The ultimate look at how to learn value investing

Fundamentals 14: There are several options to consider when you want to learn value investing. They include whether to self-study or join a class, whether to follow some system or a comprehensive course, and where to get the resources. This article explores all of them.

|

| "It's not whether you're right or wrong that's important, but how much money you make when you're right and how much you lose when you're wrong." George Soros |

How to learn value investing? There are 2 aspects to the question:

- How to learn the value investing concepts and principles?

- What is value investing?

The former is about how to master the various tasks associated with value investing and include options such as:

- How to learn? eg self-learning or attending a formal class.

- What to learn? eg learning a value investing “system” or learn value investing comprehensively

As for the latter, you cannot learn all about value investing in one article. I will only touch briefly on the value investing concepts and principles here as these are covered elsewhere in the blog. However, I will provide the links to other relevant articles in the blog.

I would recommend that you first try self-study using free online resources. This is because the main challenge in learning value investing is practicing what you have learned. The concepts are straightforward. But you need to practice the analysis, valuation, and risk mitigation so that they become second nature.

I will explore all the above in this article.

Contents

1. Top 5 value investing concepts

2. The value investment process

3. Behavioural requirements

4. Steps to be a value investor

5. Learning options

6. Pulling it all together

|

1. Top 5 value investing concepts

Value investing is an investment philosophy. It is about how you approach investing. I would like to distill value investing into 5 key concepts as follows:

- Buy part ownership of businesses. There is a business behind every stock and you become part-owner of the company you invest in. This is opposed to the other investment approach of buying and selling pieces of paper and ignoring the value of the underlying business.

- Buy a bargain. Value investing is about buying when the price is trading at a discount to the value of the business as determined by its fundamentals. You believe that the market price will eventually reflect the business fundamentals enabling you to make money.

- Buy with a margin of safety. All valuations are based on assumptions. To protect yourself against error or bad luck, you have a margin of safety when estimating the value of the business.

- Invest for the long term. Stock prices are volatile in the short run. You want to hold long-term so that the market price reflects the business fundamentals rather than just market sentiments.

- Worry about the downside and let the upside take care of itself. While there will always be investment risks, you can adopt measures to mitigate them.

To learn more about the value investing concept read the following articles in the blog.

2. The value investment process

You have to answer 3 main questions whenever you invest:

- What to buy. You hunt for what to buy based on companies that you understand.

- How much to buy. Have a stock portfolio with about 30 companies in the portfolio. This will provide diversification benefits without spreading your investments too thinly. This will determine how much you buy for each stock.

- When to buy or sell. You should ignore the market most of the time except when you want to enter or exit a position.

The value investment process to answer these questions involved:

- Screening for companies for in-depth study. Analysis and valuation are time-consuming activities. Screening helps you to focus on those that are likely to lead to actual investments.

- Analyzing the screened companies. There are two objectives here.

- To make a case of why you should invest in them that is independent of the pricing vs value part. You want to know whether this is a “good” company to invest in.

- To ensure that the assumptions you use in your valuation are grounded in reality.

- Valuing the companies. All valuations are based on assumptions and different techniques will lead to different values. You want to triangulate a value with a margin of safety.

- Comparing the price with value. The goal is to assess whether this is a good investment ie can you make money. The analysis and valuation also help ensure that you are not buying a value trap.

- Mitigating risks. Warren Buffet has 2 rules in investing

- Rule 1 - never lose money.

- Rule 2 - never forget rule 1.

The following articles in the blog provide details of the above.

3. Behavioural requirements

There are certain mindsets required to be able to follow the value investing approach. These are more than tackling behavioral biases.

You have to also cultivate the following attitudes as they are part and parcel of the value investing approach.

- Be patient. You are relying on the success of the underlying business to make money. Company performance changes slowly and you may have to wait years for the market to re-rate the company.

- Be a contrarian. You are buying bargains. The nature of investing is such that a stock is only selling at a bargain if there is low demand. This will happen only if the crowd is not interested in the stock.

- Be the tortoise rather than the hare. You should not seek excitement from your investments. Fundamental analysis takes time and it takes more time for the market to come around.

- Have confidence in yourself. If you are going to be a contrarian, you need to be confident that your analysis is correct and that the market is wrong. You are a contrarian based on analysis.

- Be resilient. In looking for the value stocks to invest in, the process eliminates far more stocks than it uncovers. It can be a frustrating way to invest during a bull market. Many stocks that you dismiss during your search will keep rising in value in bull markets. This is despite the fact that at first, you found them too expensive

4. Steps to be a value investor

To learn how to be a value investor, you should follow these steps

- Learn the concepts.

- Develop the skills.

- Cultivate the right habits.

- Establish your own process.

4.1 How to learn the concepts

Apart from the articles in this blog, there are many articles and books on value investing.

- I actually started by reading the free articles on Morningstar and The Motley Fool. You should start here.

- I am a great fan of the “Little Book” series. I suggest that your first book should be “The Little Book of Value Investing.”

BTW, I read Security Analysis and The Intelligent Investor years after I have learned value investing. In hindsight, it was good that I did not start with these 2 books.

When it comes to learning, each of us will have our own way to study. If you have never liked studying during your school days, look at the following tips to improve your study skills:

- Keep learning and practicing new things - this probably involves reading the same subject from different sources.

- Learn in many ways - reading, listening to podcasts, watching videos.

- Teach what you have learned to another person.

- Use mnemonics to aid the retention of lists of information.

- Use tests and do work examples to reinforce learning.

4.2 How to develop the skills

Investing is an activity and you need to develop the skills for it. This means not only being knowledgeable but practicing so that it is second nature.

I suggest the following way to develop your value investing skills

- Reiterative process of getting a bit of knowledge and practicing it.

- Practice with case studies and paper transactions.

There are 3 skills to develop.

- How to analyze companies. This is more challenging if you don’t have a business background. Effectively, you have to take a mini-MBA course if you don’t have a business background.

- How to value them. You don’t need to be an accountant or a maths expert to value companies. And there are many online valuation tools that compute the value if you provide the relevant inputs. The key is to understand the valuation methodology.

- How to mitigate risk. There are very limited materials on risk mitigation despite being an integral part of value investing. Many of the measures I have adopted were based on my own experience.

There is only one way to develop the skills - practice, practice, and practice. I have many case studies in my blog to help you in this process. I also have 3 articles that contain a list of URLs to free online resources on these 3 skills:

Then when it comes to risk, refer to the following:

4.3 How to cultivate the right habit

There are two schools of thought when it comes to the behavioural aspect of value investing.

- Those who believe that either you have the mindset or you don’t.

- Those who believe that you can cultivate the required mindset.

I tend to follow the former and as such, I do not have any advice on how you can cultivate the right mindset.

4.4 Establishing your own process

Investing is an activity where success (making money) is the result of a combination of skill and luck. One of the ways to ensure that skill plays a bigger role is to have a consistent process that you follow.

You cannot control luck but you can control what you do. Focusing on your process keeps you focused on the things you can control.

The opposite is to focus on the results. It is easy to get too focused on results, especially when you are a newbie. Investing is clearly black and white in the sense that you know whether you make money or not. A win will be seen as a success while a loss will be seen as a failure.

All of us want more successes than failures, but trying to invest with this mentality can actually lead to more failures.

Investing and growing wealth through the stock market is a long-term activity. Value investing will give you a long-term edge provided it is applied consistently. Having a standard investment process will ensure this.

The best analogy is the casino. You want to be the house rather than the visitor. The casinos have all the games set up so that the house has a long-term edge. They have standard operating procedures (SOP) for consistent operations.

I would go as far as to say that you should document the process so that you have a basis to review and improve it as you become more experienced. The other benefit is that you can build in ways to avoid the many behavioural biases associated with investing.

Furthermore, there are many nuances to value investing. I am sure that as you become more experienced you will find your own value investing niche. You will tweak it toward what has worked for you.

Documenting your process from the start will go a long way to help you linked the results with your process. You can tweak it with an evidence-based approach.

5. Learning options

I have seen many questions on Quora on the best way to learn value investing and/or the best value investing course.

While we can debate about how to define “best”, a practical definition is one that enables you to master value investing. There is no point in reading about value investing if you do not end up being an expert practitioner.

Everyone will have to decide on the best way to learn so that you can become a skilled value investor. Basically, you have 2 major options

- Self-study vs classroom setting.

- Follow a “system” or learn about value investing in general.

5.1 Self-study vs classroom

I am a self-taught value investor. Basically, I learned on my own through books, podcasts, and videos.

This is different from learning in a classroom setting where you interact with other students. It really does not matter whether the classroom is virtual (ie online courses) or a physical room. The key here is group learning where the pace of learning is regulated by the teacher.

The advantage of the classroom set-up is that you will have faculties to teach you and clear all your doubts on the spot. The challenge with self-study is that you need to be disciplined. You need to set aside time to study and you have to diligently do all the exercises and case studies.

The other advantage of the classroom setting is that you can interact with other students. Depending on your background the opportunity to interact with other students may be important. If you don’t have a business background, I would think that a classroom setting may be more appropriate.

You should be able to do fine with self-study if you have the following traits. You are self-driven, prefer learning visually and independently and grasp new things fast. If these are not your strong points, you may benefit significantly with the help of a classroom setting.

Of course, with a classroom setting, there is a fee involved.

You could self-study through a fee-based online course or self-study with free online resources as I did.

With many free online resources on value investing, I will question why you need to pay to learn value investing. This is because to master it, you have to practice a lot. This means that you are actually in control of whether you become an expert. So why pay when the most important aspect is something that you have to do on your own?

As mentioned earlier there are many free online resources and I have collated some of them in my “Baby steps into the investment universe” posts. Refer to them if you want to self-study.

5.2 Follow a “system” or study value investing comprehensively

A “system” in this context is a method that the person selling it claimed has worked for him. He is now offering to share his process with you for a fee.

There are many websites and blogs offering their own value investing system. If you have difficulty learning by yourself, learning a system of value investing is a quick way to learn one aspect of value investing.

I do not doubt that what has been offered works as all value investing “systems” will have their own way to identify bargains.

If you want to follow a system, use it as the first step. I am sure that as you become more experienced you probably want to develop your own niche. This requires you to have a more in-depth knowledge of value investing

BTW, if you are going to follow a system, you should first explore the following “free” systems.

- “The Little Book that Beats the Market” has one value investing system developed by Joel Greenblatt.

- Ben Graham has his own value investing “system”. You don’t have to read his books to learn it as there are many websites that summarized his system.

I am in favour of a comprehensive approach when learning value investing. I would like to think of value investing as an investment philosophy where there are many different nuances.

- We all will have our own focus when we analyse companies.

- There are not only different valuation techniques, but everyone will have their own assumptions. No two intrinsic values of a company will be exactly the same.

- We have different behavioural biases. There are also differences in analysis and valuation. Together these will lead to different risk mitigation measures.

As such I think there is a benefit of learning value investing comprehensively rather than just some "system”.

Secondly, if you believe in continuous learning, you are likely to continue to read value investment books. This is even after you have become an expert. Without a comprehensive understanding of value investing, you may not benefit from reading such books.

I also think that investing is a zero-sum game. You make money at the expense of the other party. You may not have too much advantage if you follow a “system” that many are using. The only mitigating point is that the market is very big. You are challenging many types of investors. There are those using the same "system", those who invest blindly, or those that follow a different investment style.

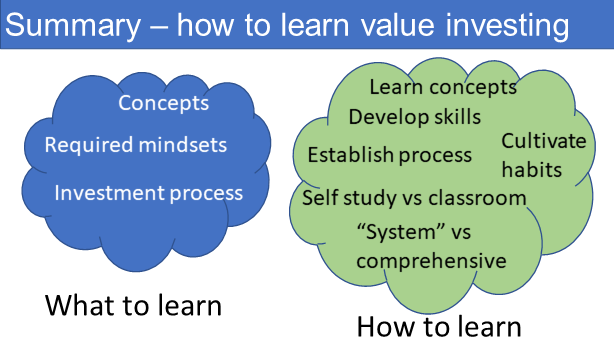

6. Pulling it all together

Value investing is an investment approach that involves a number of key concepts:

- Be a part-owner of companies.

- Buy companies at a bargain.

- Buy with a margin of safety.

- Invest for the long term.

- Worry about the downside.

In practice, you should have an investment process that first screens for potential companies. You next go into detail analysis and valuation. You then compare the market price with the intrinsic value to assess whether there is enough margin of safety to buy. Finally, you adopt a host of measures to mitigate risks.

There is also a set of behavioural requirements for value investing. These include being patient, having a contrarian approach, be confident and resilient. You behave like the tortoise rather than the hare in the investing race.

I have proposed a 4 steps process to learn value investing:

- Learn the concepts.

- Develop the skills.

- Cultivate the right habits.

- Establish your own process.

You also have 2 major options to learn value investing:

- Self-study vs classroom setting.

- Follow a “system” or learn about value investing in general.

I would recommend that you first try self-study using free online resources. The main challenge in learning value investing is practicing what you have learned. The concepts are straightforward. But you need to practice the analysis, valuation, and risk mitigation so that they become second nature. These are very dependent on you alone.

You may think that it is too troublesome to learn company analysis and valuation. One way out is to then rely on third parties to do the fundamental analysis for you.

There are several financial advisers who provide such analyses.

Those who do this well include people like Seeking Alpha.* Click the link for some free stock advice. If you subscribe to their services, you can tap into their business analysis and valuation.

END

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment