Contents

1. Stock tips

- Source of the tips

- Are they in line with your investment approach?

- Do they share the same risk approach?

- What to do with stock tips

2. What to consider when investing in Bursa4. Risk mitigation measures when investing

8. Asia File

9. Boustead Plantation

11. Crescendo

12. Crest Builders

13. CSC Steel

14. Dayang

16. Dominan

17. Eksons

18. Glomac

19. Heitech Padu

21. IGBB

22. Kumpulan Fima

23. Lee Swee Kiat

24. LIIHEN

26. MBSB

27. MKH

28. MNRB

29. Naim

31. Opensys

32. OSK

33. Parkson

34. Petron Malaysia

36. Plenitude

37. Poh Kong

38. Protasco

39. Sapura Energy

41. TDM

42. Tower REIT

43. White Horse

Case Notes A stock market is a place where people buy and sell pieces of paper representing part ownership of companies. As such there are 2 main ways to invest: - Buy and sell pieces of paper. This is a market sentiment-driven approach. You buy a stock hoping to find someone else who is prepared to buy from you at a higher price for no other reason than the belief that prices will continue to rise. Many use price and volume data (aka technical indicators) to help them read market sentiments.

- Buy and sell part ownership of companies. Here you buy if the price is less than the value of the business as determined by the business fundamentals. The belief is that the market price will eventually reflect the business fundamentals.

There are success stories with both approaches.

To give you a sense of the various styles of investing and how the conclusions may differ from those derived from value investing, I have tabulated the various free online valuations based on the first page of Google search.

The focus of this blog is based on buying and selling part ownership of companies. This approach is based on analyzing and valuing companies with a strong emphasis on their future. For beginners, it can be challenging, and thus it may be helpful to supplement it with third-party analyses.

There are several financial advisers who provide such analyses. Those who do this well include people like Seeking Alpha.* Click the link for some free stock advice. If you subscribe to their services, you can tap into their business analysis, valuation, and risk assessment. Then as you become more experienced, you can phase them out.

|

1. Stock tips

The Oxford dictionary defined “tip” as a “small but useful piece of practical advice”.

A stock tip should then be interpreted as a small but useful piece of practical advice about investing in a particular stock.

In this context, I would like to differentiate between a stock tip and an investing or investment tip

- A stock tip relates to a recommendation about a particular company.

- An investing or investment tip refers to advice on how to invest. It is independent of the stocks or companies you invest in.

I am talking about the former ie what to buy or sell. Think of it as KLCI stock tips.

However, investing means different things to different people and before you act on the stock tips, it is useful to consider the following

- Are they in line with your investment approach?

- Do they share the same risk approach?

Source of the tips

It is important to know the source of the tips so that you can identify the motives.

You can decide on the quality of the tips. A good stock tip should be one that is

- There are justifications for the recommendation

What are some of the possible sources and/or motives for the stock tips?

- To market products or services to you

- Part of a casual conversation

1) The stock tips could be part of the tipster marketing plan. For examples, there are many web sites offering stock tips

- The Street by Jim Cramer offers a daily bevy of stock picks, starting points for stock analysis, and stock ideas

- Newspapers occasionally feature stock picks for the month, year, etc.

- This post is about KLCI stock tips.

2) Many working in the stock market/investing sector are frequently asked about stock tips. Ideally, to be useful, the stock tips should be given to a selected group.

3) Scams are investment schemes to get you to part with your money on the promise of a questionable financial opportunity.

You should not be surprised as investment scam (not related to the stock market) has been around for ages.

It is more common than you think.

- The US Securities and Exchange Commission (SEC) even has a webpage warning of this.

- The Australian Competition and Consumer Commission has a Scam Watch web site

- In Malaysia, the Securities Commission has warned about stock scams in the national media.

There are several forms of investment scams, but I want to focus on those involving giving tips

- Churning and the similar Wash Trading

- Stock Bashing and the similar Bear Raid

a) You could be part of a Pump and Dump scam where scammers buy thinly traded stocks at a low price.

- They then praise the stocks by email or other social media platforms. When people buy the stocks, the price naturally is “pumped” up.

- The scammers then “dumped” the shares they own driving the price down. You then become a victim holding the stock at a loss.

In Mac 2019, Bitcoin started to recover after hitting a low of $ 3,360. It started to rise dramatically to peaked at $7,542 in May before dropping. Many alluded to this as a pump and dump scheme.

There have been movies featuring pump and dump schemes. "Boiler Room" and "The Wolf of Wall Street" are two such movies. They featured telemarketing stockbrokers pitching stocks in companies with highly questionable prospects.

b) The person giving the stock tips could be part of a “Churning” scheme where a broker places both buy and sell orders at about the same price. The increase in activity is intended to attract more investors, and increase the price.

This also enables the broker to trade excessively to generate commissions.

“The elderly are a trusting group whose accounts are among those most often churned. And immigrants seem particularly vulnerable to this ploy, particularly entrepreneurs and professionals...”

A similar scheme is Wash Trading. This is selling and re-purchasing substantially the same security to generate activity and increase the price.

In 2016, the SEC arrested 2 persons for coordinated trading in more than $10 billion worth of securities in dozens of brokerage accounts.

These 2 looked for companies with low trading volumes and then entered numerous trades using “helper” accounts. This artificially inflated their prices. Later they sold the shares in “winner” accounts at artificially inflated prices after accumulating positions at lower prices.

c) Stock Bashing. The people behind this scheme make up false and/or misleading information about the target company in an attempt to get shares for a cheaper price.

They try to drive a stock price down by trying to convince shareholders they have bought worthless security. The next step is then to buy and profit from a pump and dump scheme.

Smaller companies are generally targeted because the markets are more easily manipulated.

“… fraudsters may exploit social media... spreading false and misleading information .. to affect the stock’s share price. Wrongdoers may perpetuate stock rumours.... on online bulletin boards and in Internet chat rooms.”

Very similar to stock bashing is the Bear Raid. Here traders try to forcibly lower the price of a stock to cover the price of a short position. This is normally achieved by spreading negative rumours about the target company, which puts negative pressure on the share price.

One of the most famous bear raids on Wall Street occurred in October 1997. Short sellers noticed the sharp slide in the Hang Seng index and began shorting US-stock index futures. The Dow Industrials began to lose ground, tumbling 450 points in the first few weeks of October

d) The opposite of stock bashing is the Run and/or Ramp. These are actions designed to artificially raise the market price of listed securities. And give the impression of voluminous trading to make a quick profit.

The Guinness share-trading fraud in the 1980s is a good example of this. The parties involved manipulated the London stock market to inflate the price of Guinness shares. This assisted Guinness's takeover bid for the Scottish drinks company Distillers.

e) A Lure and Squeeze scheme is used for a company that is very distressed and looks as if it will declare bankruptcy. People new to the stock short it based on the company’s poor outlook. As a result, the price starts to drop.

The short continues until the number of shorted shares greatly exceeds the total number of shares that are not held by those undertaking the scheme.

In the meantime, those organizing the scheme purchase the stock as the price drops to lower.

When the short interest has reached a maximum, the company announces it has made a deal with its creditors to settle its financial position. This positive news caused the stock price to rise and those with short positions will be squeezed.

Near its peak price, the scammers start to sell and the price gradually falls back down.

There are many today who think that VTV Therapeutics that is listed on Nasdaq is a potential stock squeeze.

f) A Chop Stock is one that is purchased at pennies per share. This is then sold to unsuspecting retail customers at several dollars per share.

The scammer generally acquires a block of shares that have little or no liquidity prior to the block purchase. The scammer then sells the stock to their brokerage customers at the then-current quoted offer/ask price. Often victimized investors are generally unaware of this practice.

Not surprisingly, such scams usually involve penny stocks

Are they in line with your investment approach?

There are several investment styles from

- Short term trading vs long term investing

- Technical vs fundamentals

- Value investment vs growth investing

When you receive the stock tips, you have to be aware of whether stock tips and/or the tipster is in line with your investment approach.

- You can imagine the disaster that the tip is intended for a day trader but you treat it as a long-term investment

- If your investment is to be different from the crowd, the stock tip is not likely to be useful as it would have been given to many as well

One of the factors for successful investing is having a consistent investment approach. You should not let a stock tip change this.

I am a long-term value investor. The various KLCI stock tips in this post should be viewed from this perspective.

Do they share the same risk approach?

There are 2 schools of thought when it comes to risk

- Those that consider volatility as a measure of risk

- Those that consider a permanent loss of capital as a risk

Both approaches approach risk mitigation differently and this will impact on

- Whether you treat the investment as investing in pieces of paper or part share of a company

Very likely the tipster would not be thinking of risk when the tip is given.

What to do with stock tips

- The main goal of getting the stock tip is that it helps you cut short your investment process.

- You should then review it in the context of your investment approach and risk mitigation plan

- The last thing you should do is to be caught in the emotion of the stock tip and change your investment style because of it.

Moomoo is a trading platform that caters to both beginners and experienced traders alike. It is engineered to empower beginners to trade like a pro with an intuitive interface and powerful tools, while at the same time, offering a suite of advanced tools that meet the demands of seasoned traders. The tools are completely free on moomoo. Are you ready to take your trading journey to new heights? GET MOOMOO*

|

|

|

|

2. What to consider when investing in Bursa

There are 3 key questions to consider when investing

I find that the value investing school provides the best way to answer them.

- You buy those companies trading at a discount to their intrinsic value. You buy a bargain. You buy into those companies where you are unlikely to lose your investment.

- You put more money into those companies that you have the greatest conviction. This could be based on the biggest margin of safety or highest quality, etc all of which are valuing investing concepts

- You sell when the market price exceeds the intrinsic value. Or you sell if you have made a mistake in your analysis and valuation

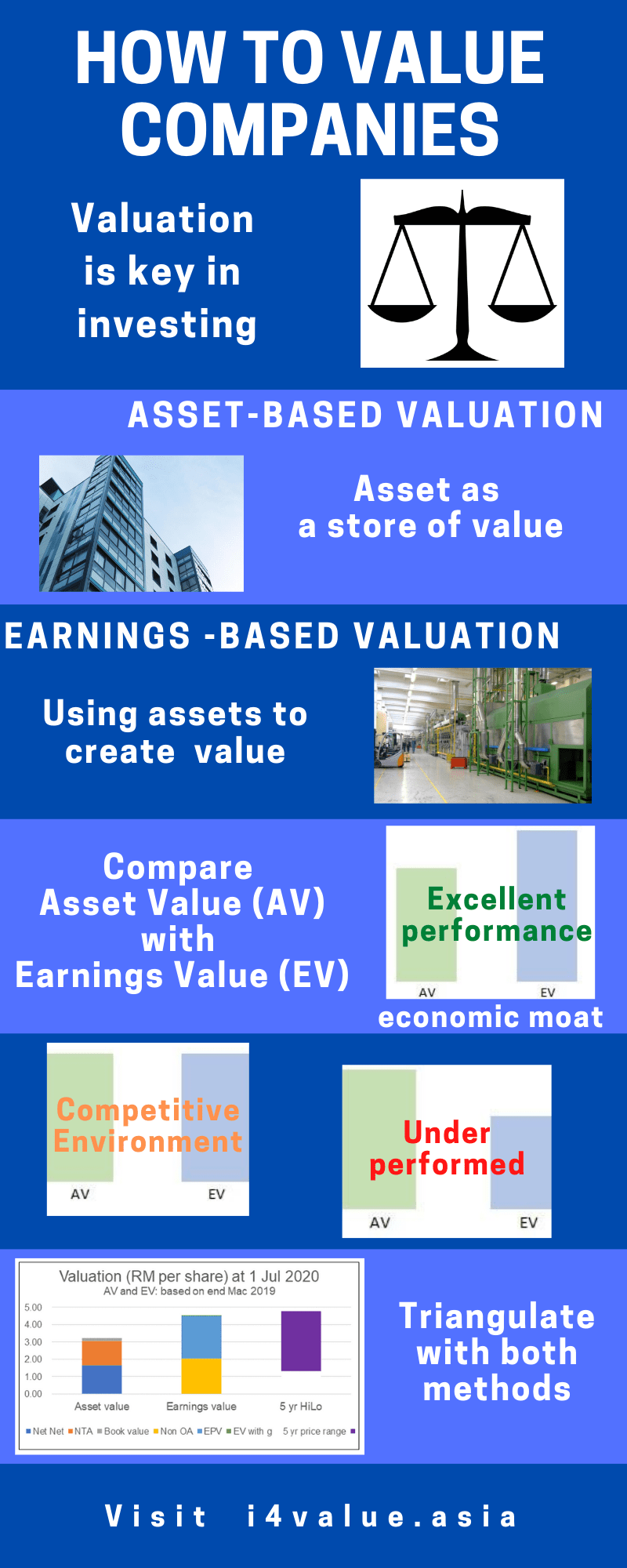

The infographics below summarizes the key points for each of them. The various KLCI stock tips you see in this post are based on them.

If you are a value investor, you use the difference between the market price and the intrinsic value to answer questions like

Even determining how much to buy is influenced by the intrinsic value. You allocate more to those companies with higher margins of safety. And this is dependent on the difference between market price and intrinsic value.

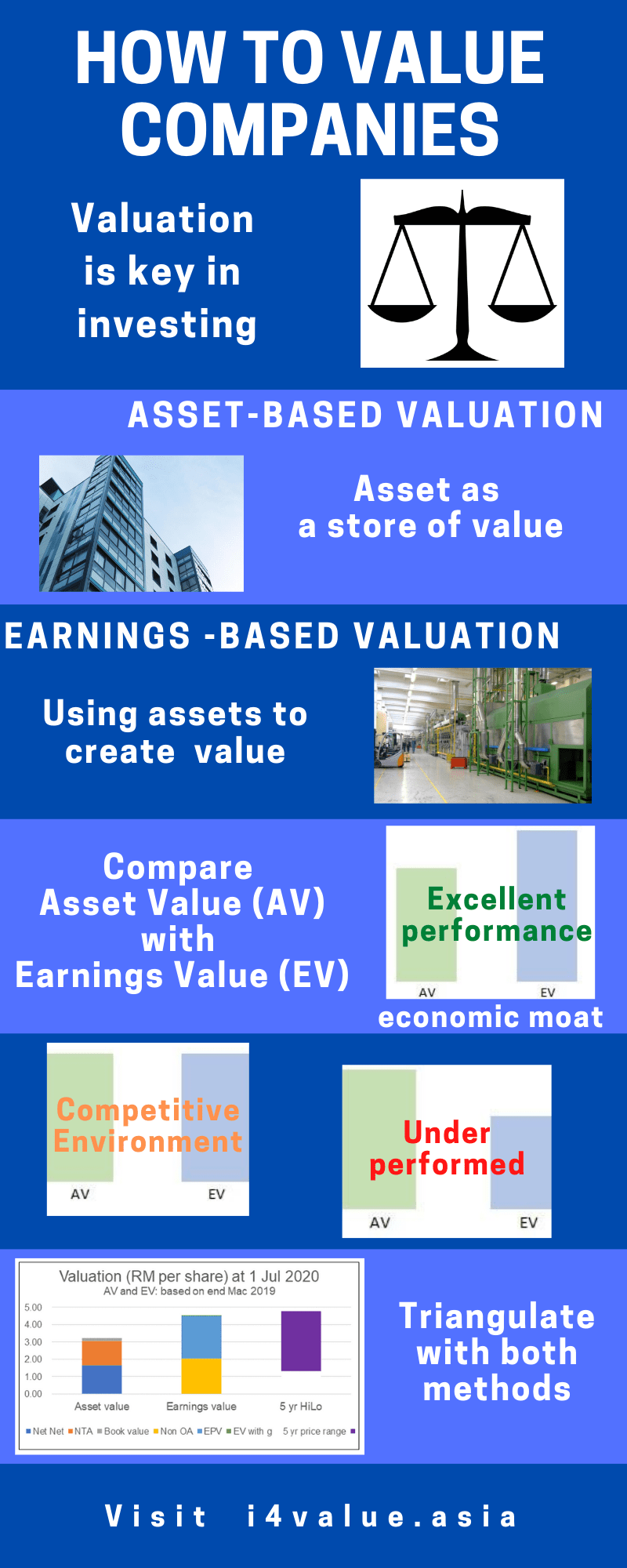

Valuation then is one of the key elements of value investing.

There are two main ways to value a company

- Asset-based where you consider the assets as a store of value

- Earnings-based where you consider the assets as a creator of value

You should adopt both the Asset-based and Earnings-based methods. Comparing the results of both will provide strategic insights.

As the infographic illustrates, these approaches will enable you to triangulate the intrinsic value.

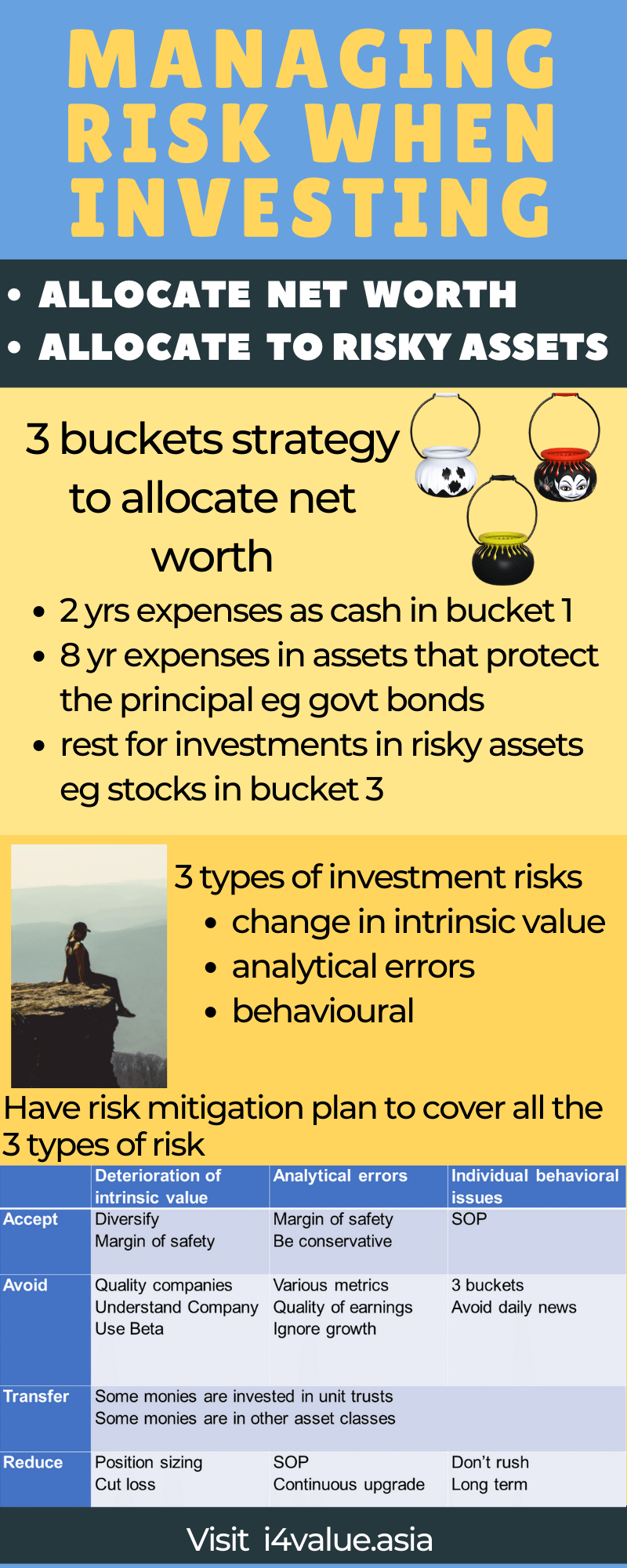

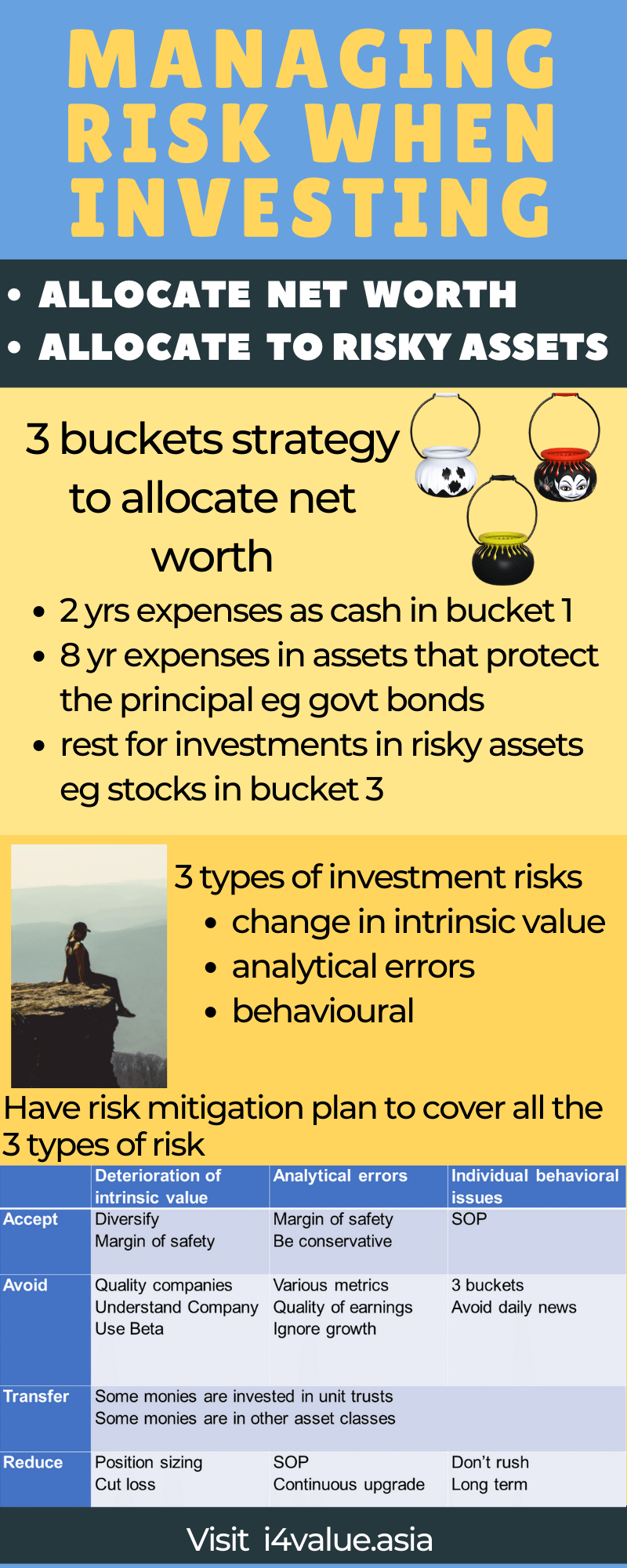

4. Risk mitigation when investing in Bursa

I defined risk as a permanent loss of capital. To protect yourself from such a situation, I recommend a 2-tiered approach

- First, allocate your net worth using the 3 buckets strategy

- Then have a comprehensive risk mitigation plan for investing in risky assets

The 3 Buckets strategy is about dividing your net worth into 3 parts

- Have 2 years of annual expenditure as cash - Bucket 1

- Have another 8 years of annual expenditure invested in assets that protect the capital eg government bonds - Bucket 2

- The balance of your net worth is allocated to risky assets eg stocks - Bucket 3

The 3 Buckets strategy will ensure that you are not forced to sell your risky assets at the wrong time just to meet some emergencies.

Then when it comes to preventing permanent loss of capital, you need a set of measures to cover the 3 main investment risks

- A reduction in the intrinsic values due to changes in the business fundamentals. Such changes can be due to socio-economic issues, political reasons, or plain bad luck

- Errors made during the analysis and valuation

- Those due to behavioral biases

The infographic below summarizes this risk management approach.

When it comes to risk mitigation, once you have identified the risks you have to put in place a number of measures to address them as follows

- Adopt a conservative approach

- Understand the company well

- Invest more in those where you have higher conviction

- Incorporate Beta into your valuation

The infographic summarizes the 10 key measures that you should adopt when investing in the various KLCI stock tips.

Affin Bank is a commercial bank and the financial holding company of several financial services companies.

While Affin has not been performing well relative to its peers, it is not a loss-making bank. While it has low returns, it has been profitable every year.

Affin has a margin of safety of over 30% based on its tangible book value. However, there in not enough margin of safety based on its Earnings Value. The reality is that the market places more emphasis on the Earnings Value rather than the Asset Value. So, if you are investing hoping for a re-rating, there must be some expectation of better performance.

The Sarawak State government is seeking a substantial stake in the bank (late 2023). As such there may be a potential change in the management. At the same time, there are considerable infrastructure projects in Sarawak. Affin could be a beneficiary of this project if the Sarawak state government is a major shareholder.

I see this as a potential catalyst for improving the business performance of Affin.

6. Ambank

The Group is a leading financial services group with over 40 years of operating history. As of 2023, the Group has over three million customers and employs over 8,000 employees.

Ambank's performance is below the sector average. While its NIM and Efficiency ratio are not as good as the sector, there are some positive signs.

- Interest income and revenue were growing.

- Returns seemed to be turning around.

- Loan performance seemed to be improving.

- Capital adequacy is holding although there is room for improvements.

While AmBank has not been performing well relative to its peers, it is not a loss-making bank. While it has low returns, it has been profitable every year except for the extraordinary losses in 2019.

But there is not enough margin of safety based on the Earnings Value. There is a 28 % margin of safety based on the Asset Value. Given the valuation and fundamental picture, AmBank is not a value trap.

While it may not be a value trap, you may be overpaying for the bank based on its Earnings Value. I do not see any catalyst at this stage.

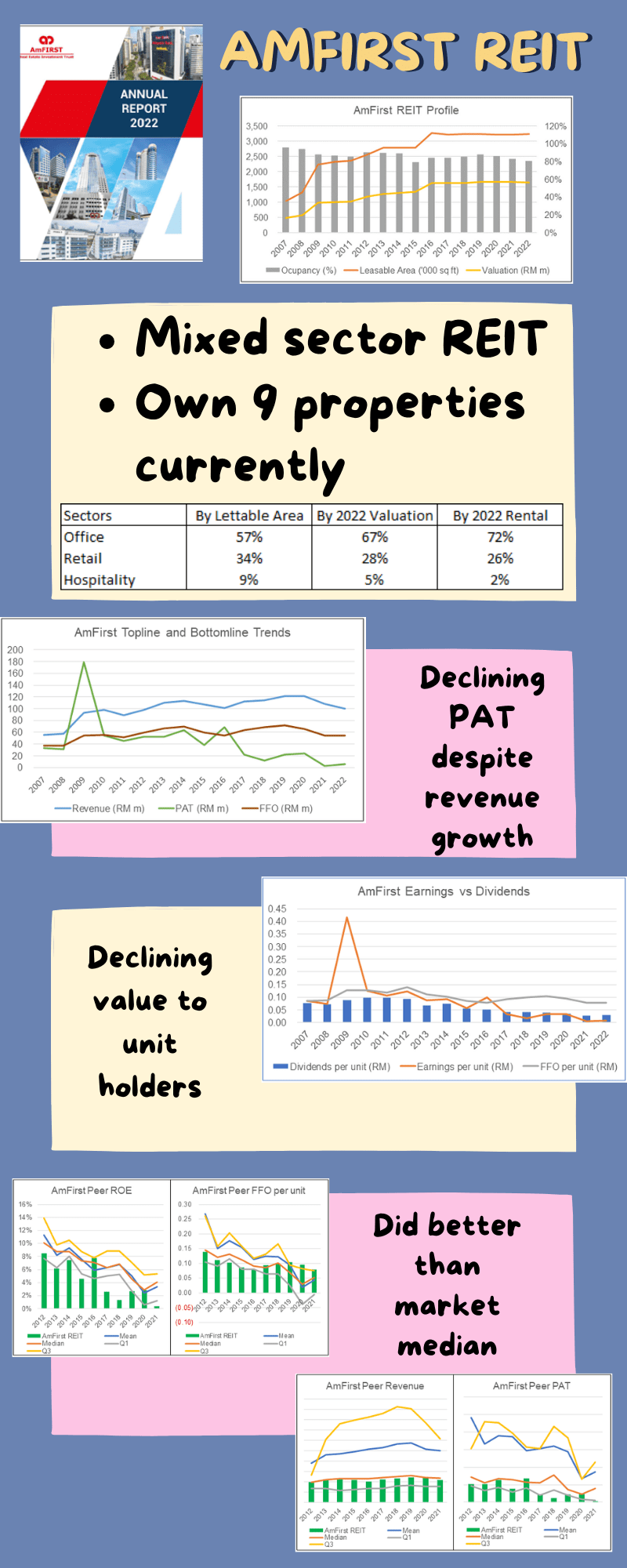

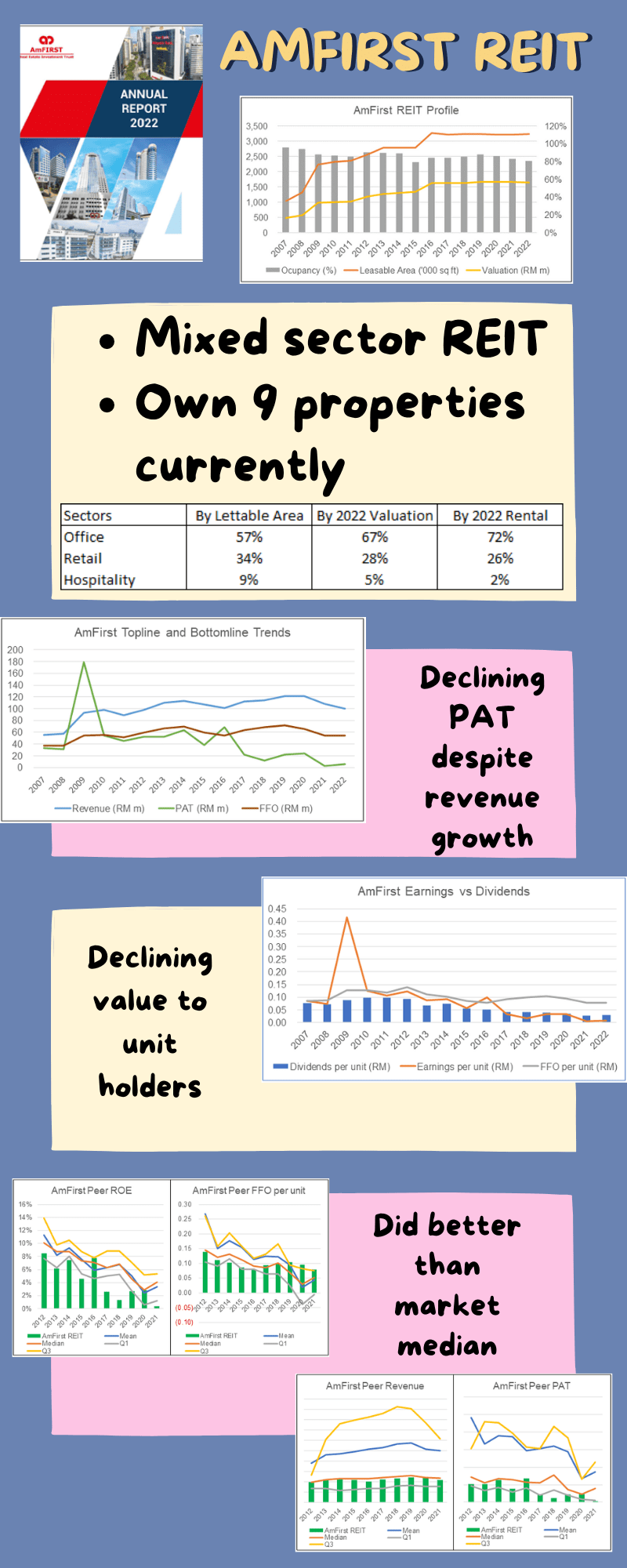

7. AmFirst REIT

AmFirst is a mix-sector REIT that has seen declining occupancy despite a growth in the leasable area.

AmFirst failed in its mission to deliver sustainable long-term income distribution and investment performance:

- The annual dividend had declined from an average of RM 0.09 per unit (2008 to 2010) to an average of RM 0.03 per unit (2020 to 2022).

- The Book Value had grown by a 1.0 % CAGR from 2007 to 2022.

- The average FFO per unit had declined from an average of RM 0.11 per unit (2008 to 2010) to an average of RM 0.08 per unit (2020 to 2022).

From a unitholder’s perspective, from 2011 to 2022, I achieved a gain of 0.9 % CAGR. Not exactly great compared to the returns from keeping the money with the EPF. I would conclude that my investment in AmFirst was a mistake. It may previously have been a good Bursa stock. But I am not sure this is still the case.

But based on my hold-exit decision-making framework, I should not exit. The potential gain from a recovery of the property market far outweighs the potential gain from selling now and investing in other undervalued stocks.

8. Asia File

To beat the market, you have to be able to differentiate yourself from the crowd. Compare this with the analysis and valuation of Asia File in the infographics that show that this is not a value trap.

- The intrinsic value is intact implying that it is undervalued rather than a value trap.

- Asia File is financially strong giving it time to seek a diversification path

- The market price does not reflect its Asset value let alone the Earnings value. There is thus downside protection

Since value traps and bargains are opposite sides of the value investing coin, it must mean that Asia File is a safe Bursa stock.

9. Boustead Plantation (BPlant)

BPlant is principally involved in the ownership and management of oil palm plantations.

The Group's total landbank stands approximately at 98,200 Ha with 79,400 Ha under oil palm cultivation. Among the listed plantation companies under Bursa Malaysia, the Group ranked No 6 in terms of the total acreage of oil palm planted areas.

BPlant performance is poor. Over the past few years, its returns were boosted by the sale of land. The Group returns are below the cost of funds. Looking at the performance of the top 5 plantation companies, one possible reason for the poor results is the low FFB yield.

The Asset Value represents the minimum intrinsic value. The current price is significantly below this intrinsic value thus providing a sufficient margin of safety.

The news on the possible sale of BPlant could be a catalyst for a re-rating. The other catalyst is the turnaround of the business. The only worrying item for any turnaround is the change in the CEO.

Looking at the margin of safety, I concluded that BPlant is one of the better Bursa Malaysia stocks to invest in. I consider it a good Bursa stock.

Refer to the analysis and valuation of

8 Aug 2021 for the details.

Since 1979, CB Industrial Products (CBIP or the Group) has been equipping palm oil mills in Malaysia and around the world with high-quality processing equipment and replacement parts. The products enjoy a healthy market share in Malaysia as well as foreign markets. The Group today comprises of 4 main business segments.

CBIP is a Group in transition. The bulk of the returns is currently generated from one segment – Equipment & Engineering – resulting in an average 10.9 % ROE. This segment appears to be a mature business. But there is a possibility of segment growth if the Group can commercialize the zero-discharge technology.

There are also potential growths from the Plantation and Refinery segments. But these will need reinvestments. The SPV segment is project-based and should not be depended on for improvements in the ROE.

CBIP is financially strong. Historically it funded the reinvestments required for growth without affecting its dividends. At the same time, there is a sufficient margin of safety based on the various valuation metrics.

Given the above, CBIP is an investment opportunity from both business fundamentals and valuation perspectives. It is a good Bursa stock.

11. Crescendo

I bought Crescendo about 9 years ago having valued its EPV then at RM 4.00 per share. The Book Value then was RM 3.25 per share.

The Book Value had not changed very much since then with the 2022 value at RM 3.29 per share.

Over the past 12 years, the Group has generated a positive total gain for the shareholders. This was due to the dividends. The Group has a good dividend track record paying out about 40% of its earnings. I expect this dividend payments to grow in line with the Group’s performance.

Given that my purchased cost is below both the Asset Value and Earnings Power Value, I would continue to hold onto the stocks.

12. Crest Builder

The currently listed form of Crest Builder came about in 2003 by taking over the listing status of MGR Corporation Berhad. The Group today reports its performance under 4 business segments.

Crest Builder’s performance over the past few years was impacted by the soft construction and property development market. COVID-19 aggravated the situation. To return to profitability, the Group has to turn around the Construction and Property Development segments. This meant rebuilding the Construction margins and launching new property projects.

Before COVID-19 the Group had a track record in replenishing its construction order books as well as achieving good construction margins. At the same time, the Group has RM 2.1 billion GDV in the property development pipeline. These together with its strong financials, will enable the Group to turn around.

Assuming another 4 years of losses before it returns to profitability, there is more than a 30 % margin of safety at the current market price. Crest Builder is not a value trap.

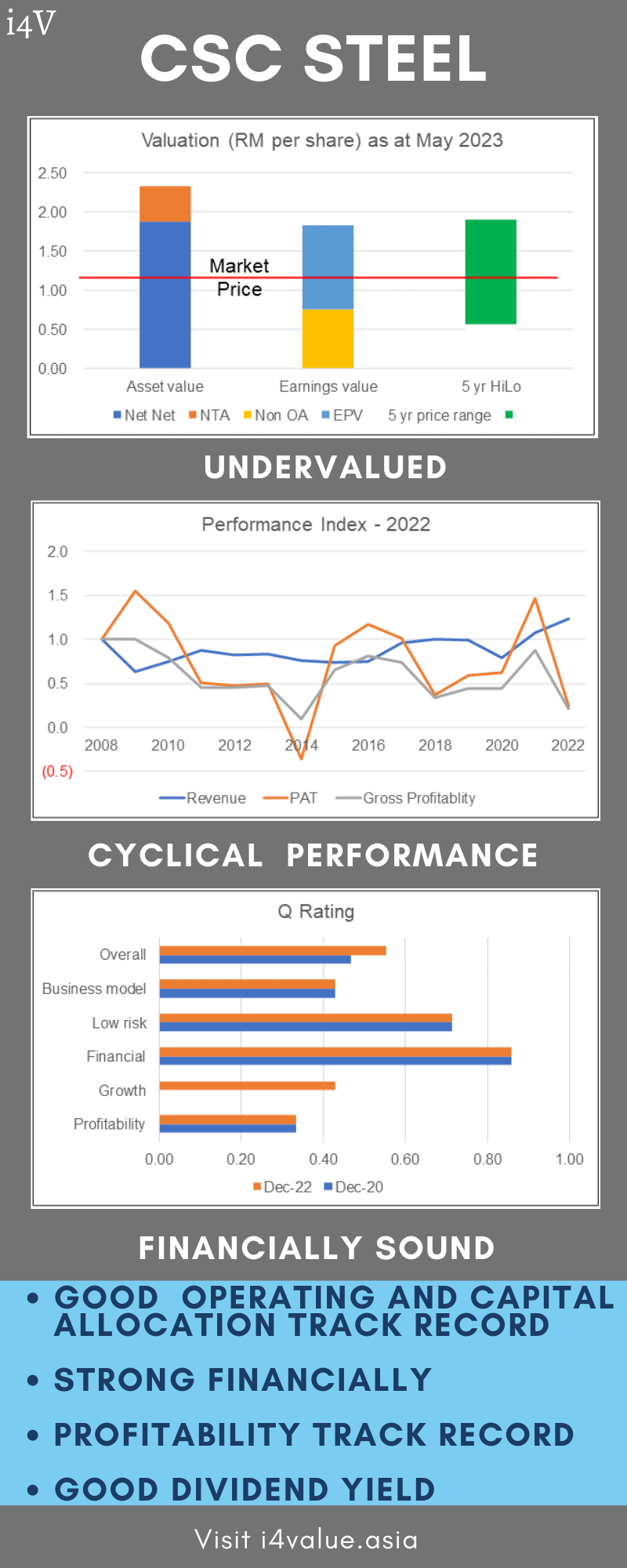

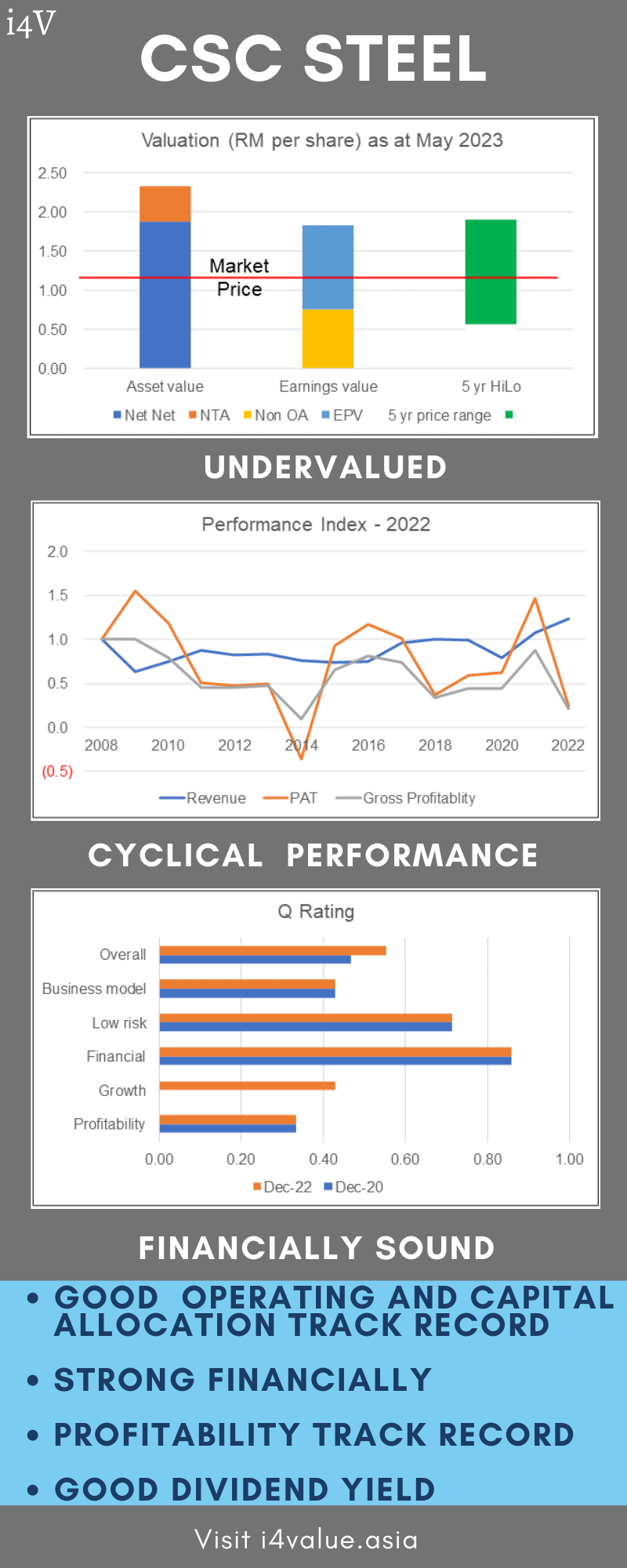

13. CSC Steel

This is an updated fundamental analysis of CSC Steel, the largest cold roll mill in Malaysia.

My investment thesis is that CSC Steel is trading below its Graham Net-Net. The Net-Net is often considered a shorthand for the liquidation value. There is no reason for CSC Steel to be liquidated. Furthermore, there is no reason for any impairment of its assets.

The Asset value is a good indicator of the intrinsic value. Even if you consider the EPV, there is a 61 % margin of safety. CSC Steel is a company with strong fundamentals. As such CSC Steel is not a value trap but an investment opportunity.

Rationale

- CSC is financially sound with zero Debt and cash of RM 0.75 per share.

- It has managed to be profitable in 2020 despite the Covid-19 pandemic restrictions.

- Its 2021 performance has been boosted by the current uptrend in the price cycle.

- There has not been any major change in the way to Group is managed. Management still has good operations and capital allocation track record.

- But it did not create any shareholders’ value over the past 15 years. Part of the reason for this is that it has substantial cash that generated low returns.

- There is less risk today to invest in CSC Steel compared to 2020.

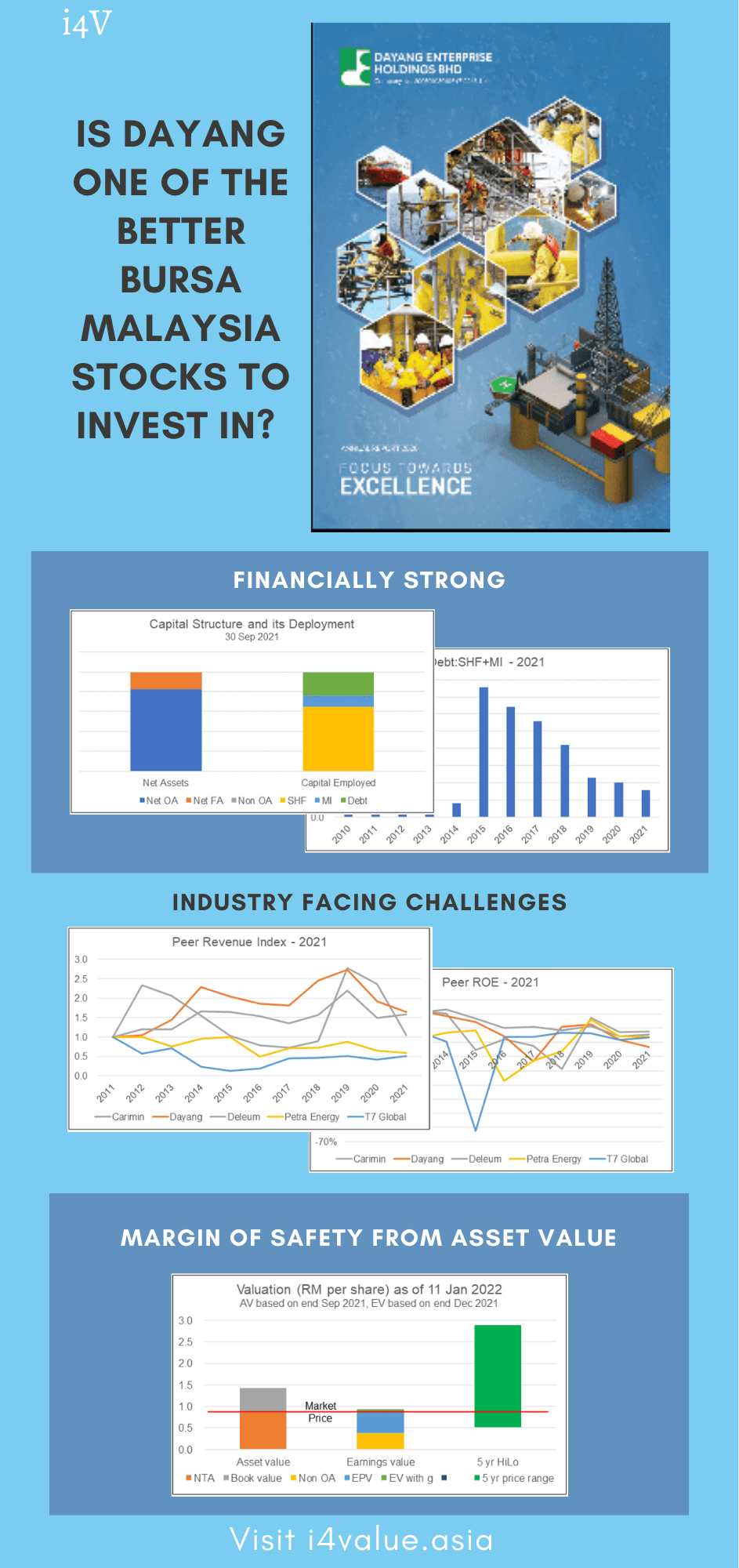

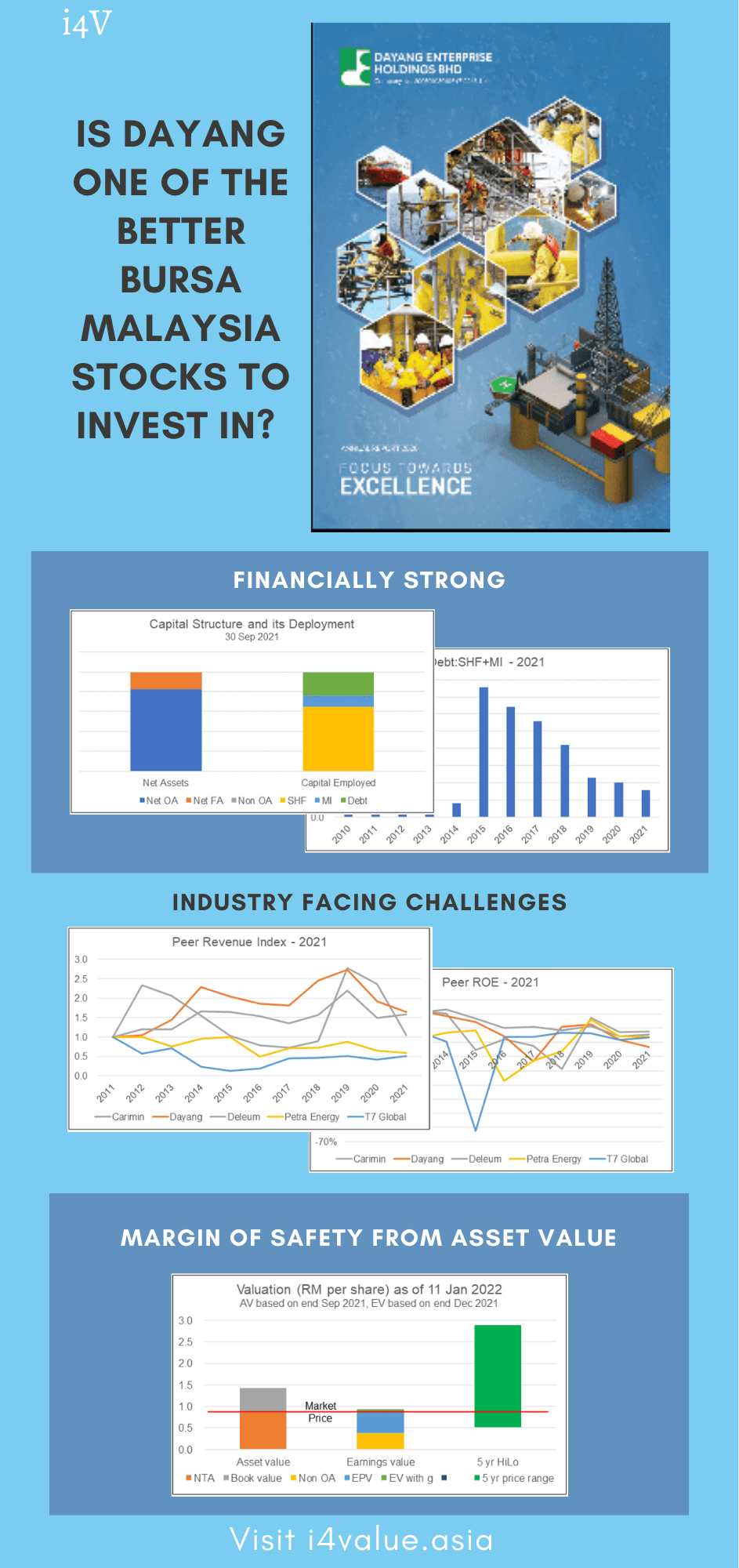

14. Dayang

Dayang is an oil & gas services group with 2 business segments:

- Offshore supply vessel operating through its listed subsidiary Perdana Petroleum Berhad (PPB) as well as its own vessels.

Analysis and valuation of Dayang as summarized in the infographics show that this is not a value trap. It is a good Bursa stock.

- It is financially strong.

- Except for 2017, it has a strong track record of being profitable since its listing in 2008. The 2017 performance was a one-off blip resulting from its acquisition of PPB.

- PPB has since been restructured, right-sized and the integration with DEHB has improved its vessel utilization.

- The Asset value has some margin of safety at the current market price. Buying DEHB at the bottom part of the cycle also provides some margin of safety.

- A valuation assuming the future performance as similar to that for 2019, will provide a 30% margin of safety at the current price.

The Group provides a diverse range of supporting specialised products and services to the oil and gas industry in Malaysia. And as such its prospects are tied to the performance of the sector.

The Group did well when crude oil prices were high. But when oil prices were in the trough part of the cycle during 2015 to 2019, the company performance deteriorated. Its performance improved over the past 2 years due to the better crude oil prices.

Over the cycle, the Group delivered average returns that were greater than its cost of funds. The Group is also financially sound.

A valuation based on the performance over the cycle, showed that there is more than 30% margin of safety. Given the improving crude oil prices and Deleum strong fundamentals, this is an investment opportunity.

You may be concerned that this is a value trap. A value trap is a company that looks cheap but is cheap for a fundamental reason. The trap springs after you bought it.

This is not the case with Deleum. It has strong fundamentals. The comparatively low market price is due to market sentiments rather than business performance.

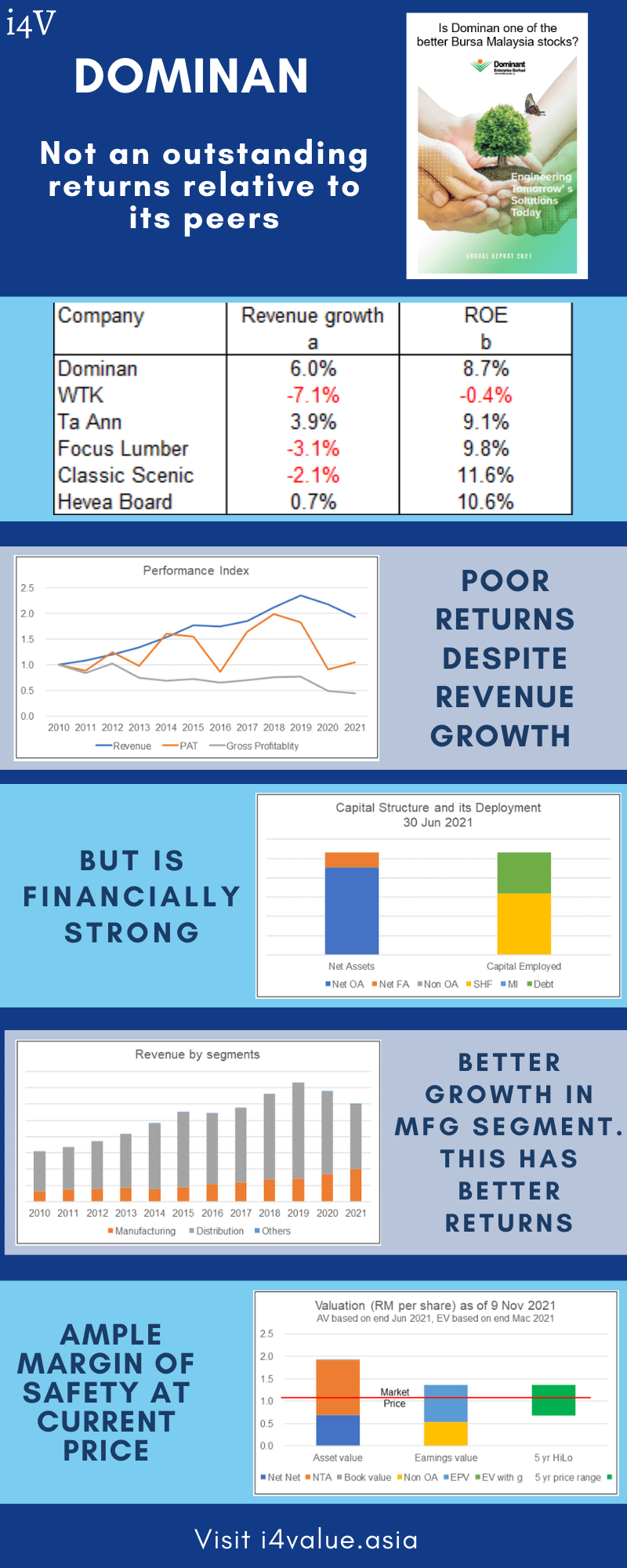

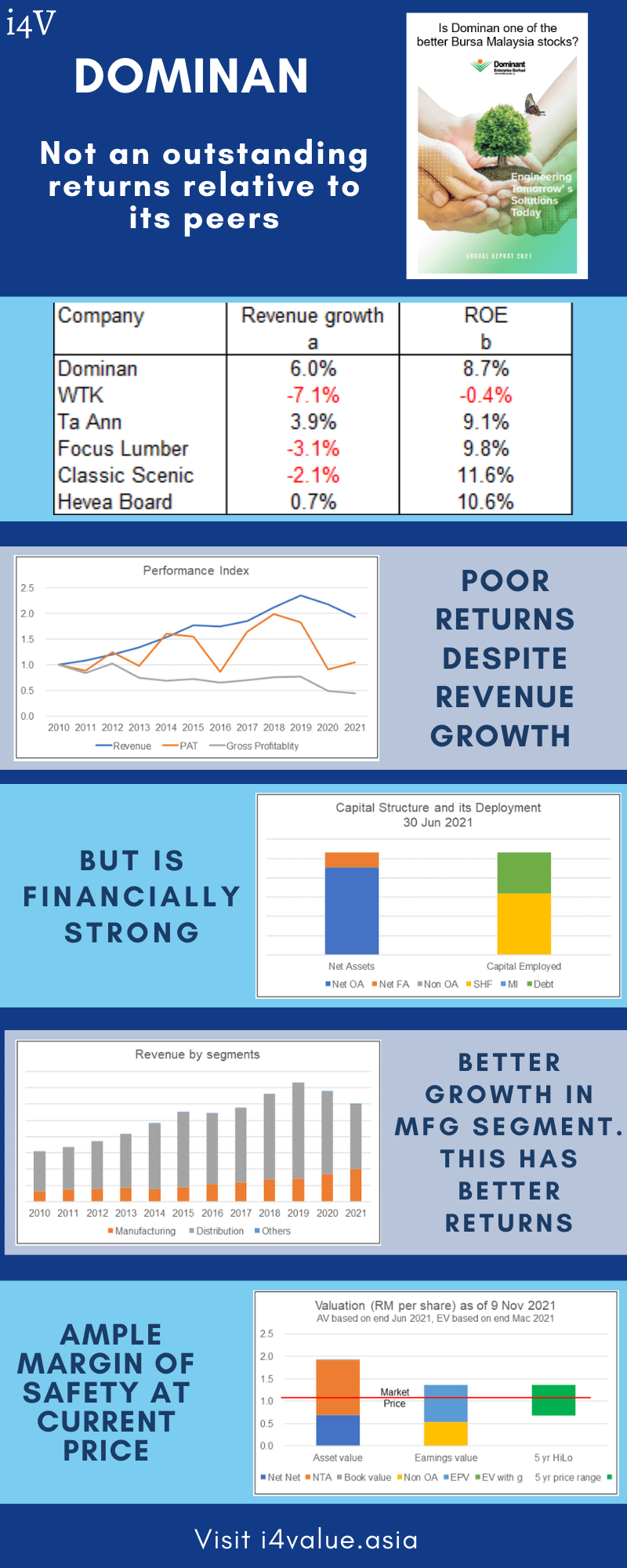

16. Dominan

Dominan manufactures and sells engineered wood mouldings and laminated wood panel products worldwide.

I would not consider Dominan a good Bursa stocks in terms of fundamentals.

The Group returns are low relative to the cost of funds and has been declining over the past 12 years. The main cause for this is the declining gross profit margins. The poor returns meant that Dominan had not been able to create shareholders’ value over the past 12 years.

The positive points are that Dominan has a strong capital structure and a track record of revenue growth. At the same time, it had been able to increase the contribution from the Manufacturing segment. This segment had the better returns.

The furniture sector is not a sunset industry. The challenge then is about improving its operations. I see this as the main business risk as there is no track record in this area.

However, from an investment perspective, there is sufficient margin based on the EPV and Acquirer’s Multiple. As such it is one of the better Bursa stocks to invest in. It is a cigar-butt type of investment with the potential to turn into a quality stock if it can improve its gross profit margins.

17. Eksons

The Eksons infographic below summarizes the business analysis and valuation of Eksons in mid-2020.

It shows that Eksons is not a value trap because

- This is a classic Graham Net Net long-term investment – you have downside protection and you bet on the upside.

- The Group is financially strong and not burning cash giving it time to put its recovery plan into action.

- Despite its challenges, Eksons' intrinsic value is higher than its current price. Its cash, securities, and other assets are not going to be wasted away.

Value traps and bargains are opposite sides of the value investing coin. Since it is not a value trap, Eksons must be a bargain.

Note that there is an updated analysis dated

2 May 2021 that shows that it is a cash value trap.

18. Glomac

The earnings of property developers have been declining over the past few years. This was due to several measures by the government to reduce property speculation. Covid-19 aggravated the situation. The performance of Glomac was similarly affected.

But Glomac has a profitable track record and is financially sound. I expect the business performance of Glomac in the coming years to improve. Together with the expected improvement in the market sentiments, the market price of Glomac would be much higher than what it is today.

The market price of Glomac is currently below its intrinsic value. This is from the perspective of the Asset Value, Earnings Power Value, and Acquirer's Multiple.

For a company to be a value trap, its low price must be due to poor fundamentals. In the case of Glomac, the analysis does not indicate poor fundamentals. The intrinsic values are significantly higher than the market price. I would not consider Glomac a value trap.

Even based on my average purchased price of RM 0.65 per share, Glomac would not be considered a value trap. It is a good Bursa stock.

19. Heitech Padu

HTPadu is an ICT systems and technology services provider.

In the early 2000s, the Group was performing OK. The revenue seemed to peak in 2009. After hovering around this level for a couple of years, it began to decline in 2015. Its profit performance was worse with declining profits since 2001. There were even losses in 5 out of the past 10 years.

While financially strong, the fundamental analysis suggests that HTPadu is not likely to return to its 2001 performance any time soon. It was previously a good Bursa stock but cannot be consider so today.

- The Group had not been able to grow its legacy products and services. At the same time, it had not been able to grow its new products and services (introduced in 2014) to be sizeable.

- The gross margins of the Group had been declining. I would interpret this as the market becoming more competitive for its legacy products and services.

- The Group had recognized the need to diversify into a new customer base (ie no public sector) and new products and services. But, it had not been able to achieve any success.

The Book Value of RM 1.07 best reflects the intrinsic value of HTPadu. The only problem with this is that the Book Value had been declining from RM 1.95 per share in 2007 to the current price today.

Hektar is a shopping centre REIT with currently 5 properties with about 2 million sq ft of lettable area.

While Revenue and FFO in 2022 were higher than those in 2007, PAT was lower. We can trace the financial performance to the declining tenancy performance.

The number of units in Hektar increased from 320 million units in 2007 to 469 million units in 2022 while the financial performance deteriorated. This meant that on a per unit basis, unitholders were worse off in 2022 compared to 2007. Earnings per unit and FFO per unit declined. This then led to a declining Dividend per unit.

The Hektar analysis was to see whether I swap my office sector REIT with the shopping centre REIT. I believe both the KL office and the retail sectors would have the same rate of recovery.

The other concern with swapping is that Hektar will issue new capital to fund growth. This issuance would most likely value dilutive to the existing unitholders.

21. IGBB

This is a property group. A large part of IGBB’s revenue comes from a recurring income base. Over the past 11 years, the project-based activities from property development and construction only accounted on average for about 14 % of the Group EBIT.

Furthermore, a big portion of the Group business is dependent on the Malaysia retail sector. This is projected to grow at 5.94 % over the next 5 years thereby providing the Group with a steady but single-digit growth path.

The Group is also financially sound with a low Reinvestment rate and a good capital allocation track record.

Are there concerns?

First, the historical Operating returns and ROE were lower than the WACC and cost of equity respectively. There was no shareholder value creation from a business perspective.

Next, this is not a high-growth company. But I have already accounted for this by using the EPV in my valuation of the property development, construction, and hospitality component.

The attractive part is that there is currently more than a 30% margin of safety based on both the Asset Value and sum-of-parts value. I see IGBB as an investment opportunity.

22. Kumpulan Fima

Kumpulan Fima (KFIMA) is a diversified group with 4 core business divisions - Manufacturing, Plantation, Bulking, and Food. They have also expanded beyond Malaysia to Indonesia and Papua New Guinea.

The analysis has shown that it is a good Bursa stock.

- The Group is financially sound with 1/3 of the Total Capital Employed (TCE) held as cash. The borrowings are less than RM 100 million.

- The Group has been profitable every year over the past 12 periods covered.

- In terms of TCE, the Group is focused on the plantation sector. This is also the most promising growth division of the Group.

- There is still growth potential. While this may not be double-digit, it looks to be better than what the Group had achieved from 2009 to 2020.

- Management had a reasonable capital allocation track record. It has been able to maintain shareholders' value despite the loss of a major supply contract and the Indonesian land dispute.

There is a sufficient margin of safety at the current price. KFIMA does not look like a Group facing insurmountable problems. A value trap is a stock that while appearing cheap is actually a dud because it is facing some insurmountable problem.

I have an updated analysis on

Dec 2023.

23. Lee Swee Kiat

Lee Swee Kiat Group (LEESK) specializes in 100% natural latex and spring mattresses. The Group claimed that it is one of the most extensive mattress manufacturers in South East Asia.

The analysis showed that LEESK is fundamentally sound.

- The Group is financially strong with low Debt Equity ratio and a history of generating Cash Flow from Operations.

- The Group had a good track record in improving the top line and bottom line.

- Management had performed well relative to the industry. They have been able to create shareholders’ value.

But a good company as represented by its strong fundamentals does not necessary mean that it is a good investment. A good investment is one that enable you to make money. From a value investment perspective, this is buying at a price that is less than the intrinsic value. I look for at least a 25 % margin of safety.

In the context of LEESK, there is no margin of safety based on a Conservative Scenario. There is only a margin of safety if you accept the Optimistic Scenario. I don’t rate this as a good Bursa stock to invest in.

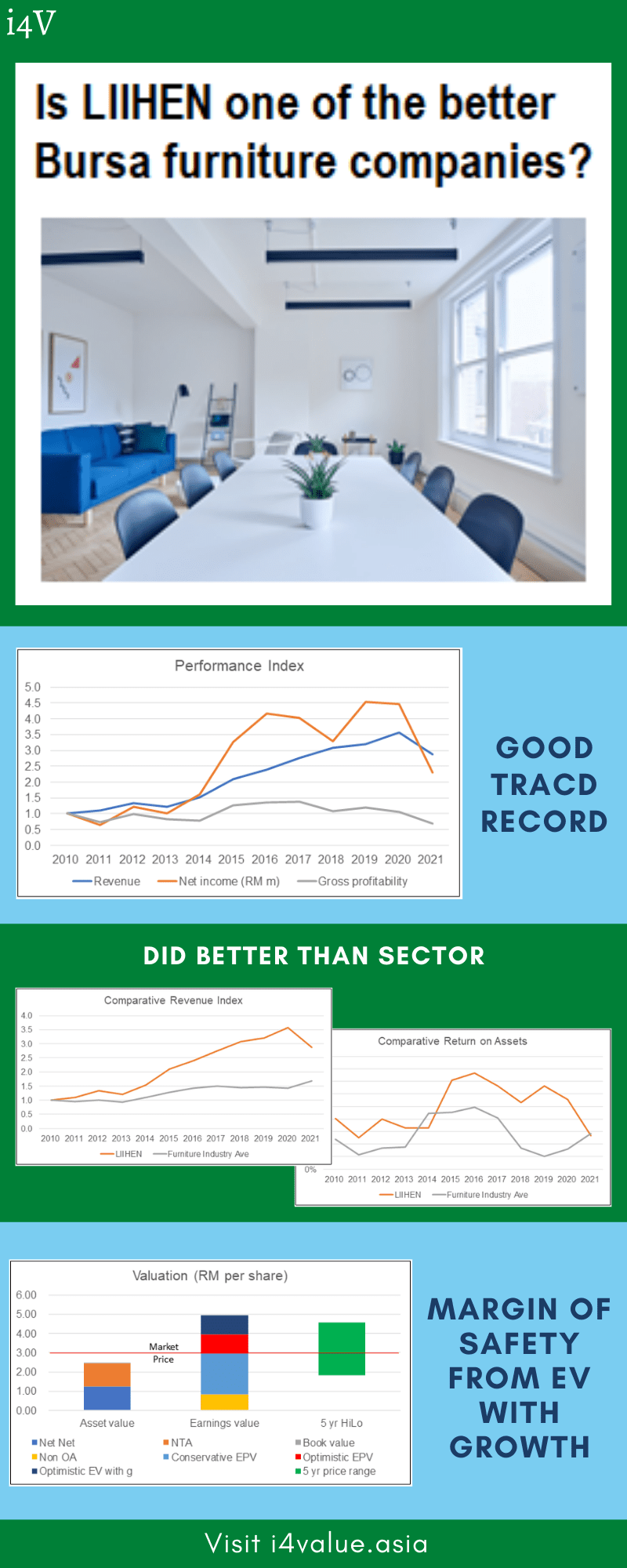

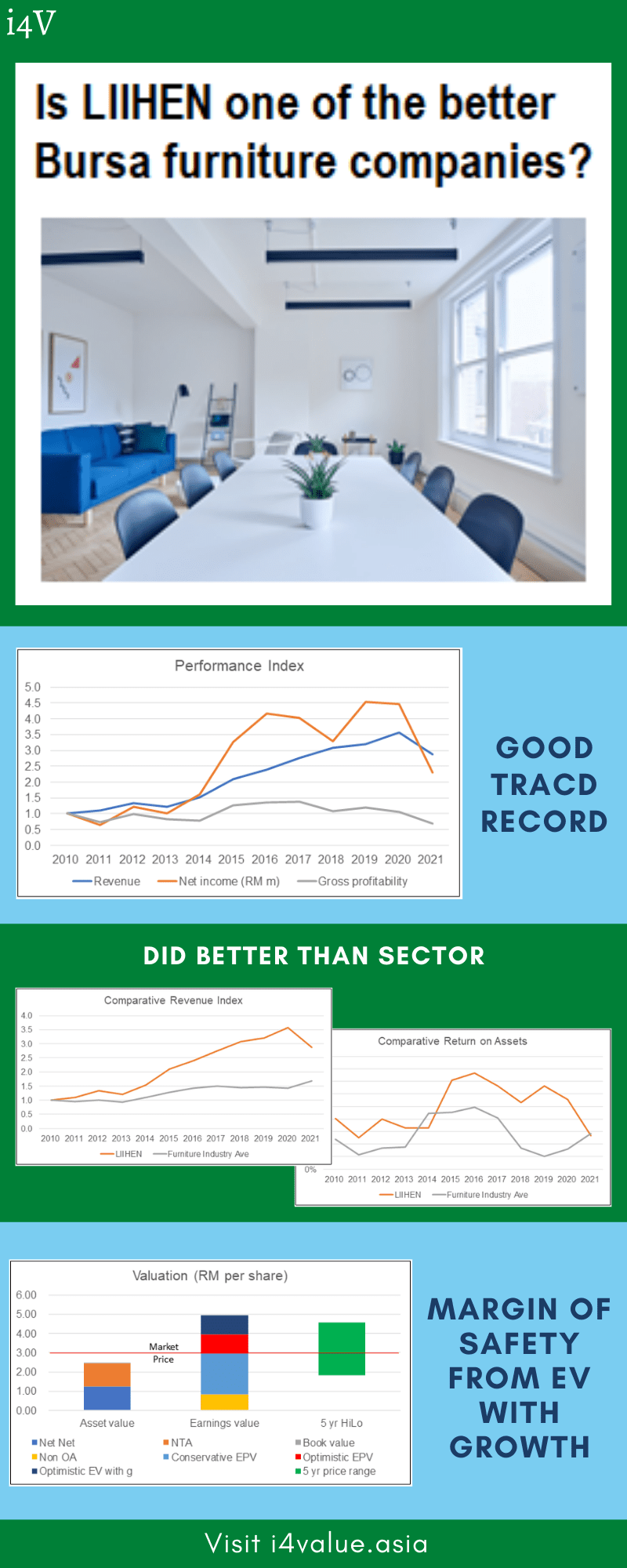

23. LIIHEN

LIIHEN or the Group is involved in the manufacture and sales of furniture products as well as rubber tree plantations. The main focus is furniture as the plantation segment is relatively small accounting for less than 1 % of the Total Assets in 2020.

LIIHEN is fundamentally a strong company and is a good Bursa stock.

- It is financially strong.

- It had a strong growth track record, in terms of top-line, bottom-line as well as gross profitability.

- Management had a good track record as an operator and capital allocator.

- It had been able to create shareholders’ value.

A valuation of LIIHEN showed sufficient margins of safety.

- It is 32 % under the Optimistic EPV.

- It is a 65 % margin of safety under the Optimistic Earnings Value with growth.

As such I would conclude that LIIHEN is one of the better Bursa Malaysia furniture stocks.

But there are some risks. The first is whether the Group would be able to maintain its exports to the US. The second is whether the Ringgit would strengthen relative to the US Dollar.

In Jan 2022, the Group had announced a 2 for 1 bonus issue that will probably be completed in the second quarter of 2022. I see this as a catalyst for a higher market price.

The Group traced its roots to the 1902 smelting plant. You would be forgiven for thinking that this is a smelting company.

In 2023, about 58% of the net assets were deployed for the smelting operations.

Although all the tin produced by RHT was “sold” to the smelting operations, this accounted for only 10% of the tin used by the smelting operations.

While MSC has been able to grow its profits over the past 12 years, this does not seem to be due to topline growth or improved operating efficiencies.

While the Group is in the process of relocating its smelting operations to a more efficient plant, there is yet not enough evidence that this can deliver significant operating improvements.

My valuation under both bases did not provide a sufficient margin of safety. As such I do not see this as an investment opportunity.

26. MBSB

Malaysia Building Society Berhad (MBSB or the Group) has evolved from being the first property financier to a financial provider that offers a spectrum of innovative products and services throughout its branch network nationwide.

Over the past decade, MBSB has transformed itself from a property financier into an Islamic bank. While it had become a much bigger group in terms of equity and total assets, there has not been much revenue growth. The PAT in 2023 was lower than that in 2013.

The lower profits with higher equity and assets resulted in a declining ROE and ROA. The declining returns are supported by declining NIM margins and higher expense ratios. Compared to the Bursa banks, MBSA did worse.

There is a margin of safety based on the Asset Value. But there is no margin of safety based on its Earning Value. Together with the lack-lustre fundamentals, there are better bank stocks if you are a fresh investor. However, given an existing shareholder like me with a relatively low investment cost, it makes sense to hold.

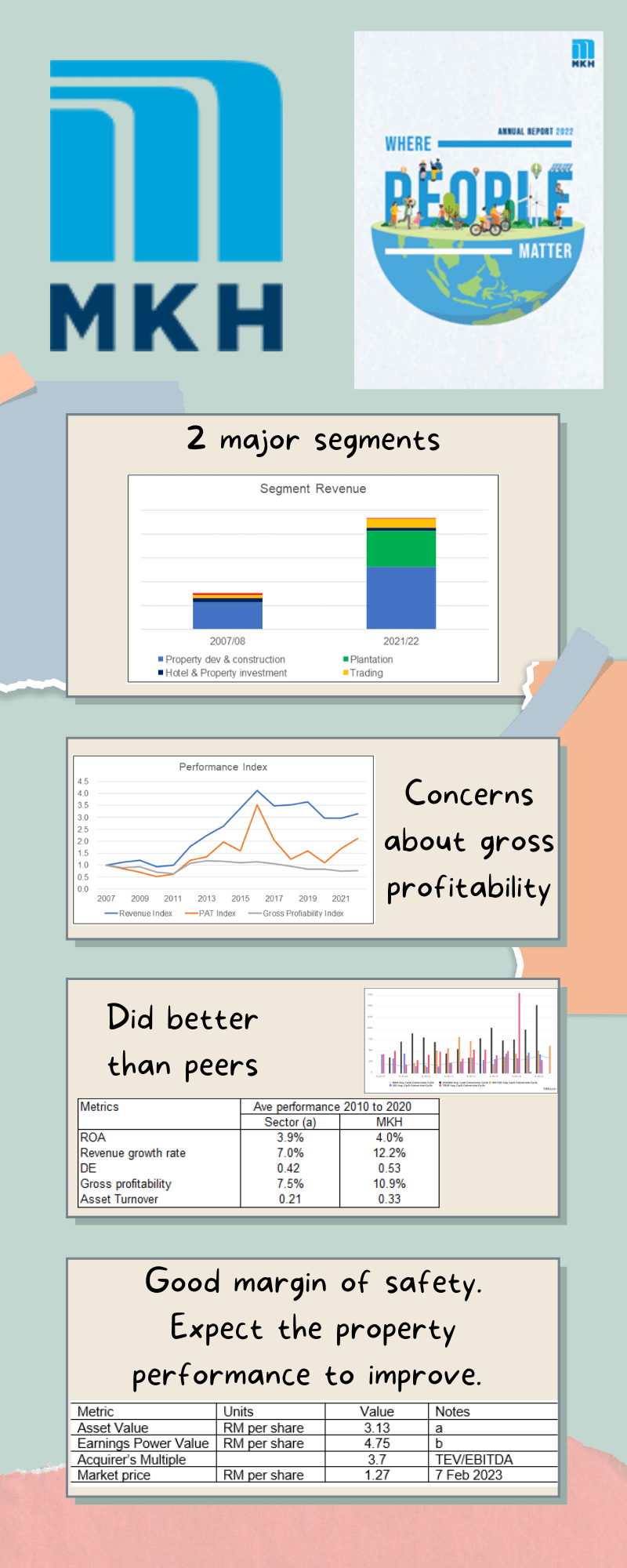

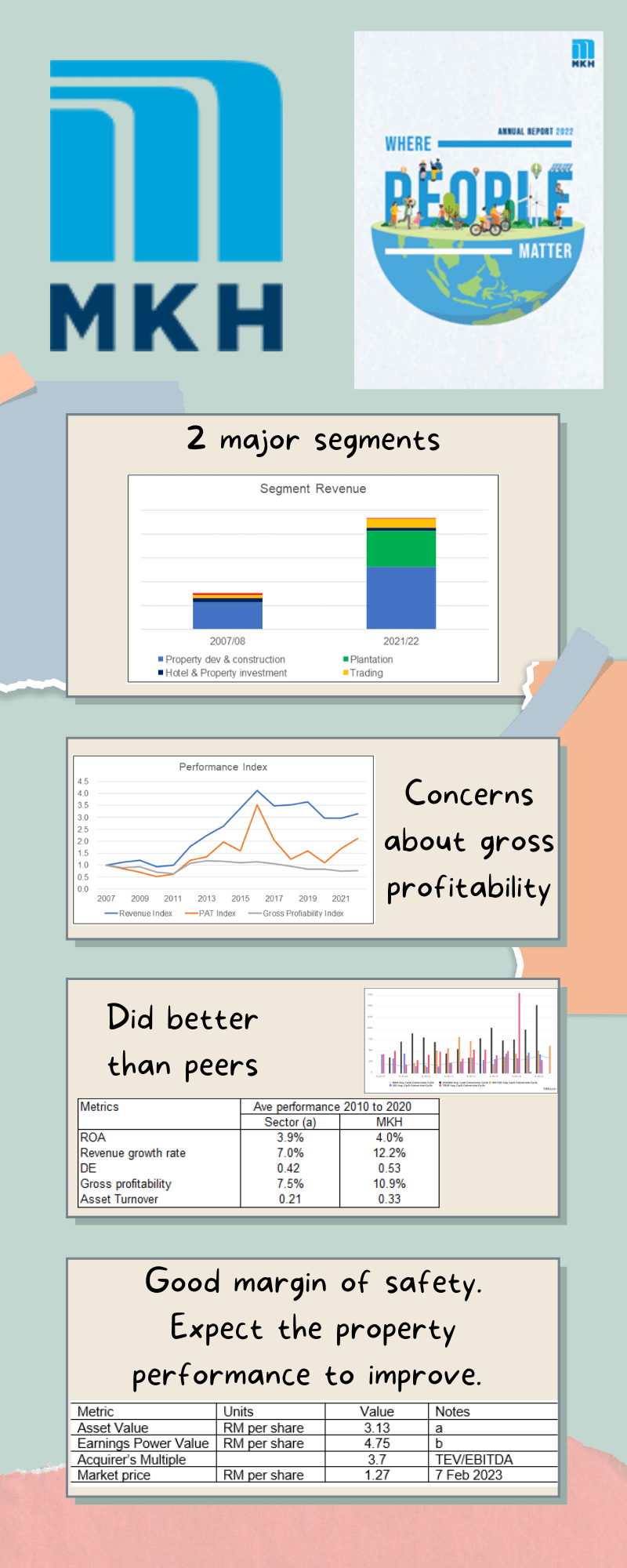

27. MKH

MKH has two major profit contributors – Property Development and Plantation.

The Plantation segment is cyclical and has reached “maturity”. While cyclical, the Property Development segment cycle is different from that of the Plantation segment.

The Malaysian property market has been soft since the mid-2010s. This was the result of several measures by the government to reduce property speculation. Covid-19 aggravated the situation. But with the post-Covid-19 opening of the economy, the bottom of the cycle has been reached.

I expect the property performance of MKH in the coming years to improve. Together with the expected improvement in the market sentiments, the market price of MKH would be much higher than what it is today.

There are two general questions value investors ask before investing in a company:

- Is it a good company? In other words, is it fundamentally strong?

- Is it a good investment? I assess this by looking at whether there is a sufficient margin of safety (> 30 %) at the current price.

My analysis and valuation of MKH are intended to answer these questions. I believe that the answers to both of them are positive.

28. MNRB

The Group today comprises a leading wholesale provider of reinsurance and takaful as well as two takaful operators. Its reinsurance subsidiary stands tall among the top reinsurers in the region, writing lines of general businesses locally and abroad. In Malaysia, its takaful operators are amongst the pioneers in the provision of financial protection services based on the takaful system

While MNRB had been able to grow its revenue at 5.2 % over the past decade, PAT only grew at about half the rate. When I compared MNRB's performance with those of the other Bursa insurance companies, I found that it is at best just below the sector average.

MNRB's problems are more about poor operating fundamentals – profitability, underwriting performance, and investing its float. There is no indication of improving trends. Most of the historical trends point in a deteriorating direction.

While the Asset Value provides more than a 30% margin of safety, there is no margin of safety based on its Earnings Value. As such I think that there a better Bursa insurance companies to look at. Is it a value trap then? Yes.

29. NAIM

NAIM is not just a property and construction group. Because of its 25 % shareholdings in Dayang, it is also an Oil and Gas services provider.

Leaving aside the Covid-19 years, the performance of the Group had been affected by the soft property and construction market. At the same time, it had suffered losses due to the impairments suffered by Dayang.

It may take a few more years to see significant uptrend in the property and construction sectors. But the Oil and Gas sector is currently experiencing buoyant prices. This would translate into more investments in the Oil and Gas sector thereby boosting the demand for the services provided by Dayang. If this turns out, it would be a catalyst for the market to re-rate NAIM as what happened in 2019.

Will this happen? NAIM is financially sound and able to withstand a long soft market condition. It has a track record of good returns during more positive market conditions. I am confident that it will be able to turn around. For these reasons, NAIM is a good Bursa stock to invest in.

Notion is a global supplier of high-quality and precision-machined components. While it had been able to achieve marginal growth over the past 12 years, it faced declining performance on many fronts:

Returns were declining with average returns less than the respective cost of funds.

There were declining operating and capital efficiencies as exemplified by the gross profitability and contribution margin.

I have also shown that over the past 12 years, a significant part of its profits came from insurance claims rather than from operations. %. Over the past 12 years, there were only 3 years with positive Operating returns.

However, the Group has a strong Balance Sheet and Cash Flow from Operations. Notion needs to turn around its business.

My current valuation showed that there is only a margin of safety based on the Asset Value. For any meaningful margin of safety based on the Earnings Value, we have to assume a sustainable turnaround immediately. I am not sure of this. As such I would not consider Notion an investment opportunity this time round.

31. Opensys

Opensys (the Group) is an IT solutions provider that is currently serving banks with its cash and cheque processing equipment. The Group also provides bill payment services to telco and utility companies.

Although its revenue in 2021 was 40% lower than that for 2019, it was due to the various Movement Control measures taken to control the pandemic. With the opening of the economy, I expect the revenue to recover.

The Group had achieved double-digit revenue growth over the past 12 years driven by its Cash Recycling ATMs. Given the digital disruption in the financial sector, its current products have limited lives. Nevertheless, I expect the Group to continue with its double-digit growth for the next 6 years. The Group has to continue to innovate and develop new products if it is to grow over the long term.

Its market price at RM 0.35 per share (as of 13 June 2022) has yet to reflect in its full business recovery value. I estimated its EPV at RM 0.40 per share and its Earnings value with growth at RM 0.47 per share.

We are lucky with Opensys in that the current market price does not reflect this growth path. Even a conservative estimate based on low growth rates and the past 3 years’ average revenue provided a sufficient margin of safety. It is a good Bursa stock to invest in.

32. OSK

OSK began operations in 1963 as a small stockbroking company which then grew into a regional investment bank. In 1997, OSK diversified into properties.

Over the past 8 years, OSK has transformed itself from a financial services company to a property group. While OSK's main operation is property development, a big part of the profits came from its investment in RHB (bank)

While the financial services segment employed the largest amount of the net assets, its revenue contribution was small. This was because a big part of the net assets was for its investment in RHB.

From an operations perspective, the Group is not strong fundamentally. I have concerns about its financial standing. As a property company, the Group did not perform as well as its peers. Its ROE was boosted by the investments in RHB.

OSK is trading below its Earnings Value and Asset Value. While part of the reason for this could be due to market sentiments, I think that its operation result has a role. Nevertheless, there is a large enough margin of safety so that OSK is not a value trap but an investment opportunity.

33. Parkson

Parkson Holding is a Group with 3 listed entities:

- Parkson Holdings under Bursa Malaysia.

- Parkson Retail Group Ltd (PRGL) under HKeX.

- Parkson Retail Asia Ltd (PRA) under SGX.

Based on my 2021 analysis, Parkson is not a value trap. But does this mean that it is a good Bursa stock?

The decline in same-store sales in China, the biggest revenue contributor, appeared to have been arrested. At the same time, Malaysia seems to have turned the corner. There appears to be a turnaround in the same-store sales. Malaysia is the next biggest revenue contributor to the Group.

These are not the sign of a company facing a secular decline.

The department store industry in China is not a sunset industry like what happened in the US. In Malaysia, the performance of Aeon suggests that this is also not a sunset sector.

While the Asset Value of the PHB Group has been reduced over the past few years by impairment charges, the fair value of the Investment Properties will enable the PHB Group to “rebuild” the Asset Value.

Even on a conservative earnings-based valuation, the market price of PHB is far below the EPV.

But this view is based on my analysis of its intrinsic value. Since there are several ways to estimate this intrinsic value, would the answer be still the same from other lenses?

34. Petron Malaysia

Petron Malaysia is part of the Philippines’ Petron Corp that has been transformed into a fuel retail marketing and distribution company with an in-house refinery.

Is this a value trap?

A stock is a value trap when

- It appears to be cheap looking mainly from the historical multiple perspectives

- But is actually cheap because of insurmountable underlying problems.

These underlying problems will eventually cause the intrinsic value to deteriorate.

If there are no such underlying problems, then the intrinsic value would be intact and the stock is actually a bargain. It is a good Bursa stock.

Analysis and valuation of Petron Malaysia in 2020 as summarized in the infographics show that this is not a value trap.

- The assets are intact and are not going to be impaired due to under-utilization

- Its business is expanding

- It has been able to generate returns that are more than its cost of capital

Pintaras Jaya (Pintaras or the Group) is a Bursa Malaysia construction company. The Group is fundamentally strong.

- It is financially strong.

- It has a good operating track record.

- It is one of the better performers in the industry.

The Group has also been able to create shareholders’ value.

Although it had achieved an overall return (EBIT/TCE) of 10 %, this was because the returns from cash and securities were very low. Given that these accounted for 41 % of the TCE, I would conclude that not all its cylinders were firing.

Over the past few years, the contribution from Malaysia was low. This was because of the soft property and construction market. The Malaysian property and construction market will eventually turn around. When this happens, I expect its Malaysian Construction segment to benefit.

Based on the weighted average performance, I had estimated that the EPV provides a 95% margin of safety.

Given all the above, I would conclude that Pintaras is a good Bursa stock to invest in.

36. Plenitude

Plenitude has two major potential profit contributors – property development and hospitality.

Property development has been contributing to the bottom line, even in the 2020/21 pandemic years. With the opening of the economy, I expect the contribution to be better. The property development segment was the major contributor to the Group’s performance.

Plenitude started as a property developer but in 2001 diversified into the hospitality business. Today the hospitality business is the largest segment in terms of the Total Capital Employed. But it was not profitable since 2013.

The hospitality segment’s poor performance was due to competitive pressures. The Group had refurbished and rebranded the hotels to address this. At the same time, it had also focused on efficiency to improve the margins. There are signs that gross profit margins are improving but the jury is still out on whether revenue will improve. The hospitality business is a turnaround case. Because of its size, the creation of shareholders’ value will depend on a successful turnaround.

37. POH KONG

Poh Kong Holdings Berhad (Poh Kong or the Group) is the largest gold-based jewellery retailer on Bursa Malaysia.

I bought Poh Kong in several tranches from the end of 2010 to 2013. During this period, the average ROE for the Group was 11%. However, from 2014 to 2021, the average ROE had declined to 4 %.

The Group performance appears to be in line with the gold price pattern. From 2001 to 2021, there is a 0.77 correlation between the revenue of Poh Kong and the price of gold. It was 0.70 correlation for the gold price and Poh Kong's PAT. I would consider an investment in Poh Kong a proxy for an investment in gold.

While Poh Kong’s average return over the past 8 years was lower than its cost of equity, the Group is financially strong and still profitable. Its intrinsic value (using the NTA as a proxy) has been growing. There is thus the prospect of the share price increase and reaching my target price of RM 1.33 per share. It is a good Bursa stock.

My analysis shows that I should continue to hold onto Poh Kong rather than sell it and invest the proceeds in gold. In other words, Poh Kong as a gold proxy is a better bet than investing in gold itself.

38. Protasco

Protasco is a construction company. The performance of Protasco has declined over the past 12 years. Although the Group had tried to diversify into other businesses, the road maintenance business is still the main revenue and profit contributor.

The Group is undergoing a turn around. This would depend on it improving its road maintenance margin as well as finding a profitable venture. I am not sure that it could rebuild the road maintenance margin. The other challenge is that it had a poor diversification track record.

While there is a margin of safety, the business fundamentals are not that good. While the construction sector is not a sunset one, I think that there are construction companies with similar margins of safety but better business fundamentals. As such I would not recommend Protasco for a fresh investor.

However, since I am already invested, it makes more sense to bet on a turn around than exit and incur a loss.

39. Sapura Energy

The present form of Sapura came from several major corporate exercises:

- 2012 merger of Sapura Crest Petroleum with Kencana Petroleum for RM 6.3 billion.

- 2013 acquisition of Seadrill Tender Rig Ltd for RM 7.7 billion.

- 2014 acquisition of Newfield Malaysia Holding Inc for RM 3.0 billion.

Sapura's current financial problem is due to not just using debt to fund its acquisitions. With hindsight, its timing was bad in carrying out the acquisitions.

The oil and gas sector experienced declining crude oil prices soon after Sapura completed it major acquisitions. The oil and gas companies began to cut investments and this reduced the number of tenders available.

When orders began to dry up, the Group suffered. There was not only a decline in the order book, but it looked as if the Group was bidding at non-viable prices.

The result is operating losses. This was made worse by the impairments. The performance deteriorated to such a stage that it had to seek creditors' protection. At the same time, it became a PN 17 counter requiring it to come up with a regularization plan.

The Group is undergoing a turnaround. And unless you are a turnaround expert and understand the debt and corporate restructuring process, this is a stock to avoid.

Suria Cap today provides port services and facilities in Sabah. Suria Cap has also widened its business into related areas like logistics, property development, and seaport passenger gateway.

Suria Cap’s port operations accounted for 91 % of the consolidated EBIT over the past 12 years. But this is not a high-growth sector.

The Group tried to extract value from its port land in Kota Kinabalu by developing it into a residential and commercial centre. Over the past 12 years, this contributed only about 7 % of the Group revenue.

The result is that the Group only achieved an average ROE of 5.8 % over the past 12 years. Among the 3 other port operators in the country, Suria Cap achieved the worst performance over the past few years.

Given the above, the Earnings Power Value of Suria Cap is much lower than the Asset Value. At the current market price as of 9 Feb 2024, there is no margin of safety based on the Earnings Power Value.

41. TDM

TDM today has 2 business segments – Plantation and Healthcare.

The Group's performance over the past 8 years was impacted by the poor performance of its Indonesian plantation.

TDM made a wrong bet on its Indonesia plantations. The Group ventured into Indonesia in 2007. The Group had earmarked Indonesia as the growth path for the Plantation segment. Unfortunately, the Indonesia venture did not turn out as planned. In 2019, the Group announced its plans to sell its Indonesian assets.

The Group is thus left with 2 operating segments – Malaysian Plantations and Healthcare. Without the Indonesian operations, the Plantation segment was a profitable one. The Healthcare segment had a good track record in terms of growth and profits. It delivered double-digit revenue growth over the past 12 years.

The Plantation and Healthcare segments are driven by different economic factors. As such I valued TDM based on a sum-of-parts approach. On such a basis, there is more than a 30% margin of safety based on the Earnings Value and combined Earnings and Asset Values.

42. Tower REIT

Tower REIT is an office REIT with 2 goals:

- Provide Unitholders with regular and stable distributions.

- Achieve medium to long-term growth in its NAV per unit.

My analysis showed that it did not deliver these 2 goals from 2012 to 2022. The annual dividend had declined from RM 0.12 per unit in 2012 to RM 0.02 per unit in 2022. The Book Value had grown by a 0.2 % CAGR.

I originally invested in Tower REIT a decade ago at a 23 % discount to its Book Value. There was also an 8.3 % Dividend Yield based on its purchase price. At the same, I the Funds Flow from Operations (FFO) per unit to be RM 1.27.

The price of Tower REIT is today RM 0.47 per unit. I had a loss of 1.8 % per year compounded basis. This is due to a combination of declining performance and negative market sentiments.

The decline in the performance per unit was due to a reduction in the occupancy and average rental per sq ft. I am not sure this is a good Bursa stock.

43. White Horse

White Horse Berhad is the leading tile manufacturer in Malaysia that is currently trading at a discount to its Graham Net Net of RM 0.76 per share (as of 30 Jun 2020).

Is this a value trap? I don’t think so.

- Ceramic tile is not a sunset product.

- White Horse Malaysian business has declined due to the soft property market. I expect the Group to return to profitability when the property market recovers.

- There is growing global demand and hence export potential.

What is our investment thesis (as of end 2020)?

- The Group is financially strong and not burning cash giving it time to outlast the economic downturn.

- A turnaround is tied to the recovery of the Malaysian property market (for domestic sales) and well as global GDP growth (for the exports). My estimate is that this will take another 2 to 3 years before we see any results.

- The Group has a good track record when the property market is doing well and hence should be able to recover. Its under-utilized capacity would also boost its bottom line when production volume goes up.

- This is a classic Graham Net Net long-term investment – you have downside protection and you bet on the upside.

The post you've shared here is basically informative because it contains some best knowledge which is extremely essential on behalf of me for recover lost funds. I like your travel experience, it is good for our life. Thanks for posting it. Keep it up.

ReplyDeletephilippine stock exchange broker explained this same concept

ReplyDeleteSo let's know how you should invest your moneydark sell

ReplyDelete