when you reach the Advanced level.

- Level 1 – Foundation.

- Level 2 – Intermediate.

- Level 3 – Advanced.

- Level 4 – Expert.

|

| Chart 3: Learn how to invest |

How to learn investing in stages

- Foundation level where you focus on concepts.

- The Intermediate level where you can start valuing companies using multiples.

- The Advanced level where you seriously start number crunching and pick companies.

- The Expert level.

Learning objectives

|

| Chart 4: Foundation Level |

- Intro to investing.

- Intro to business analysis.

- Understanding financial statements.

- Intro to value investing.

- How to analyze business.

- Intro to valuation.

- How to value companies.

- Business strategies.

- Value investing spectrum.

- CAPM and Modern Portfolio Theory.

- Options.

- Other investment approaches – Technical, Smart Beta.

The formal course route.

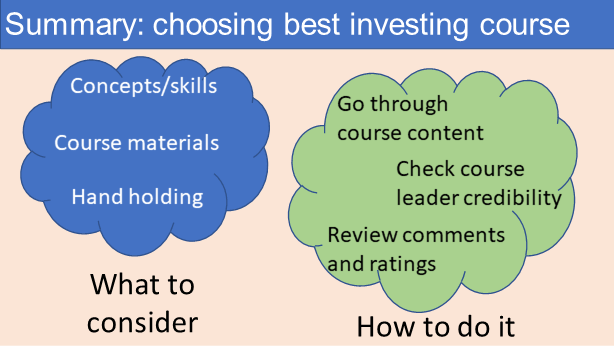

- Self-study vs classroom setting for a formal course.

- A general value investing course vs a formula course.

- Do they cover all the concepts and skills required?

- How comprehensive is the course material?

- How much hand-holding do they provide?

- Go through all the course descriptions.

- Check on the credibility of the course leader/teacher.

- Review past student comments and ratings.

|

| Chart 8: Self-taught or formal course |

Self-study or classroom setting?

- How to learn investing ie classroom vs self-study as per the discussions in the previous section.

- Course focus i.e. whether you follow a “formula” or learn about value investing in general. A formula here refers to a specific technique that is being marketed. You can think of this as a “copy and paste” investing strategy. This is opposed to learning about value investing in general.

| ||

| Chart 9: Options for how to learn investing |

|

| Chart 10: General Course vs Formal Course |

General course vs formula course

What to assess

- Learn the concepts - knowledge acquisition.

- Develop the skills - applying the knowledge.

- Cultivate the right habits - behavioral/soft skills.

- Establish your process - SOP.

- Do they cover all the concepts and skills required?

- How comprehensive is the course material?

- How much hand-holding do they provide?

|

| Chart 11: Checklist for concepts/skills |

Checklist for the basic concepts/skills that you need to develop.

- Value investing - Margin of safety, Mr market, Buying at a discount.

- Understanding financial statements (only for the general course) - Ratio analysis.

- Business analysis - moats, risks, management performance.

- Valuation - discount rates, free cash flows, DCF, relative valuation.

- Portfolio - number of stocks, position sizing.

- Risk mitigation - diversification, behavioural biases.

|

| Chart 12: Checklist for course materials |

Checklist for the course materials

Checklist for hand-holding

- Coaching by the teacher/lecturer.

- Peer interaction.

|

| Chart 13: Checking the validity of a formal course |

How to assess the validity of the formula course

- It is a successful formula that will enable you to make money.

- You can start value investing immediately.

- At the pre-buying stage, you only have the past student comments and ratings to work on. One metric that I used was to look at the number of past students. Unfortunately, not all sites provide this information.

- Another metric is to look at how long the course has been offered. The older courses could mean that they had enough interest to continue with the course. I know this is not ideal.

- You could also look at market share ie the comparative number of past students. You are of course equating popularity with the validity of the formula.

|

| Chart 14: How to choose the best course |

How to choose the best course?

- The Motley Fool.

- Morningstar.

- The Street

- Course content. Check that it covers all the basic concepts and skills.

- Learning style. Look at the course materials and whether the presentation format fits your learning style.

- Support provided. Look at hold-holding as well as access to resources.

|

| Chart 15: Summary for choosing the best course |

What to learn

- What is value investing?

- What are the skills required to be a good value investor?

- Learn the concepts.

- Develop the skills.

- Cultivate the right habits.

- Establish your process.

What is value investing

|

| Chart 16: What is value investing |

- Buy part ownership of businesses. There is a business behind every stock and you become part-owner of the company you invest in. This is opposed to the other investment approach of buying and selling pieces of paper and ignoring the value of the underlying business.

- Buy a bargain. Value investing is about buying when the price is trading at a discount to the value of the business as determined by its fundamentals. You believe that the market price will eventually reflect the business fundamentals enabling you to make money.

- Buy with a margin of safety. All valuations are based on assumptions. To protect yourself against error or bad luck, you have a margin of safety when estimating the value of the business.

- Invest for the long term. Stock prices are volatile in the short run. You want to hold long-term so that the market price reflects the business fundamentals rather than just market sentiments.

- Worry about the downside and let the upside take care of itself. While there will always be investment risks, you can adopt measures to mitigate them.

|

| Chart 17: Value investing process |

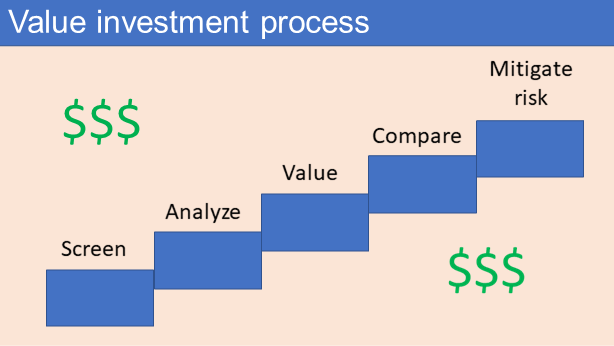

The value investment process

- What to buy. You hunt for what to buy based on companies that you understand.

- How much to buy? Have a stock portfolio with about 30 companies in the portfolio. This will provide diversification benefits without spreading your investments too thinly. This will determine how much you buy for each stock.

- When to buy or sell. You should ignore the market most of the time except when you want to enter or exit a position.

- Screening for companies for in-depth study. Analysis and valuation are time-consuming activities. Screening helps you to focus on those that are likely to lead to actual investments.

- Analyzing the screened companies. There are two objectives here.

- To make a case of why you should invest in them that is independent of the pricing vs value part. You want to know whether this is a “good” company to invest in.

- To ensure that the assumptions you use in your valuation are grounded in reality.

- Valuing the companies. All valuations are based on assumptions and different techniques will lead to different values. You want to triangulate a value with a margin of safety.

- Comparing the price with value. The goal is to assess whether this is a good investment ie can you make money? The analysis and valuation also help ensure that you are not buying a value trap.

- Mitigating risks. Warren Buffet has 2 rules for investing:

- Rule 1 - never lose money.

- Rule 2 - never forget rule 1.

|

| Chart 18: Behavioural requirements |

Behavioural requirements

- Be patient. You are relying on the success of the underlying business to make money. Company performance changes slowly and you may have to wait years for the market to re-rate the company.

- Be a contrarian. You are buying bargains. The nature of investing is such that a stock is only selling at a bargain if there is low demand. This will happen only if the crowd is not interested in the stock.

- Be the tortoise rather than the hare. You should not seek excitement from your investments. Fundamental analysis takes time and it takes more time for the market to come around.

- Have confidence in yourself. If you are going to be a contrarian, you need to be confident that your analysis is correct and that the market is wrong. You are a contrarian based on analysis.

- Be resilient. In looking for the value stocks to invest in, the process eliminates far more stocks than it uncovers. It can be a frustrating way to invest during a bull market. Many stocks that you dismiss during your search will keep rising in value in bull markets. This is even though at first, you found them too expensive.

|

| Chart 19: How to be a value investor |

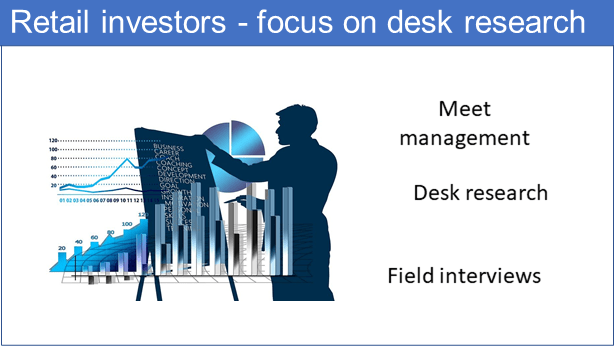

Company analysis

- Before you perform any analysis, you have first to figure out the purpose of the analysis. Analyzing companies for investments is different from analyzing them to determine their creditworthiness.

- Analyzing companies for takeover also looks at different things. It also differs if you are an insider trying to figure out the business direction of the company.

|

| Chart 21: My fundamental analysis approach |

My approach

- Competitors' actions.

- Uncertainty in the company product development timeline and the market reception of the new products.

- Changes in government policies and unforeseen economic situations.

Don’t be too clever

- I know the historical performance. The depth and breadth of the analysis will determine the accuracy of the assessment as an outsider.

- I use the historical performance as the base. I then judge the business prospects relative to the historical performance. I categorize the future performance into 3 - same, better, or worse than the past.

- Operations. I focus on profitability and growth.

- Capital allocation. The focus is on those elements that impact shareholders' value creation. This covers reinvestments, dividends, and capital structure.

- Financial strengths. This impacts both financial risks and the cost of funds which in turn affects the valuation.

- Market potential. I looked at projected industry growth, whether it is in a sunset sector or the likelihood of the business being disrupted.

- Management. Comparing the company's performance with its peers will provide a good picture of how well management performed. I also look at the continuity of staff.

- One way is to compare it with peers on several metrics - returns, growth, and market share.

- For a more objective measure, I compared the returns with the cost of funds. In a competitive environment, returns would be equal to the cost of funds. Poor performance is when the returns are lower than the cost of funds. The best is for returns to exceed the cost of funds.

- If the company has laid out some business plans or directions, I also compared its performance relative to the plans.

|

| Chart 22: Focus on desk research |

Scuttlebutt

Link to valuation

- The future is better and correspondingly, the future value is better than the historical value.

- If the future performance is expected to be similar, then it is safe to assume that the future value would be the same as the historical value.

- If the future is worse, then you can expect a lower value for the future.

|

| Chart 23: What to analyze |

What to analyze

- Identifying the company and industry’s economic characteristics.

- Identifying the products and/or services.

- Assessing management.

- Understanding the risks and concerns of the company.

- Where is it now?

- How did it get here?

- How does it make money?

- Where is it heading?

Financial statement analysis

- Finbox

- Macrotrends

- TIKR.com

- Yahoo Finance

Management

- Are they owner-managers?

- How long have they been with the company?

- How have they performed relative to their peers?

- How have they allocated capital?

- The best way is for the major shareholders to be part of management. This is common in family-controlled companies.

- The second is to tie performance bonuses to long-term returns on capital with clawbacks for losses. Performance payment should be made years later and even after the person has retired to send the message that the company wants long-term results.

Risk

Valuation

- Relative valuation.

- Asset-based valuation.

- Earnings-based valuation.

|

| Chart 24: Valuation analogy |

Relative valuation

- Compare it with the historical multiples of the company.

- Compare it with the multiples of comparable companies.

|

| Chart 25: Three Valuation Methods |

Asset-based valuation

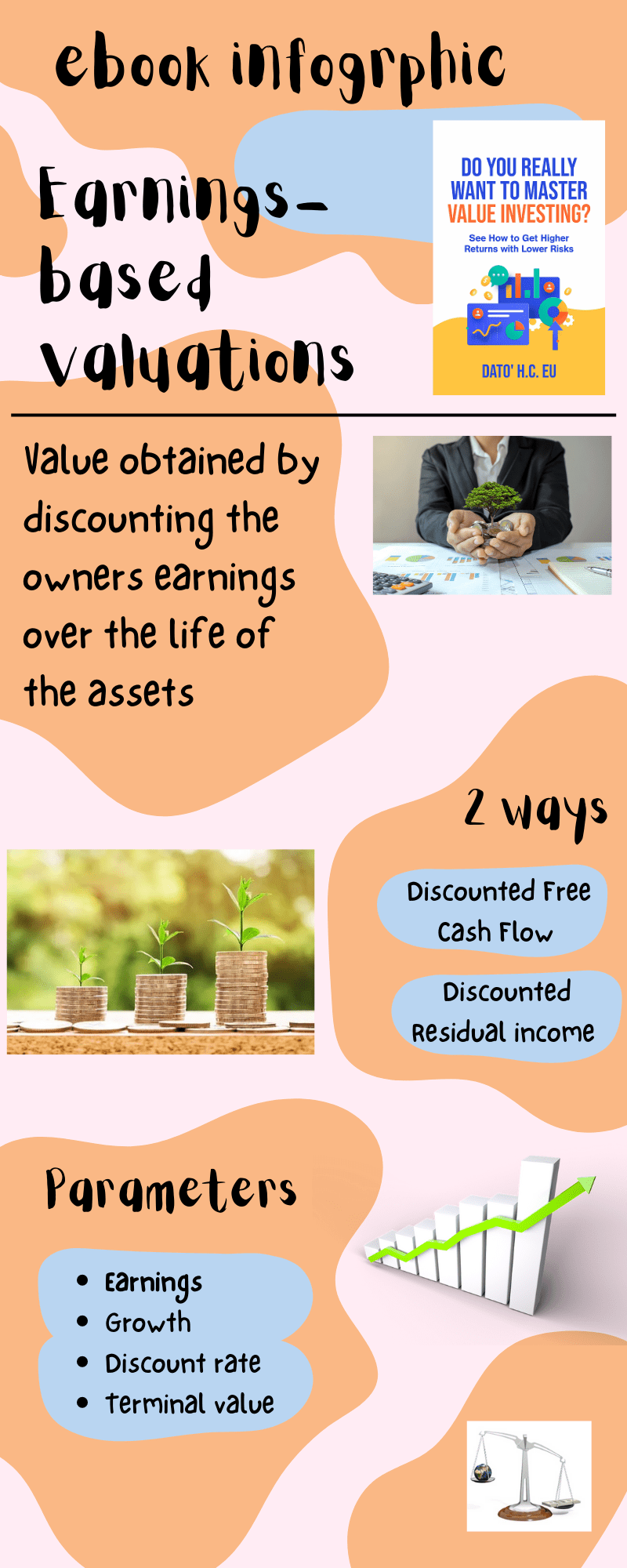

Earnings-based valuation

- EPV = Book Value X (ROE / Discount rate). Note that this formula takes into account the Book Value as well as the returns generated.

- EPV = PAT / Discount rate. This model looks at earnings.

|

| Chart 26: Earnings-based valuation |

Margin of safety

Value investment resources

- For each search criteria, I run through what Google has identified.

- I don’t select them based on Google page ranking. Rather I try to identify those that complement my historical lists.

URLs to value investment resources

Foundation

No | Site

| Guide and comments |

Reading materials

| ||

1 | Morningstar Investing Classroom

| · You have to sign up (free) and go to Learn · Read all articles under Investing Basics · Read all articles under Stock under Investing Classroom · I found this site after a year of trying to learn about investing and with hindsight, I should have started with this site.

|

2 | · Read all articles under Investing 101 and Stock Market Basics, both under Investing Basics · There are also podcasts under the above two topics and you should listen to them. · I go to the Motley Fool whenever I want to start learning about a new topic as I find it simple to digest. But the real value is their case studies.

| |

3 | · Go to Beginner's Guide to Investing in Stocks and read all the articles. · To be transparent I did not use the material here when I was learning. But on looking thru them, I think there are useful for beginners.

| |

4 | · Go to Personal Finance, look under Articles and Tutorials read all articles under Stocks and Explainers under Investing. · By the time I found Yahoo Finance, I was already into Level 2 so I skimped through many of the material that I am recommending

| |

5 |

| · This is a site with many sections so you should go to the specific URL as provided to get to the recommended reading list. Alternatively, is to Google search under “The Street How to Invest in Stocks” etc · Read all articles under the following 2 URL o How to Invest in Stocks, o How to Invest Your Money and read Stock Market Basics - Stock 101 and Investing Basics - Investing 101 · I watch Cramer more for entertainment and was surprised that his site had some good educational material.

|

Podcasts

| ||

6 | Go to Investing Podcast and search for · Investing Basics or Back to Basics and listen to all those relating to investing · Value Investing - there are blogs and podcasts you should read/listen · Investing for Dummies – listen to this · If you don't have an accounting background, the site has good articles on the various finance and accounting terms · When I started, there were really not many investment podcasts so my learning was more from reading materials. But I think podcasts can help as a refresher.

| |

7 | · This is a podcast of case studies of companies · I would start with episode 100 Stock Investing Lessons · Listen to as many case studies as you can · I listen to them to get ideas on where to look for new investments

| |

8 | · For those without a finance or accounting background, this is a good podcast about understanding financial statements · Start with Episode 1 and go through all of them as you will need to be able to read the financial statements · I did not go through any finance/accounting material as I was already familiar with them when I started to learn to invest

| |

9 | · Go to Episode, under Podcast series, select Investing 101, and listen to all the podcasts here. · This is a site I found through a Google search.

| |

10 | Investors Field Guide – Invest Like the Best | · I would start with Episode 51 on Buying Companies With Economic Moats, Pat Dorsey · This podcast applies to all the 3 levels of study. · One of the podcasts I currently listen to regularly.

|

Videos | ||

11 |

| · They have 2 videos under the Investing 101 title. Watch both · I found this through a Google search.

|

12 | · This is more like an audiobook than a video. · Watch/listen to Business Management 101. · An important aspect of an investment is assessing management. This gives an overview of what management does. · When I started to learn to invest, I was already familiar with management issues.

| |

13 | · This is another audiobook. · Watch/listen to Business 101. · This is for those without any business background. · I found this through a Google search and I thought it gave a good intro for those without any business background.

| |

14 | · There are a couple of videos but focus on Warren Buffett: How to Invest for Beginners and Stock Market for Beginners 2020. · I found this through a Google search.

| |

15 | · Ben Graham Centre for Value Investing. · This a series of value investing presentations by industry players. · Watch all of them. · I still watch this series.

| |

Intermediate

No | Site

| Guide and comments |

Reading materials

| ||

1 | · This is a good intro to business strategies. · I suggest that you read all the articles under Business Strategy. · There are two interpretations of “Business analysis”. In my context, I refer to understanding the business for investment purposes. The other interpretation is in software system development where you are determining the business needs in terms of the processes. Skip all the articles relating to this latter definition. · I have read several “Dummies” books over the years and found them to be a good way to start learning about a new topic.

| |

2 | · This contains a list of websites for learning all aspects of the business. · I am recommending that you go to the various business and investing simulation sites and play those games as part of the case learning experience eg BricksorClicks, Energee Incorporated, How the market works. · I used to be the Director of Studies of a renowned MBA programme and I understand the value of business games and simulation.

| |

3 | · This is a blog with articles, podcasts, and videos about value investing. · It is a good intro to value investing and I would recommend that you go through all the material (blogs, podcasts, and videos) that is available for free. · I found this through Google search and I think it is very comprehensive.

| |

4 | · The site has articles about investing basics and some case studies, and investors' histories. · You should go through all of them. · I found this on Google search. I have read lots of investing books and I thought this website give a good intro.

| |

5 | · This is a site with articles and videos. · Focus on valuation and modeling videos. · At some stage, you will have to start building your financial models. This site gives you the background info and practice in model building. · I am a numerical person so working with modeling using spreadsheets was not something unusual.

| |

Podcasts

| ||

6 | · This is actually an audiobook on Stock Market Investing for Beginners & Dummies. · I found this through a Google search.

| |

7 | · This has a series of short podcasts on value investing topics. · Start with this episode on 6 Skills You MUST Know Or Learn To Make Money. · Listen to as much as possible. · I found this on a Google search and would have loved to have had this when I started to learn about investing.

| |

8 | · This is a series of talks by McKinsey partners and executives on strategies. · This will give you insights when analyzing a business. · Start with the episode on What sets the world’s best CEOs apart as assessing management is an important aspect of your analysis · Listen to as much as possible. You want to understand strategy from the investor’s perspective. · I have a consulting background so I did not have to learn this skill.

| |

9 | Motley Fool – Industry Focus | · Motley Fool analysis of specific industries · You will need an understanding of the industry in which a company operates as part of the business analysis · I suggest that you listen to this as general knowledge and when you analyze a company go and look for the specific industry to listen to · One of my favorite sites for industry knowledge.

|

10 |

| · This podcast is about the skills and analysis required by McKinsey and BCG consultants. · I think it would help you analyze companies. · There are 2 categories in the podcast – case studies and consulting skills. Focus on the case studies. · But start with episode 91 on corporate strategy. · I was lucky to be working at the C suite level when I started to learn about investing so I focussed my time on the valuation aspects.

|

Videos | ||

11 | · Everything You Need to Know About Finance and Investing in Under an Hour by William Ackman. · A good intro for those without any finance or investing background. · I found this years after I passed Level 2. I would have loved to have started with this.

| |

12 | Valuation by Damodaran

| · These are an intro series without the quantitative aspect of valuation and you should watch all of them. · I only found these videos after I have read his book. The best is to watch the videos first.

|

13 | Kase Learning, Empire Financial Research | · Kase Learning is created by value investor Whitney Tilson and you should watch the Introduction to Value Investing episode. · For those without a finance or accounting background, you should also watch the Understanding Financial Statements episode. · I first saw Whitney in one of the value investment seminar’s videos and have been following him since · I have also listed Kase Learning for the Advanced Level as I think it is worth following him for everything on his site.

|

14 | · The University has a series of investment talks. · You should track and watch all of them. Start by watching the Pat Dorsey - Investment Strategies. · I still follow these talks.

| |

15 | · Business Models and Theories. · This site has short (generally < 15 minutes) videos on various business concepts. · For those without any business background, you should watch all of them. · I found this through a Google search and think that it gives a good summary of business concepts.

| |

End of Part of 2 of 3

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

If the above article was useful, you can find more insights on how to make money in my e-book. The e-book is now available from Amazon, Kobo and Google Play.

PS: If you are in Malaysia or Singapore, the e-book can only be download from Kobo and Google Play.

Disclaimer & DisclosureI am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

|

Comments

Post a Comment