The second annual review of the stock picking portfolio

Fundamentals 20-9: This is the Dec 2023 review of the stock-picking portfolio that was first established at the start of 2022. It is also the second annual review of the portfolio. I also elaborate of why you should focus on the US.

In Jan 2022, I constructed a stock portfolio based on the companies that I had analyzed and valued over the past year. The goal was to track the portfolio performance to provide insights into establishing and managing a stock portfolio.

This is my eighth quarterly cum second annual review. The goals of each portfolio review were:

- To determine the portfolio return.

- To ensure that the portfolio still meets the diversity criteria.

This post builds on the data from the various tables presented in my earlier articles in this series. To benefit from this article, you should first read the following (in chronological order):

Contents

- Tracking performance

- End Dec 2023 Returns

- End Dec 2023 Diversity

- Where to diversify to

- Conclusion

|

Tracking performance

To recap, I started in the end of 2021 with a USD 100,000 investment fund. I then added another USD 10,000 at the end of 2022.

I did not use all the money when I established the portfolio. There is some balance cash. When looking at performance, I will look at it from the fund perspective rather than just the stock portfolio perspective. For the avoidance of doubt:

- The portfolio refers to the stocks that I invest in.

- The fund refers to both the value of the stock portfolio and the unutilized cash.

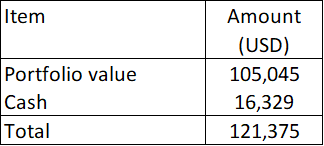

The total fund value as of the last review date (end of Sep 2023) was USD 121,375 as per Table 1.

|

| Table 1: Total Fund Value as of the end of Sep 2023 |

From 1st Oct 2023 to the end of Dec 2023, I bought Smurfit Kappa (SKG). This is a packaging company listed on the LSE that is undertaking a takeover of WestRock Company, a US packaging company. Refer to “Smurfit Kappa And WestRock: Exploring The Value Of Synergy.”

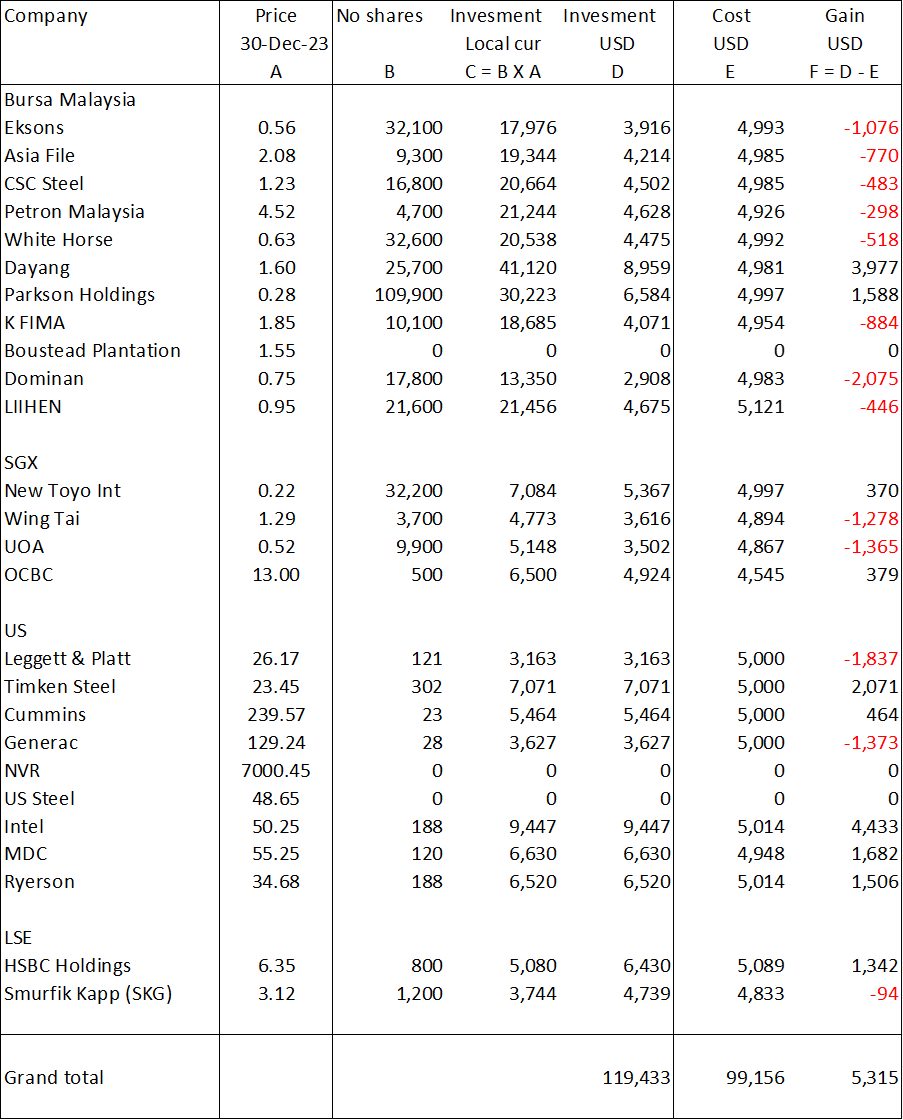

This affected the value of the portfolio as of the end of Dec 2023 as shown in Table 2.

|

| Table 2: Portfolio as of the end of Dec 2023 |

At the same time, there were changes to the cash positions as shown in Table 3. You can see that the cash had reduced to USD 15,138 at the end of Dec 2023 compared to USD 16,329 at the end of Sep 2023.

The changes were due to the purchase of SKG and accounting for all the dividends received in 2023.

|

| Table 3: Cash Position as of the end of Dec 2023 |

The total fund value at the end of Dec 2023 then became USD 134,571 as per Table 4.

|

| Table 4: Total Fund Value as of the end of Dec 2023 |

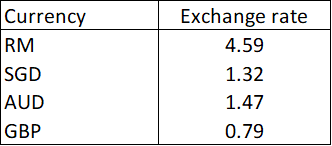

Note that to derive the portfolio value in USD, I used the updated forex rates as per Table 5.

|

| Table 5: Forex Rates at the end of Dec 2023: Note: 1 USD to the respective currencies. |

Recap

When it comes to assessing performance, I consider the following 3:

- Look at absolute returns.

- Compare the returns with those of the benchmarks.

- Compare the returns on a risk-adjusted basis.

When it comes to the fund or stock portfolio, the return is complicated by sales, additional funds, and cash taken out. Refer to the earlier articles for specific examples.

To cater to such situations, I define the total gain and return in the following manner.

- Total Gain = current value - previous value + dividends.

- The Total Returns for the period = Total Gain divided by the previous value.

- The fund value includes any un-invested cash.

I used the market value of the stocks in the portfolio to calculate the portfolio value. It is the sum of the market value of the respective stocks. The current and previous values refer to the value of the portfolio assuming it is liquidated.

The market value of a particular stock = number of shares held × market price. The number of shares held currently may be different from the number of shares held before. This could be due to bonus issues and or other corporate activities.

To ensure that I am comparing apples to apples, I also include any dividends or money that I have received that has not been reinvested.

- The dividends refer to all the dividends received during the annual review period. Since there is a likelihood that I may reinvest the dividends, I look at the after-tax value of the dividends received.

- The cash on hand could be money pending reinvestment or money taken out.

I hope that I have shown you how to handle various situations through the past few articles. I have provided work examples so that you can see the “mechanics” of the computation.

To ensure a meaningful comparison, I recommend considering quarterly performance excluding dividends. Then on an annual basis, I would consider a total return basis ie including dividends.

Along the same lines, I would assess the Information Ratio and Jensen Alpha only on an annual basis.

End Dec 2023 Returns

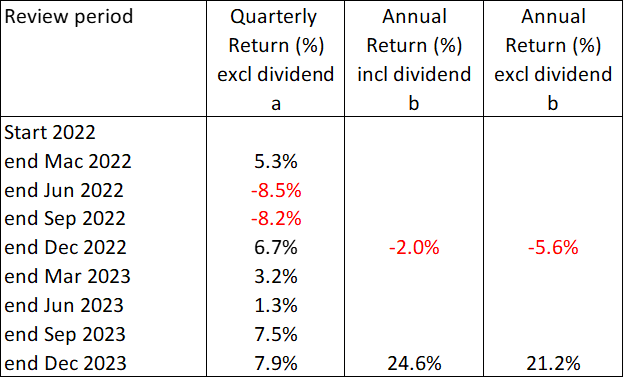

The fund gain for the quarter ended Dec 2023, before accounting for the dividends,

= 134,571 – 3,642 = 130,929. Refer to Tables 3 and 4.

The fund returns (before accounting for dividends) for the quarter ended Dec 2023

= (130,929 – 121,375) / 121,375 = 7.9 %. Refer to Table 6. The quarterly returns ignored dividends. I have earlier mentioned that I considered dividends on an annual basis.

The annual return inclusive of the dividend

= (134,571 – 108,026) / 108,206 = 24.6 %

Note that the USD 108,026 included the additional funds and 2022 dividends at the start of 2023. A summary of the quarterly and annual returns over the past few quarters is shown in Table 6.

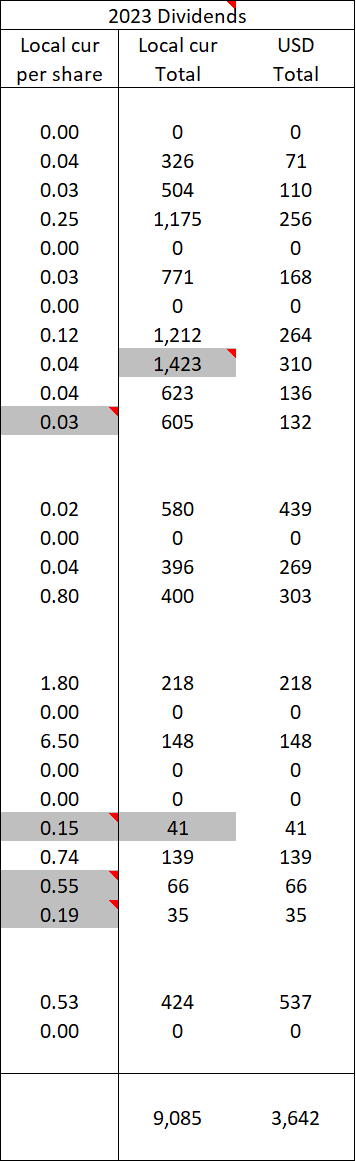

2023 dividends

The dividend information for each stock was obtained from Investing.com. These were based on the dividends received in 2023. To be consistent with what I did last year, I followed the following protocol:

- I would exclude dividends that were declared in Dec 2023 but payable in 2024.

- I would also include those declared in 2022 but payable in 2023.

For those stocks purchased during the year, the dividends would depend on whether the stock was in the portfolio on the ex-payment date.

Table 7 summarizes the dividends received in 2023. You can see that in total the portfolio received USD 3,642 in 2023. I assumed that this was all in cash thereby increasing the cash position as shown in Table 3.

|

| Table 7: 2022 Dividends Note: The grey-shaded items are for those who did not receive the full dividends for the year. These could be because of sales and/or purchases during the year. |

Benchmarking returns

You can see that the portfolio gained when looking at the latest quarter. Now whether this is a good performance can only be gauged by comparing it with some reference performance or benchmark.

In my previous article, I created a benchmark based on the following:

- KLCI for Bursa Malaysia.

- STI for SGX.

- S&P 500 for the US.

- FTSE100 for the London Stock Exchange.

The weights for each benchmark are the value of funds allocated to the respective stock exchange at the beginning of the period. Refer to Table 8 which estimated the benchmark return for the quarter.

You can see that the benchmark gained 4.21 % for the quarter compared to the fund gain of 7.9 %. I would consider this a good performance for the fund.

I have not attempted to compute the benchmark return from the start of the fund for this quarter. This was because of the following:

- The quarterly total gains for the benchmarks are difficult to find.

- The weights used in the benchmark quarterly review differ from quarter to quarter. Refer to the previous post “How often do you review the stock picking portfolio?” for an illustration.

For these reasons, when it comes to estimating the benchmark returns, I differentiate between the following:

- The quarterly returns where I have ignored dividends.

- The annual returns which are based on a total return basis ie with dividends.

Annual returns

When comparing annual returns, you must be careful to compare apples with apples. If the benchmark is on a total return basis (ie including dividends), your fund should be on a total return basis.

Table 9 shows the calculation for the annual benchmark return excluding dividends.

A more appropriate comparison is on a total return basis ie including dividends. Table 10 illustrate the computation of the total return for the benchmark. On such a total return basis, the fund in 2023 gained 24.6 % compared to the benchmark of 10.9 %. Again, a good performance for the fund.

Risk-adjusted returns

I assess my performance here using the Information ratio and the Jensen alpha. Refer to my previous articles on the discussion of risk-adjusted returns.

The risk-adjusted returns for 2023 are:

- Information ratio = 1.29.

- Jensen Alpha = 15.01

Note the following limitations when looking at these risk-adjusted metrics

- I did not include dividends.

- There were changes to the composition of the portfolio during the year. However, the metrics assumed that there was no change.

- The metrics assumed volatility as risk. The Jensen Alpha is very dependent on the values of Beta.

Details for the computation of these 2 metrics are presented in the following 2 sub-sections.

Information ratio

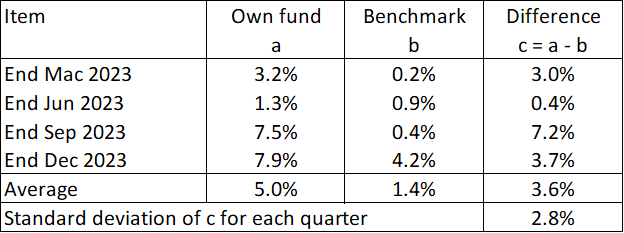

Table 11 illustrates the data for the computation of the Information ratio.

|

| Table 11: Computing the Information Ratio |

Fund relative performance = fund return - benchmark return = 5.0 % - 1.4 % = 3.6 %.

Tracking error = Standard deviation of the differences = 2.8 %.

Information ratio = 3.6 % / 2.8 % = 1.29

This information ratio is interpreted as the fund overperforming the benchmark by 1.29 per unit of volatility over the past 4 quarters.

Jensen alpha

The alpha is one way to determine if a portfolio is earning the proper return for its risk level. The formula for calculating the alpha as per Investopedia is based on the Capital Asset Pricing Model:

Alpha = R(i) - [ R(f) + B × { R(m) - R(f) } ].

Where:

R(i) = the realized return of the portfolio.

R(m) = the realized return of the appropriate market index or benchmark.

R(f) = the risk-free rate of return.

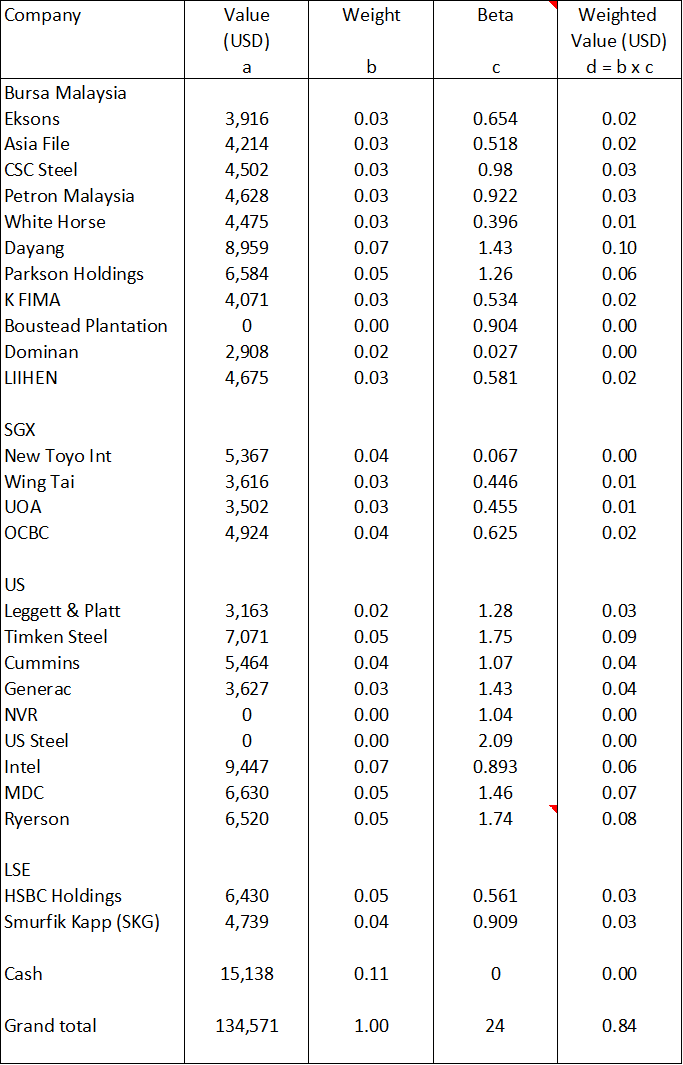

B = beta of the portfolio for the chosen market index. The portfolio beta is the weighted average betas of all the stocks and cash in the fund.

The alpha for the fund in 2023 was derived as follows:

- The fund return is 21.1 %.

- The Benchmark return is 6.51 %.

- The risk-free rate of return for the year based on USD is 3.88 % (based on 10 years treasure rate as of Dec 2023).

- The portfolio beta is computed to be 0.84. Refer to Table 12.

Alpha = 21.1 - [ 3.88 + 0.84 × {6.51 – 3.88} ] = 15.01.

The alpha represents the amount of the portfolio return that is attributable to my stock-picking ability. As you can see, there was a great deal of Alpha in 2023.

If you look at Table 12, you can see some of the shortcomings with the Alpha. This is because:

- I assumed the risk-free rate to be based on that at the end of the year. In 2023 because of the FED action, the rates changed during the year.

- I used the year-end values for the stocks in estimating the portfolio Beta. You can see that the stocks sold during the year did not have any contribution.

- The Beta used were the year-end values.

My point is that you should use the Alpha as a rough measure.

End Dec 2023 Diversity

The goal of a portfolio is to have about 20 to 30 uncorrelated stocks. You will have difficulty computing the covariances required to determine the correlations. As such, I used a rule of thumb to ensure diversity.

- Single stock concentration - the market value of a stock should not be more than 10% of the market value of the total portfolio.

- Group concentration - the market value of all the stocks within a group should not be more than 30% of the market value of the total portfolio.

Refer to my earlier post on this series for the details. The diversity profile at the end of Dec 2023 is presented in Table 13.

You can see that cash increased in this quarter compared to the other quarters. But the concentration within each group reduced in this quarter.

The other feature from Table 13 is that over the past 2 years, I have reduced the exposure to Bursa Malaysia from 50% when I first started to 36 % currently. At the same time, I have increased the exposure to the US from 15 % at the end of 2021 to 31 % currently. The rationale is explained in the next section.

|

| Table 13: Diversity Profile |

Where to diversify to

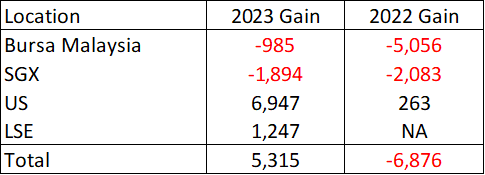

The portfolio gained USD 5,315 in 2023 whereas for 2022, there was a loss of USD 6,876.

Table 14 breaks down the gain or loss by location. You can see that for both years, the losses from Bursa Malaysia and SGX were offset by the gain from the US. The US delivered better returns than Bursa Malaysia.

|

| Table 14: Composition of the gain/loss |

I have in my previous articles discussed how diversification can help to reduce risk. But I want to highlight a different perspective here. This is in the context of where you should place most of your money.

At the end of 2023, the US accounted for about 31% of the funds whereas Malaysia accounted for about 36 %.

The stocks in both countries were selected based on value investing principles. They all had their respective margins of safety. The difference in the returns for the US suggests that the re-rating occurred earlier than those in Malaysia.

Over the past 25 years, the KLCI grew at 3.9 % CAGR whereas the S&P 500 grew at 5.8 % CAGR. It makes more sense to allocate more to the US.

Why the US?

The reasons for the higher growth rate for the US index are as follows:

Economic Size and Development. The United States has one of the largest and most developed economies globally. Its economic size and diversification across various sectors contribute to a more resilient stock market.

Global Market Integration. The US stock market is highly integrated into the global economy, attracting international investors and benefiting from a more extensive range of investment opportunities.

Technology and Innovation. The US is a global leader in technology and innovation. The presence of major tech companies on the US stock exchanges has been a significant driver of growth. These companies often experience rapid expansion, contributing to overall market growth.

Political Stability and Regulatory Environment. The US has historically been viewed as politically stable. With a well-established regulatory framework, it can attract more investors compared to markets with perceived instability.

Market Maturity and Investor Sophistication. The US stock market has a longer history and is considered more mature compared to the other Asian stock markets. Investor confidence and sophistication tend to grow with market maturity. This can positively impact market performance.

Currency Factors. Currency exchange rates can influence investment decisions. The US dollar is a widely used global currency, making US assets attractive to international investors.

Market Liquidity. The US, being larger and more liquid, may provide investors with greater ease in buying and selling securities.

Financial Infrastructure. The US is seen as having a more efficiency and sophisticated financial infrastructure. This can impact the ease of doing business and investing.

Interest Rates and Monetary Policy. Differences in interest rates and monetary policies between the US and other countries can affect the cost of capital and influence investment decisions.

If you are thinking of maximizing the returns, you should allocate more funds to those countries with better stock market performance.

In the context of diversification, I would suggest that instead of Bursa, I would select an Asian stock market with a better growth track record such as China or even India. To give you a sense of this, from the end of 2010 to 2023, the CAGR for the various stock market indices were

- S&P 500 (US) – 10.8 %.

- Nifty 50 (India) – 10.2 %.

- SSE (China) – 0.4 %.

- KLCI (Malaysia) – negative 0.3 %

Conclusion

There are 2 key questions when reviewing and interpreting the results of the portfolio review:

- How did we perform?

- Are we still well diversified?

What I said in my previous article is still valid:

- Compare quarterly returns excluding dividends to assess how well the fund has performed during the year.

- Compare annual returns on a total return basis to assess how well the fund has performed year-to-year.

- Use the Information Ratio and Jensen Alpha on an annual basis.

Based on this, the portfolio in 2023 did better than the benchmark.

In the context of risk management, I am satisfied that the portfolio at the end of Dec 2023 is still diversified. However, I would start to look for other Asian stock exchanges to substitute for Bursa Malaysia.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment